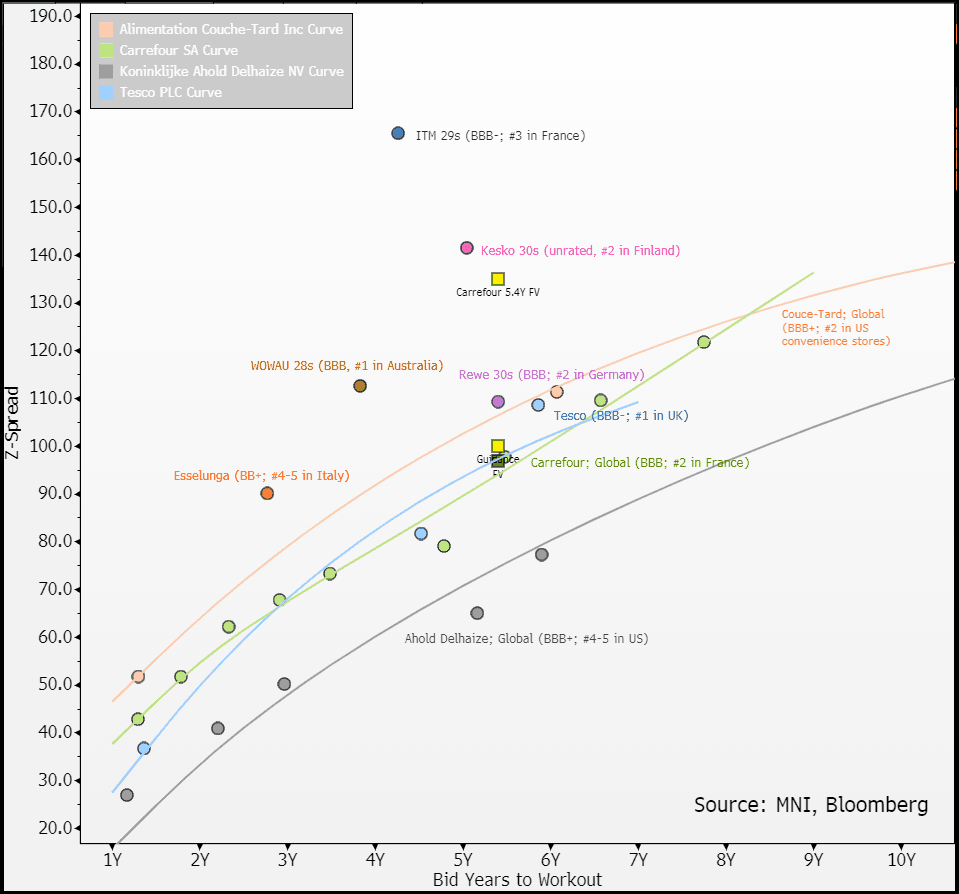

EU CONSUMER STAPLES: Carrefour; 5.4Y Guidance

Jan-17 11:46

(CAFP; NR/BBB)

- WNG €500m 5.4Y SLB guidance +100a vs. FV +97 (3bp NIC)

- books > €3.1b, -35 in from IPT

- FV is based on secondary. We do NOT see value at FV. Please note restructuring leaks below. Thoughts above (10:03)

Like Kering, it continues to show signs of having a loyalist investor base. Unlike Kering, it's circumstances are not as dire and was reflected in the more in-line with index '24 performance.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

JPY: January BoJ Pricing Could Be the Market to Watch For Next 24hrs

Dec-18 11:40

USD/JPY vols are suitably bid today, with the overnight contract capturing both the Fed decision later today, as well as the BoJ due during the Thursday Asia-Pac session.

- It's clear that signalling at both the banks will be key for the market reaction: a 25bps FOMC cut, and a BoJ hold are close to fully priced - meaning it's the comms strategy for 2025 that could swing prices here, and that's likely what's showing in vol space.

- USD/JPY vols are bid to 25 points, and EUR/JPY to 23 points, meeting levels akin to the lead-up to the September US jobs report, and prompting the break-even on an overnight straddle to widen to ~130 pips - close to double the YTD average for the same structure.

- This raises the focus on layered resistance at the Y155 handle and the cycle highs above at 156.75 should the confluence of Fed/BoJ risks be beneficial for the pair. Such a move would work against the recent improvement in the JPY net position, which currently sits at a small net long after this year's sharp correction.

- It's January BoJ pricing that could prove key here - a 25bps hike is ~50% priced, leaving notable two-way risk on a firm steer in either direction from Ueda's press conference - which could make this the market to watch in the coming 24 hours.

OUTLOOK: Price Signal Summary - Bear Threat In EURUSD Remains Present

Dec-18 11:40

- In FX, EURUSD is unchanged. The pair maintains a softer tone and recent gains appear to have been a correction. The 20-day EMA, at 1.0542, remains intact. A close above this average is required to signal scope for a stronger corrective recovery. This would expose 1.0660, the 50-day EMA. For bears, a resumption of the downleg would pave the way for a test of key support at 1.0335, the Nov 22 low and bear trigger.

- GBPUSD is trading above last week’s 1.2609 low (Dec 13). The primary trend direction remains down and recent gains appear to be corrective. Moving average studies are in a bear-mode position, highlighting a dominant downtrend. Key resistance to monitor is 1.2811, the Dec 6 high. A breach would highlight a reversal. Initial support lies at 1.2609, a break of this level would expose the bear trigger at 1.2487, the Nov 22 low.

- USDJPY remains firm and the pair is trading just below its recent highs. Price also remains above both the 20- and 50-day EMAs. The breach of these averages undermines the recent bearish theme and signals scope for an extension. Sights are on 154.84, 76.4% of the Nov 15 - Dec 3 pullback. A reversal lower would signal the end of the latest bull cycle and refocus attention on the bear trigger at 148.65, the Dec 3 low. Initial support to watch is 152.36, the 20-day EMA.

SONIA: Call fly buyer

Dec-18 11:37

Most of the Option flow is still in Sonia this Morning:

- SFIH5 95.50/95.60/95.70c fly, bought for 2.5 up to 2.75 in 4k.