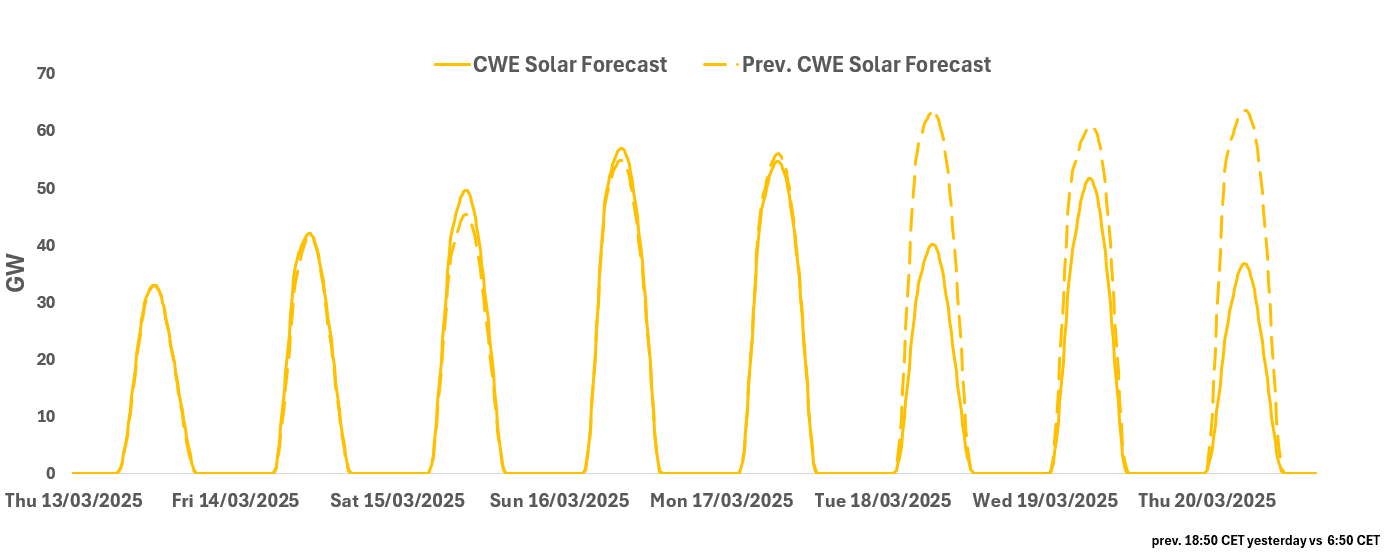

RENEWABLES: CWE Morning Solar Forecast

See the latest CWE Solar forecast for base-load hours from this morning for the next seven days. CWE Solar is forecast to be the highest over 16-17 March at between 10-11% load factors.

CWE Solar for 13-20 March

- 13 March: 9.04GW

- 14 March: 12.01GW

- 15 March: 14.20GW

- 16 March: 17.14GW

- 17 March: 16.52GW

- 18 March: 11.24GW

- 19 March: 14.78GW

20 March: 10.09GW

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EURJPY TECHS: Pierces Key Support

- RES 4: 162.70 High Jan 28

- RES 3: 161.40 50-day EMA

- RES 2: 160.50 20-day EMA

- RES 1: 157.97/158.86 Low Feb 3 / High Feb 6

- PRICE: 156.79 @ 07:20 GMT Feb 10

- SUP 1: 155.61 Intraday low

- SUP 2: 155.19/15 3.0% 10-dma envelope / Low Sep 16 ‘24

- SUP 3: 154.42 Low Aug 5 ‘24 and key medium-term support

- SUP 4: 153.87 Low Dec 14 ‘23

A bear cycle in EURJPY remains present and last week’s move down reinforces current conditions. The cross cleared 158.24, 76.4% of the Dec 3 - 30 bull cycle, and pierced 156.18, the Dec 3 low and key support. A continuation lower would open 155.15, the Sep 16 ‘24 low. Initial firm resistance to watch, and a pivot level, is 161.40, the 50-day EMA. The short-term trend is oversold, gains would allow this condition to unwind.

EGBS: J.P.Morgan Recommend Long 30-Year OLOs Vs. OATs

J.P.Morgan recommend long 30-Year OLOs vs. OATs.

- They look for a 30-Year OLO syndication this week and expect the recent run of long end post-syndication performance to continue.

BUNDS: US CPI is in focus this Week

- While the US Tnotes trades heavy into the European session following the Employment, Earning and Michigan beat on Friday, the German contract is exactly where it was trading at pre NFP, was circa 133.39.

- The US TYH5 would need to trade up to 109.18 for a similar unwind.

- Cash sellers were noted on the Open, but the range is still limited to 20 ticks, while Risk is still tilted to the upside and initial resistance remains at 133.86.

- Bund printed a 132.95 low on Friday, but first support is still eyed at 132.72, which is followed by the 132.34 gap.

- There's no Tier 1 data to start the Week, US NY Fed 1yr Inflation expectation is out later today, but won't be a market mover with focus on the US CPI this Week.

- SPEAKERS: ECB Lagarde at the EU Parliament.