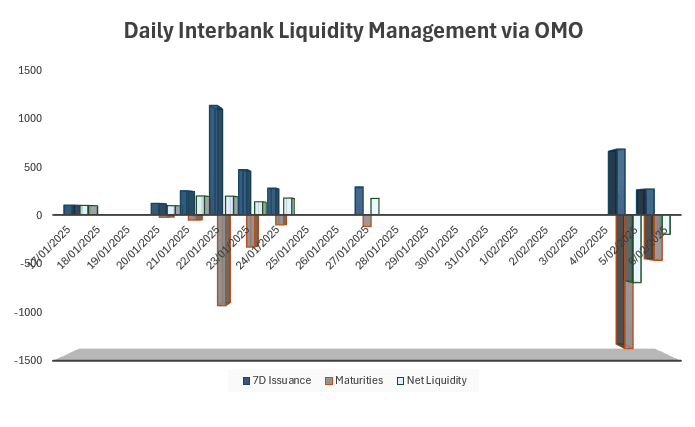

CHINA: Central Bank withdraws Liquidity via OMO.

- The PBOC issued CNY275.5bn of 7-day reverse repo at 1.5% via this mornings open market operations.

- Net maturities today CNY480bn of 14-day reverse repo.

- Net liquidity withdrawal CNY204.5bn.

- The PBOC controls and maintains liquidity in the interbank market through the issuance of reverse repo.

- The CFETS Pledged Repo deposit institutions 7-day index declined today by 16bps to 1.5667.

- China Overnight interbank rates rose to 1.7616 (from 1.70%) and the 7-day interbank rate rose to 1.90% (from 1.80%).

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

AUSTRALIA DATA: Australia Nov Total Dwellings Approved -3.6%

The November 2024 seasonally adjusted estimate:

- Total dwellings approved fell 3.6%, to 14,998.

- Private sector houses fell 1.7%, to 9,028, while private sector dwellings excluding houses fell 10.8%, to 5,285.

- The value of total residential building fell 0.5%, to $8.36b.

- The value of non-residential building rose 18.4%, to $5.96b.

THAILAND: VIEW: JP Morgan Sees Risks To Inflation & Rates From US Trade Policy

Headline CPI inflation returned to the bottom of the Bank of Thailand’s 1-3% target band in December for the first time since May, although it printed lower than expected. Core inflation was steady at 0.8% y/y. JP Morgan notes that the underlying trend for both remained “soft” and continues to “pencil in one more 25bp rate cut” in Q1 2025 with more possible if US trade policy is as hawkish as current statements imply.

- JP Morgan observes that “core-core CPI, which excludes all food and energy items, also continues to point to broadly weak demand-pull price pressures.”

- It believes “the spectre of US tariff escalation is arguably deflationary for trade-dependent Asian economies, driven by the spill-overs of a weaker external sector into domestic demand and more imported deflation from China.”

- “We marginally revise higher 2025 headline and core inflation to 1.1%/0.9% (previous: 1.0%/0.8%), with a negative risk bias depending on the timing and magnitude of US tariff hikes.”

- “Energy CPI remains anchored by range-bound global crude oil prices and ongoing administrative price controls. In fact, we think that pump prices would have declined further in the absence of price controls, given that free-floating diesel prices are estimated to be below the THB33 per liter price cap. Authorities have recently decided to lower the electricity tariff by THB0.03 per unit in the January-May period, which we estimate will shave 0.04%pt. off headline CPI this month.”

JGBS AUCTION: PREVIEW - 10-Year JGB Auction Due

The Japanese Ministry of Finance (MoF) will today sell Y2.6tn of 10-Year JGBs. The MoF last sold 10-year debt on 3 December 2024, the auction drew cover of 3.1156x at an average yield of 1.084%, an average price of 98.37, a high yield of 1.089%, a low price of 98.32, with 20.3093% of bids allotted at the high yield.

- Last month’s auction revealed disappointing results, with the low price falling short of expectations, according to the Bloomberg dealer poll. The cover ratio dipped to 3.1156x from 3.133x in the previous auction, while the tail lengthened to 0.05 from 0.04, indicating softer demand.

- This month, the 10-year auction offers an outright yield at a fresh cyclical peak of 1.14%, roughly 6bps higher than last month. Additionally, the yield curve between 2- and 10-year bonds has steepened by about 5bps compared to the prior month.

- However, the relative affordability of 10-year JGBs versus futures—gauged by the 7- to 10-year spread—has declined over the past month, currently sitting near the lower end of its range over the past year.

- Today’s auction faces challenges from persistently weak sentiment toward global long-end bonds. For instance, the US 10-year yield remains near its highest levels since April, roughly 100bps above its September lows.

- Market pricing for a potential BoJ rate hike at the January meeting remains below 50%, falling short of mid-December highs. While Governor Ueda reiterated yesterday that the path for rates is higher, the timing remains uncertain. Notably, Deputy Governor Himino is set to speak next Tuesday.

- Amid this backdrop, it will be interesting to see if the current 10-year yield generates sufficient demand at today’s auction.

- Results are due at 0435 GMT / 1235 JT.