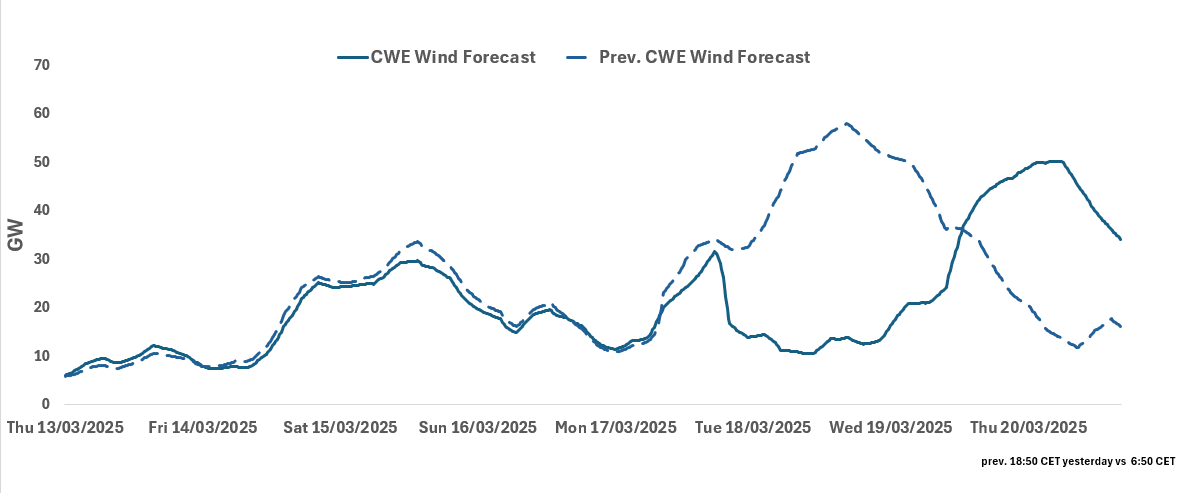

RENEWABLES: CWE Morning Wind Forecast

See the latest CWE Wind forecast for base-load hours from this morning for the next seven days. CWE wind is forecast to be the highest next week on 20 March at a 43% load factor.

CWE Wind for 13-20 March

- 13 March: 9.59GW

- 14 March: 13.41GW

- 15 March: 26.50GW

- 16 March: 17.92GW

- 17 March: 19.21GW

- 18 March: 13.14GW

- 19 March: 24.19GW

20 March: 45.13GW

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

SCANDIS: Limited FX Reaction To Stronger-than-expected Norway CPI

NOKSEK rose less than 10pips following the stronger-than-expected Norway January CPI-ATE reading (2.8% Y/Y vs 2.6% cons). This data alone wasn’t expected to push Norges Bank away from its guidance for a March cut, with Q4 GDP due tomorrow and another CPI report also due ahead of the March decision. The large upside surprise to Swedish January CPI also probably added some upside risks to the Norwegian print this morning.

- Monthly CPI-ATE growth was 0.1% M/M, above last January’s 0.0% M/M and the 2000-2019 January average of -0.4% M/M. We will provide further details on the release in due course.

- Swedish December monthly activity data was also released, with household consumption falling 0.3% M/M after positive readings in both October and November.

- These data fed into the Q4 flash GDP indicator, which was released at the end of January and printed below the Riksbank’s December MPR projection (0.2% Q/Q vs 0.4% Riks exp).

- The monthly and quarterly GDP indicators are quite unreliable and prone to revisions though, so the full Q4 report at the end of February will be an important release for the Riksbank.

BOE: MNI BOE Review

We released our BOE review over the weekend, in case you missed it:

- Dhingra reinforces her dovish status; expect her to keep voting for cuts for some time. While we expect Mann to vote for cuts at least in March and May (but it is more uncertain beyond then - we talk through the rationale).

- "Case 1" is seen as less likely - but this doesn't mean less downside risks... just different downside risks.

- We think this leaves us only needs one more MPC member in favour of a cut in March to sway the outcome - but at this point think that is relatively unlikely. We note our rationale in the report.

- We look at the takeaways from the new inflation forecasts, the additional of the word "careful" to the guidance and the Bank's updated neutral rate estimates.

BTP TECHS: (H5) Bullish Outlook

- RES 4: 123.34 High Dec 11

- RES 3: 122.85 High Dec 12

- RES 2: 121.88 76.4% retracement of the Dec 11 - Jan 13 bear leg

- RES 1: 120.98/121.00 61.8% of Dec 11 - Jan 13 bear leg / High Jul 7

- PRICE: 120.50 @ Close Feb 7

- SUP 1: 119.78 20-day EMA

- SUP 2: 118.65/117.16 Low Jan 24 / 13 and the bear trigger

- SUP 3: 116.59 76.4% retrace of the Jun - Dec ‘24 bull cycle (cont)

- SUP 4: 116.07 Low Jul 8 ‘24 (cont)

A bullish cycle in BTP futures remains intact and the contract is trading at its recent highs. Price has breached both the 20- and 50- day EMAs. This signals scope for an extension of the upleg and sights are on 120.98 (pierced) and 121.88, Fibonacci retracement points. On the downside, initial key support to watch lies at 118.65, the Jan 24 low. Clearance of this price point would highlight a reversal and the end of the correction.