EUROZONE DATA: Final Q4 GDP Upward Revision; Investment Remains Problematic

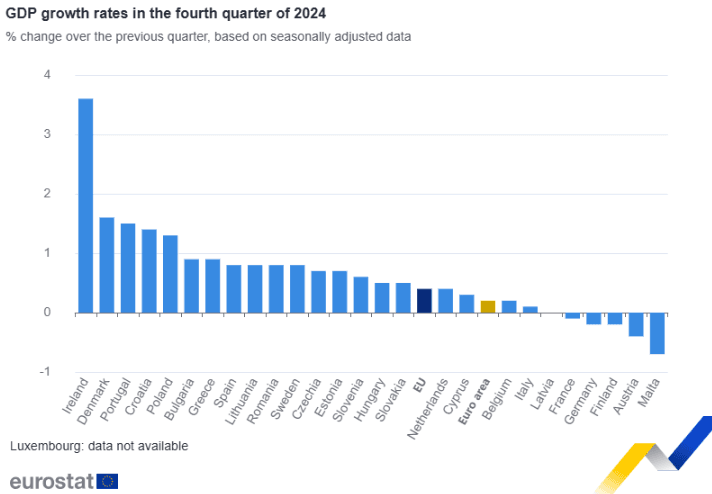

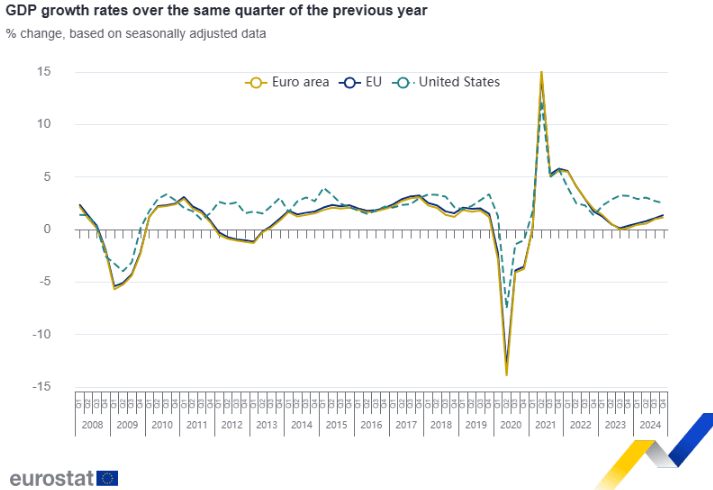

Final Eurozone figures for Q4 2024 show GDP was upwardly revised by 0.1pp to 0.2% Q/Q on the sequential reading, and upwardly revised by 0.3pp to +1.2% Y/Y.

- This means that on an annual comparison, growth in the Eurozone picked up towards the end of last year, with the Q3 print at +1.0% Y/Y, and Q1 and Q2 both at +0.5%Y/Y. However, sequentially, the trend appears less favourable - Q4 remains below the 2024 quarterly average of 0.3% Q/Q.

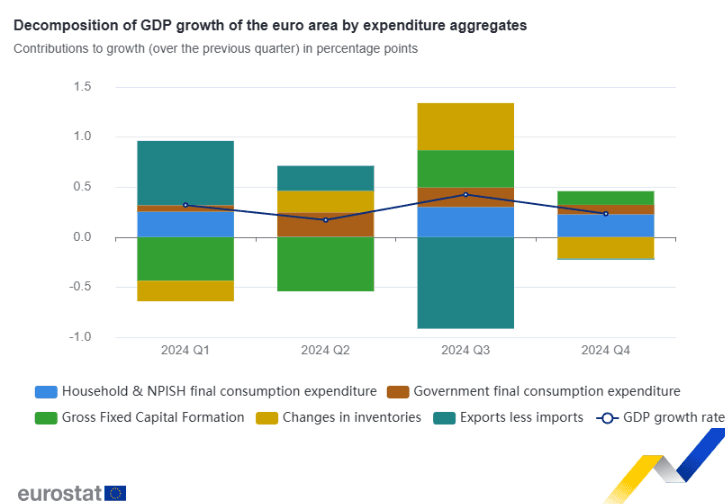

- Across expenditure categories, all Q/Q:

- Private consumption increased by 0.4%, contributing 0.2pp to overall GDP growth. The category has seen no clear trend in 2024 - the Q4 print does not indicate an uptick here towards the end of the year.

- Government consumption increased by 0.4%, contributing 0.1pp. The medium-term uptick here analysts expect following the German fiscal announcement earlier this week will likely take some quarters to filter through.

- Gross fixed capital formation increased by 0.6%, contributing 0.1pp. The category appears to have stabilized after a dismal H1. Regardless, this likely remains the most problematic part of the expenditure split as the overall 2024 print was clearly negative (Y/Y quarterly average during 2024 at -2.0%).

- Inventories contributed -0.2pp.

- Exports decreased by 0.1%, as did imports, with their combined contribution "negligible" according to Eurostat. A stabilization after Q3's 0.8pp negative contribution.

- The embargoed data does not contain a split across industries - yesterday's quarterly ECB macroeconomic projections see the following for Q4:

- "Industrial activity likely continued to decline in the fourth quarter, amid subdued demand for goods, still some negative impact of the past monetary policy tightening, ongoing competitiveness losses and significant trade policy uncertainty. Activity in the services sector likely continued to grow."

- Productivity based on persons employed increased by 0.4% Y/Y (0.0% Q3, -0.4% Q2).

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EUROZONE DATA: PPI Y/Y Slightly Higher Than Expected As Energy Base Effects Fade

Eurozone PPI in December was stable at 0.0% Y/Y, making it marginally above expectations (-0.1% consensus, -1.2% prior). This is the first non-deflationary print since April 2023 driven by energy base effects working their way out of the Y/Y figure. Note that excluding energy the PPI index has remained unchanged since September 2024, whereas including energy it has been increasing.

- Three of the five sub-components saw Y/Y pickups, and the remaining two remained stable.

- Energy producer prices fell at a softer pace of 1.7% Y/Y (vs -5.1% in Nov and -11.2% in Oct).

- Intermediate goods rose a marginal 0.1% Y/Y (vs a decline of 0.3% in Nov).

- Capital goods and non-durable consumer goods sustained their November pace of increase of 1.4% Y/Y and 2.0% Y/Y.

- On a sequential basis, PPI was touch softer than expected at 0.4% M/M (vs 0.5% consensus, 1.7% revised prior from 1.6%).

EUROZONE DATA: Jan Composite PMI Highlights Export Drag

The downward revision to the French January services PMI (48.2 vs 48.9 flash) meant the Eurozone-wide services reading was 51.3 (vs 51.4 flash, 51.6 prior).

- “January survey data indicated an improvement in demand conditions for eurozone services companies as new orders rose for a second month in a row”.

- “Sales growth was domestic driven as the latest survey data showed new export business decreasing, albeit more slowly”.

- “Inflation remained stubborn in January. Operating costs for services companies rose at the steepest pace in nine months, although selling price inflation held steady”.

- However, of the four major Eurozone countries, only the French PMI signalled that firms were not passing on input cost increases to output charges.

The composite PMI marked a second consecutive increase to 50.2 (in line with flash, vs 49.6 prior). Against a backdrop of concerns around US tariffs, “A marked drag on sales came from exports”.

EGB OPTIONS: Bobl call fly seller

OEH5 118/118.5/119c fly 1x2.5x1.5, sold at 4 in 10k.