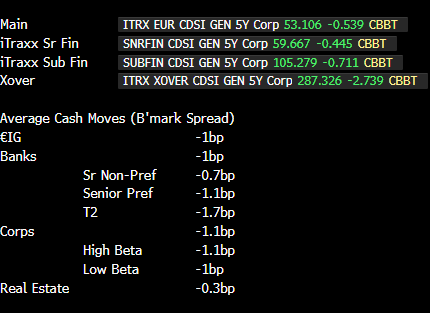

BOJ: EU iTraxx/Cash Moves

Jan-30 16:26

EU iTraxx/Cash Moves

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US STOCKS: Early Equities Roundup: Double Digit Gains For 2024

Dec-31 16:19

- Stocks cling to mildly mixed levels in quiet year end trade Tuesday. Though off this year's record highs (SPX Eminis 6178.75, DJIA 45,073.63, Nasdaq 20,204.58) major averages will finish the year with double digit gains: SPX Eminis +19.5%, DJIA +13.1%, while the Nasdaq gained 29.9%!

- Currently, the DJIA trades up 20.69 points (0.05%) at 42594.86, S&P E-Minis down 8 points (-0.13%) at 5951.25, Nasdaq down 52.5 points (-0.3%) at 19435.7.

- Energy and Real Estate sectors outperformed in the first half, oil & gas stocks buoyed the Energy sector as crude prices continued to rise (WTI +0.69 at 71.68): APA Corp +3.12%, Marathon Petroleum +2.52%, Occidental Petroleum +2.15%.

- Shares of specialized and industrial REITs supported the Real Estate sector: Crown Castle and Healthpeak Properties both +1.40%, Weyerhaeuser +1.11%, SBA Communications +1.07%.

- On the flipside, Information Technology and Communication Services shares underperformed early Tuesday, shares of software and semiconductor makers weighed on the tech sector: Crowdstrike Holdings -0.80%, Fortinet -0.63%, Nvidia -0.60%.

- Interactive media and entertainment shares weighed on the Communication Services sector: Live Nation -0.58%, Netflix -0.36%, T-Mobile -0.06%.

- Looking ahead, the next round of quarterly earnings kicks off mid-January with Blackrock, Bank of NY Melon, Wells Fargo, JP Morgan, Goldman Sachs, Citigroup, US Bancorp, M&T Bank and PNC all reporting between January 13-16.

FOREX: EURUSD Now Down 0.4% as Month End Approaches

Dec-31 15:48

- Worth noting the single currency has been under some pressure as we approach the month/year end WMR fixing window. EURUSD has extended session decline to 0.40%, to a fresh weekly low of 1.0361, while EURGBP is also down 0.3% on the session at 0.8268.

- As noted, 1.0335 remains key for EURUSD, the Nov 22 low and a bear trigger.

- For EURGBP, 0.8223 is the next support, the Dec 19 low, before major support at 0.8203.

US DATA: House Prices Continue To Rise, But High Rates To Maintain Headwinds

Dec-31 15:47

House prices rose a little more strongly than expected in October, though overall gains remained fairly steady from a longer-term perspective.

- The S&P CoreLogic/Shiller 20-city home price index rose by 0.3% M/M (0.2% expected/prior), putting the Y/y measure at 4.22% (4.1% expected, 4.6% prior). The broader FHFA house price index rose by 0.4% M/M as expected, vs 0.7% prior.

- By most measures, housing valuations remain stretched (vs affordability/rates, rental yields), though this has not translated into softer prices. Recent momentum is mixed: on a 3M/3M annualized basis, FHFA prices were up 5.1% in October (highest since April), though S&P 20-city softened to a 17-month low 3.8%. Those are fairly typical figures for pre-pandemic house price trends.

- Prices have remained supported amid historically low turnover in the housing market, exacerbated by high mortgage rates.

- At some point the standoff between buyers and sellers will end, potentially when unemployment increases and/or mortgage rates drop. As it stands, expectations are for housing market activity to pick up in 2025 (existing home sales are seen at a 3-year high with new home sales at a 4-year high), with building permits/starts at the highest in 2 years. That's alongside a very modest softening in the labor market (4.3% unemployment), with long-end rates falling (10Y Treasury yields 4.1%).

- Economic solidity and solid household balance sheets (in part due to elevated house prices) should prevent too severe a deterioration in the housing market next year, though optimism over residential construction activity and home sales looks misplaced given higher rates.