MEXICO: Banxico Cuts Policy Rate By 50bp To 9.50%, In Split Decision

Feb-06 19:06

- The policy statement is here.

- Board Member Jonathan Heath dissented, voting for a smaller 25bp cut, to 9.75%

- Going forward, Banxico foresees that it could consider adjusting the policy rate by similar magnitudes in coming meetings.

- "The Board estimates that looking forward it could continue calibrating the monetary policy stance and consider adjusting it in similar magnitudes. It anticipates that the inflationary environment will allow to continue the rate cutting cycle, albeit maintaining a restrictive stance. It will take into account the effects of the country’s weak economic activity and the incidence of both the restrictive monetary policy stance that has been maintained and the stance prevailing in the future on the evolution of inflation throughout the horizon in which monetary policy operates."

- "Actions will be implemented in such a way that the reference rate remains consistent at all times with the trajectory needed to enable an orderly and sustained convergence of headline inflation to the 3% target during the forecast period. The central bank reaffirms its commitment with its primary mandate and the need to continue its efforts to consolidate an environment of low and stable inflation."

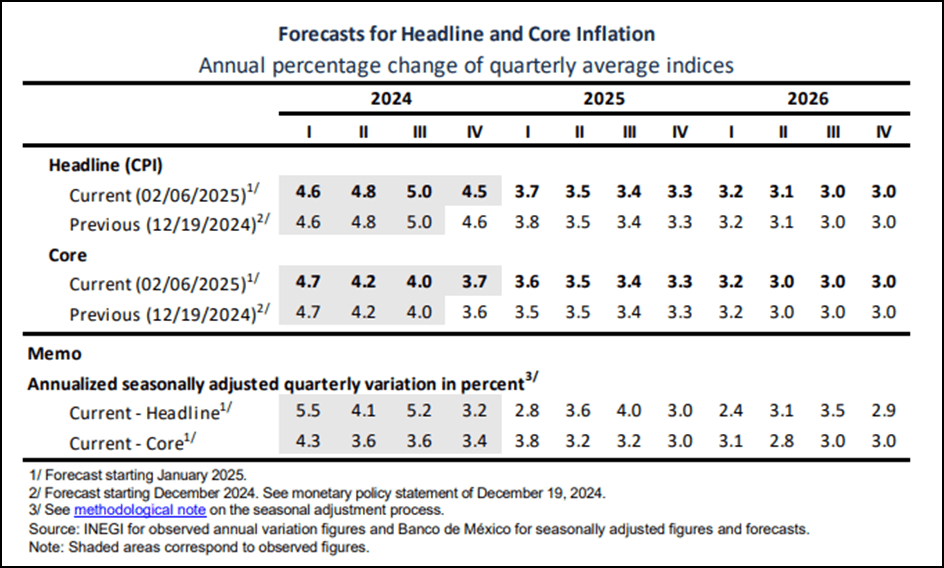

- The complete set of revised inflation forecasts were set out in the following table within the statement:

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EURUSD TECHS: Trend Needle Points South

Jan-07 19:02

- RES 4: 1.0825 High Nov 7

- RES 3: 1.0630 High Dec 06

- RES 2: 1.0537 50-day EMA

- RES 1: 1.0437/58 High Jan 6 / High Dec 30

- PRICE: 1.0354 @ 18:58 GMT Jan 7

- SUP 1: 1.0226 Low Jan 2

- SUP 2: 1.0209 3.0% Lower Bollinger Band

- SUP 3: 1.0201 61.8% of the Sep ‘22 - Jul ‘23 bull leg

- SUP 4: 1.0166 2.0% 10-dma envelope

The trend condition in EURUSD remains bearish and recent gains appear corrective. The Jan 2 sharp sell-off reinforces current conditions and note too that moving average studies remain in a bear-mode position, highlighting a dominant downtrend. The 20-day EMA, at 1.0412, has been pierced. The next resistance to watch is 1.0458, the Dec 30 high. The bear trigger has been defined at 1.0226, the Jan 2 low.

PIPELINE: Corporate Bond Issuance Update

Jan-07 18:51

At least $27B corporate bonds have either priced or launched so far today, less than half of Monday's near $60B record. Still waiting for Kexim, SMFG and Daimler Truck NA details.

- Date $MM Issuer (Priced *, Launch #)

- 01/07 $6B *European Investment Bank (EIB) 5Y SOFR+42

- 01/07 $5B *ADB 3Y SOFR+31

- 01/07 $3.55B #BPCE $1.25B 6NC5 +142, $1.5B 11NC10 +162, $800M 21NC20 +195

- 01/07 $2B #Santander $1B 5Y +110, $1B 10Y +135

- 01/07 $2B #Dai-Ichi Life PerpNC10 6.2%

- 01/07 $1.6B #Republic of Chile 12Y +105

- 01/07 $1.5B #CIBC 5Y SOFR+71

- 01/07 $1.25B #HPS Corp Lending $750M 3Y +135, $500M +7Y +165

- 01/07 $1B #GA Global Funding $500M 5Y +97, $500M 10Y +127

- 01/07 $1b #Kuwait Finance House (KFH) 5Y SOFR Sukuk +95

- 01/07 $850M #APA Corp $350M 10Y +150, $500M 30Y +185

- 01/07 $600M #Met Tower 3Y +48

- 01/07 $500M #Boston Gas WNG 10Y +115

- 01/07 $500M #Protective Life 7& +85

- 01/07 $500M DBJ WNG 10Y SOFR+73

- 01/07 $Benchmark World Bank 7Y +54

- 01/07 $Benchmark Kexim 3Y +55a, 3Y SOFR, 5Y +75a, 10Y +90a

- 01/07 $Benchmark SMFG 5.25Y +78, 5.25Y SOFR+105, 7Y +88, 10Y +95

- 01/07 $Benchmark Daimler Truck Fin NA 3Y +65, 3Y SOFR, 5Y +82, 7Y +92, 10Y +102

- Expected Wednesday:

- 01/08 $Benchmark Kommunalbanken 5Y +51

- 01/08 $Benchmark Cncl of Europe Dev Bank 5Y SOFR+45a

- 01/08 $Benchmark Inter-American Development Bank (IADB) 5Y SOFR+45a

BONDS: Germany: Bobl Remains "Shortest" Contract In MNI Europe Pi (1/2)

Jan-07 18:45

From our Europe Pi positioning indicator out earlier (PDF):

- German contracts open 2025 in increasingly short structural positioning.

- Bobl remains the "shortest" contract at very short, while Buxl and Bund have shifted to short from flat previously. Schatz is now flat, but had been "long" in mid-Nov.

- Holiday period trade pointed to shorts being set.