EUROPEAN INFLATION: EZ Final HICP Reaffirms Services Deceleration in Flash

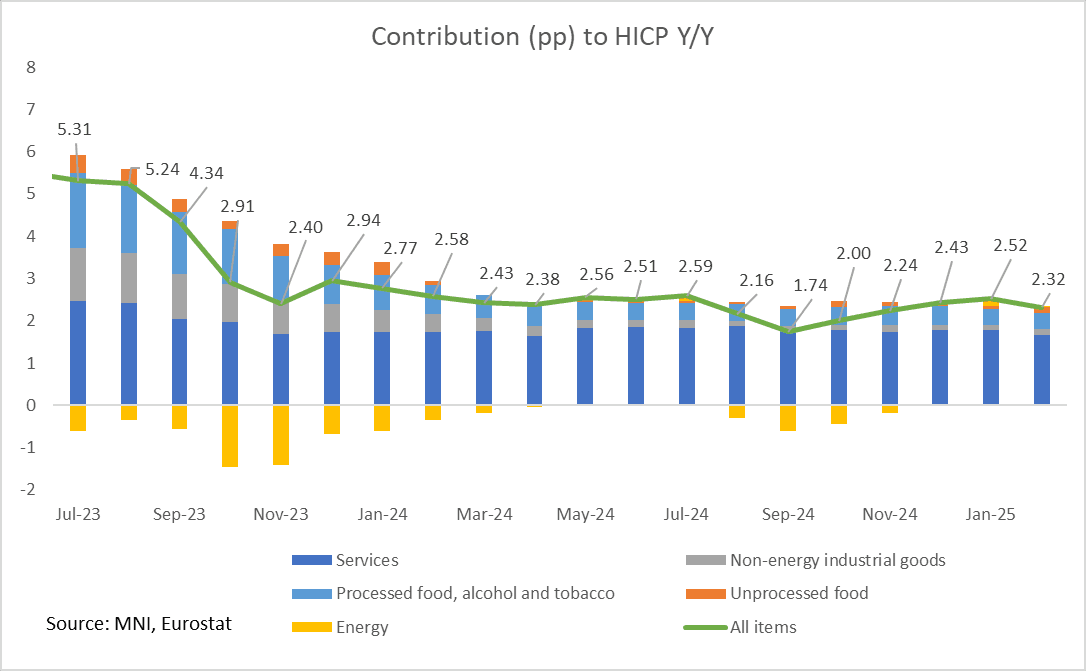

Eurozone February Final HICP was revised 5 hundredths lower from the flash reading to 2.32% Y/Y (vs 2.37% flash, 2.52% in January). The monthly rate was also revised four hundredths lower to 0.43% M/M ( 0.47% flash, -0.28% in January).

- Of the main special aggregates, only "unprocessed food" showed a revision to 1dp (although the larger food, alcohol and tobacco category did not). Core inflation, services, energy and core goods (NEIG) were all unrevised to 1dp.

- Core inflation (ex energy, food, alcohol & tobacco) was revised down three hundredths to 2.57% Y/Y (vs 2.60% flash, 2.70% in January). On a monthly basis it was 0.55% M/M (vs 0.58% flash, -0.95% in January).

- The final reading shows services decelerated five hundredths more than in flash at 3.68% Y/Y (vs 3.73% flash, 3.93% in January), with services' contribution to headline HICP at 1.66ppts (vs 1.77pts in January) - the lowest contribution since April 2024. Sequential services was revised six hundredths down from flash to 0.61% M/M (vs 0.67% flash, -0.14% in January).

- Energy prices slowed to 0.19% Y/Y (vs 0.22% flash, 1.89% in January), though this is the third consecutive positive annual reading. This is on the back of a 0.30% M/M fall in February (vs -0.27% flash, 2.96% rise in January). The contribution to headline HICP was negligible at 0.01ppts returning to December 2024's contribution.

- "Non-energy industrial goods'" (i.e. core goods') contribution edged up to 0.14ppts (from 0.12ppts in January). The print was unrevised from flash at 0.59% Y/Y (0.52% in January) and 0.43% M/M (-2.39% prior).

- "Unprocessed foods'" contribution also rose to 0.13ppts from 0.06ppts - the highest contribution to headline HICP since October 2024 as prices firmed 3.01% Y/Y (vs 1.4% in January).

- "Processed food, alcohol and tobacco's" contribution remained at 0.39ppts.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EURIBOR: EURIBOR FIX - 17/02/25

EURIBOR FIX - EMMI/Bloomberg.

- EUR001W 2.6390 0.0260

- EUR001M 2.6160 0.0120

- EUR003M 2.5100 -0.0120

- EUR006M 2.4890 -0.0250

- EUR012M 2.4240 -0.0140

EUROPEAN DATA: Larger Than Expected Trade Surplus On Import Weakness

- The Eurozone trade surplus printed close to consensus in December, at a seasonally adjusted E14.6bn (cons E14.5bn) after an upward revised E13.3bn (originally E12.9bn).

- The larger surplus was for the ‘wrong’ reasons, coming as the decline in imports (-0.8% M/M) outstripped that of exports (-0.2% M/M).

- This story was exaggerated for the EU as a whole, with a surplus widening from E10.1bn to E12.9bn (sa) as imports fell -1.2% M/M vs exports 0.1% M/M.

- Turning to the broader EU nsa data, extra-EU export growth stood at 3.7% Y/Y vs 3.9% Y/Y for extra-EU imports, whilst intra-EU trade was more subdued at just 1.6% Y/Y.

- One of the fastest growing areas of exports was for chemicals & related products (14.3% Y/Y), as we’ve noted one of the more vulnerable areas to US tariffs considering its magnitude within EU-US trade.

- By country, trade with the US was mixed the month ahead of Trump’s inauguration, with overall exports rising 5.6% Y/Y vs overall import growth of -10.8% Y/Y.

COMMODITIES: WTI Futures Remain Below 50-Day EMA

WTI futures have pulled back from last week’s high and price has again traded below the 50-day EMA - at $72.08. Attention is on $70.43, the Feb 6 low. It has been pierced, a clear break would undermine a bullish theme and confirm a breach of the 50-day EMA. This would strengthen a bearish threat and open $68.05, the Dec 20 ‘24 low. Key S/T resistance has been defined at $75.18. A move above this level is required to reinstate a bull theme. A bull cycle in Gold remains in play and the yellow metal continues to trade closer to its latest highs. Recent gains once again confirm a resumption of the uptrend and maintain the bullish price sequence of higher highs and higher lows. Moving average studies are in a bull mode position too, highlighting a dominant uptrend. Sights are on the $2962.2, a Fibonacci projection. The first key support to watch is $2826.5, the 20-day EMA.

- WTI Crude up $0.12 or +0.17% at $70.86

- Natural Gas down $0.09 or -2.42% at $3.637

- Gold spot up $20.92 or +0.73% at $2903.75

- Copper down $3.3 or -0.7% at $468

- Silver up $0.35 or +1.08% at $32.4489

- Platinum up $3.97 or +0.4% at $988.13