RENEWABLES: France Morning Renewable Forecast

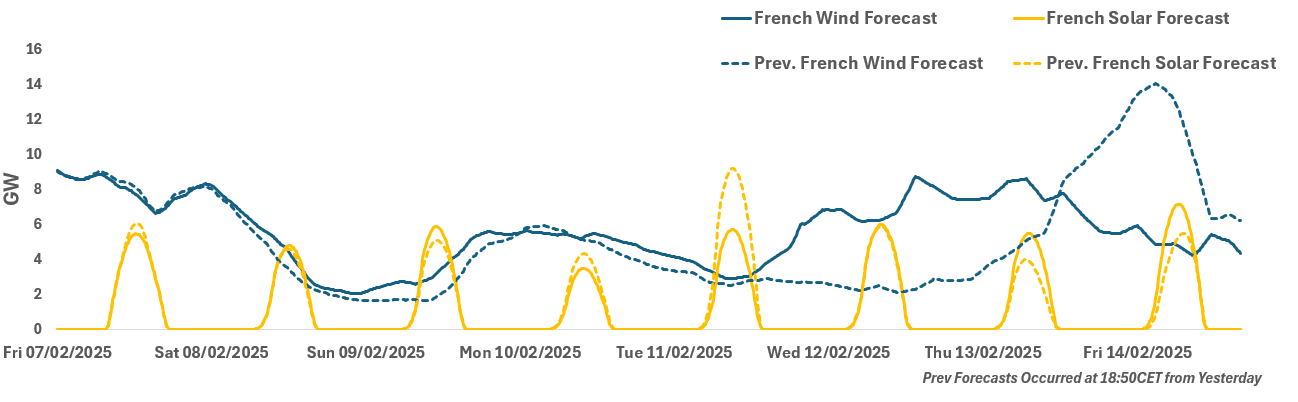

See the latest French renewables forecast for base-load hours from this morning for the next seven days. In contrast to Germany, French wind will be at 16-29% load factors over 11-12 February – which could place delivery costs at a premium to Germany.

French: Wind for 7-14 February

- 7 February: 8.02GW

- 8 February: 4.87GW

- 9 February: 3.48GW

- 10 February: 5.28GW

- 11 February: 3.76GW

- 12 February: 6.95GW

- 13 February: 7.60GW

- 14 February: 5.13GW

French: Solar for 7-14 February

- 7 February: 1.40GW

- 8 February: 1.09GW

- 9 February: 1.33GW

- 10 February: 0.790GW

- 11 February: 1.31GW

- 12 February: 1.40GW

- 13 February: 1.29GW

14 February: 1.70GW

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GERMAN AUCTION PREVIEW: Coupon announcement

DFA has announced the coupon of the new Feb-35 Bund (ISIN: DE000BU2Z049) on auction tomorrow at 2.50%. DFA is looking to issue E5bln of that Bund.

MNI: ECB 1-YEAR CONSUMER INFLATION EXPECTATIONS 2.6%

- MNI: ECB 1-YEAR CONSUMER INFLATION EXPECTATIONS 2.6%

- MNI: ECB 3-YEAR CONSUMER INFLATION EXPECTATIONS 2.4%

RATINGS: JPM See Potential Positive Action For Periphery, France & Belgium Risks

J.P.Morgan note that “2024 witnessed quite a few rating actions in the Eurozone, with several countries, particularly in the periphery, benefitting from improved outlooks and/or ratings upgrades whilst France, Belgium and Finland faced negative rating actions.”

- Looking ahead they write “for 2025, we expect limited rating actions on Euro area sovereigns, considering the modest fiscal tightening, ongoing easing from the ECB and the expected below potential economic growth in the region.”

- However, they acknowledge “decent risks of further negative rating actions on France and see some risks of negative rating actions on Belgium.”

- On the other hand, they also see “some upside risk (rating and/or outlook upgrades) for peripheral countries.” Namely, a “high likelihood of Moody’s upgrading Greece to IG in 2025 and decent chances (>=50%) of further upgrades in Cyprus (DBRS), Ireland (Moody’s) and Spain (Moody’s).”

- All-in-all, there isn’t much in the way of out of consensus views in the above, but the ideas do feed into many of the RV EGB plays recommended by desks through ’24 and into early ’25.