HUF: EUR/HUF Vol Skew Showing at Multi-Year Lows Following Jan CPI

Feb-12 09:06

Yesterday’s stronger-than-expected inflation data – led by surging food and services prices – continues to underpin forint outperformance, with the currency currently trading at its highest level against the euro since October, up around 0.2% on the session. The next level of focus for EUR/HUF will be on the 400.00 handle.

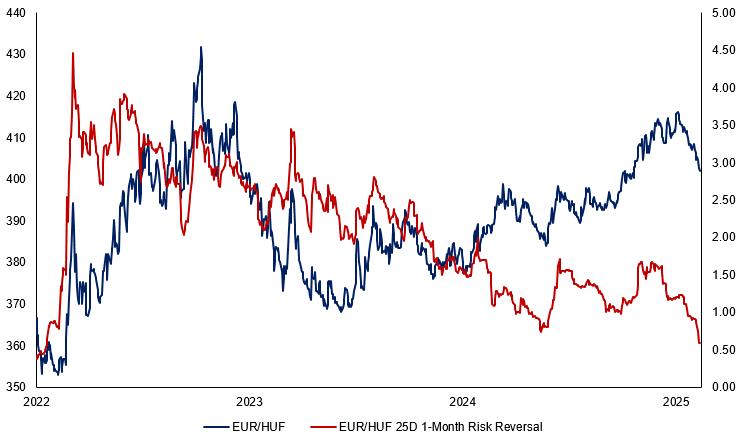

- Yesterday’s data resulted in a strong hawkish reaction across Hungarian rates markets. FRA contracts recorded a noteworthy hawkish adjustment to the figures, with the ~25bp move higher across 9x12 contracts indicative of the view that the NBH will have a significantly narrower scope for rate cuts through the remainder of the year. Meanwhile, the EUR/HUF option vol skew is showing at its lowest since 2022, suggesting that option markets are hedging against the risk of further forint strength ahead (see chart below).

- Underperformance of the Japanese yen has seen HUF/JPY rally over 3% off Monday’s lows, with the cross re-approaching the YTD highs around the 40.00 mark. USD/HUF, meanwhile, is over 1% lower compared to Friday’s close, comfortably back below the 50-day EMA and at levels not seen since mid-November. Forint strength is also evident against the Polish zloty, with PLN/HUF showing below the 50-day EMA at typing and targeting a first close below the average since September.

- Given the lack of data releases on the local slate for the remainder of the week, focus will be on the US CPI print this afternoon as the next major global risk event. Minutes from the NBH’s January MPC meeting are due at 13:00GMT/14:00CET.

Figure 1: EUR/HUF option vol skew showing at multi-year lows

Source: MNI/Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

CROSS ASSET: Equities are extending losses

Jan-13 09:01

- Not much in term of spillovers into FX for now, with Tnotes hovering at session low, and in turn the US 10yr Yield getting closer to the 4.80% level, so far printed a 4.7964% high.

- The EUR and the Pound have pared some of their earlier losses, but all in small.

- The Pound is still the worst performer, now down 0.53%, and the Yen is still holding onto a tiny 0.11% gain.

- Market Participants will be fully focused on the UK/US CPIs as well as the US Earnings.

- Equities are still falling, close to 100 points for the Estoxx futures (VGH5) since the US NFP.

- The Emini sees the next support area at 5787.5 (Nov Low), and 5776.00 (Oct low).

EGBS: /SWAPS: Commerzbank Maintain Short Recommendation In Long End ASWs

Jan-13 08:51

German ASWs stabilise this morning, despite fresh weakness in core global FI markets

- However, Commerzbank warn that “fiscal fears still linger as the underlying political frictions are very difficult to resolve. At the same time, DMOs think in terms of absolute yields and need ultra-long issuance for their funding mix. Hence, ultra-long issuance run-rates should remain on record highs.”

- They also suggest that “a 'white knight' in the form of increased ALM buying is also unlikely to emerge.” As a result, they “don’t see a quick fix and remain short long-end Bunds ASW and OATs.”

BUNDS: German 10yr Yield Targets the July high

Jan-13 08:45

- The German 10yr got close to that July high, noted at 2.642%, so far printed a 2.634%.

- This level is slightly lower Today, was at 130.56 on Friday, but at 130.50 Today.

- Further out, and a clear break through that area would open risk towards the 2024 high printed in June at 2.706%.

- 2.706% = 129.83 today.