EM ASIA CREDIT: China Tech to benefit from DeepSeek insights

The recently launched Chinese AI platform, DeepSeek, is a wake-up call for all tech stock, but this isn't necessarily a negative for credit. The open source nature of the product should mean that development insights will be quickly shared amongst incumbents as well as usher in new players, helping reduce overall development costs and time lines. The market reaction, especially as it pertained to Nvidia (equity -10% now, -17% at lows), was severe.

The reaction poses the question, is the investment in high cost speciality AI chips worth it, DeepSeek after all only needs a fraction of the computing power (compute) for arguably similar results to OpenAI ChatGPT. In my opinion compute will remain hugely important, and DeepSeek will inadvertently accelerate the capabilities of existing, compute heavy, models.

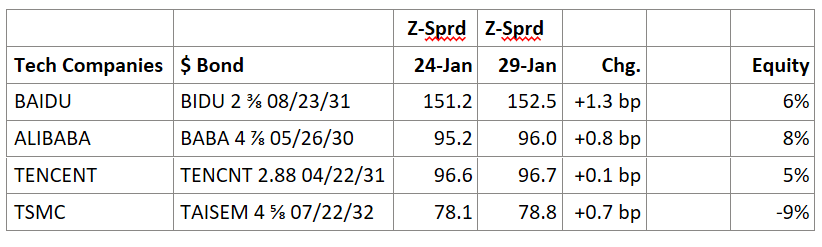

In terms of the Asia tech companies with $ bonds, we can see in the table, for the most part credit didn’t react…equities on the other hand, a more thematic approach, indicating as we said yesterday that beneficiaries are at this stage likely Baidu, Alibaba and Tencent.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

JGBS: Slightly Richer On Last Trading Day Of The Year

JGB futures are stronger after reversing early Tokyo session weakness, +4 compared to settlement levels.

- Outside of the previously outlined Jibun Bank/S&P Global Manufacturing PMI, there hasn't been much by way of domestic drivers to flag.

- Cash US tsys are slightly richer in today’s Asia-Pac session after Friday’s heavy session.

- US data this week includes MNI PMI and Pending Home Sales on Monday, FHFA housing data on Tuesday, weekly claims and construction spending on Thursday, and ISMs on Friday.

- Bond bears are emboldened as the BOJ will be reducing its monthly debt buying in the first quarter of 2025. Moreover, traders can see that Japanese inflation is proving to be sticky even though the central bank says it wants to see more information before raising interest rates again. The BOJ is also waiting for the next round of wage increases, despite the big hikes which were seen this year. (per BBG)

- Cash JGBs are 1-2bps richer across benchmarks. The benchmark 10-year yield is 1bp lower at 1.115% versus the cycle high of 1.1340% set earlier today.

- Swap rates are ~1bp lower apart from the 30-year (+2bps). Swap spreads are mixed.

- The local market is closed tomorrow for a bank holiday. The next data release will be Jibun Bank PMI Composite & Services on January 6.

FOREX: A$ And NZ$ Outperform On Higher Yields

Aussie and kiwi are outperforming against the US dollar during trading so far today. The BBDXY USD index is only slightly lower with US yields little changed. European currencies and the yen are steady.

- AUDUSD has been generally underperforming and technicals continue to signal a bearish downtrend. During today’s APEC trading though it has bounced 0.4% to 0.6239, close to the intraday high, but still 0.15% below last Monday’s close. It has found support from higher ACGB yields, commodity prices including iron ore returning above $100/t.

- NZDUSD is also 0.4% higher at 0.5656 leaving AUDNZD flat at 1.1031. The cross has range traded through the session.

- USDJPY is down 0.1% to 157.78 after a high of 157.99 but has spent the day in a narrow range with little news to give it direction.

- EURUSD is unchanged at 1.0425 and GBPUSD 1.2580.

- US December MNI Chicago & Dallas Fed PMIs and November pending home sales print as well preliminary December Spanish CPI.

FOREX: Baht & Rupiah Strengthen

The BBDXY USD index is only slightly lower and most Asian currencies stronger against USD. In EM Asia, the Korean won has been volatile but the IDR and THB have strengthened significantly against the greenback helped by year-end rebalancing.

- USDKRW fell to 1465.60 on government commitment to financial stability following continued political instability. Equities are higher.

- USDTHB is 0.5% lower at 33.94, close to the intraday low. The pair is now down 1.7% since the December 19 peak following the more hawkish sounding Fed.

- USDIDR is also down 0.5% to 16158 but off today’s trough of 16142.50. It is down 0.8% since the Fed. The rupiah and baht appear to have benefited from year-end trading, which is light. There hasn’t been market talk of possible central bank intervention.

- USDCNH has moved in the opposite direction to most other Asian crosses and is 0.1% higher at 7.3073 following a high of 7.3086.

- US December MNI Chicago & Dallas Fed PMIs and November pending home sales print as well preliminary December Spanish CPI.