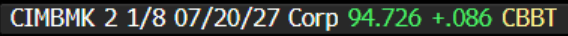

EM ASIA CREDIT: FY Results: CIMB Bank (CIMBMK, A3/A-/NR) - Miss

CIMB Bank (CIMBMK, A3/A-/NR)

"*CIMB FY NET INCOME 7.73B RINGGIT, EST. 7.81B RINGGIT" - BBG

- CIMB Bank has reported FY net income up 10.7% YoY to MYR7.73bn, marginally below consensus (MYR7.8bn). Neutral for spreads.

- Operating profits rose 6.1% YoY to MYR22.3bn, with net interest income up 5.3% YoY to MYR15.4bn. Overall the loan book grew 4.8% YoY.

- In terms of asset quality, the gross impaired loans ratio improved 60bps YoY to 2.1%.

- The bank remain well capitalised, with the CET1 ratio at 14.6%, a little better than the year ago period (14.5%).

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EURUSD TECHS: Monitoring Support At The 20-Day EMA

- RES 4: 1.0696 50.0% retracement of the Sep 25 - Jan 13 bear leg

- RES 3: 1.0630 High Dec 06

- RES 2: 1.0574 38.2% retracement of the Sep 25 - Jan 13 bear leg

- RES 1: 1.0533 High Jan 27

- PRICE: 1.0438 @ 05:53 GMT Jan 29

- SUP 1: 1.0392 20-day EMA

- SUP 2: 1.0260 Low Jan 15

- SUP 3: 1.0178 Low Jan 13 and the bear trigger

- SUP 4: 1.0138 1.764 proj of the Sep 25 - Oct 23 - Nov 5 price swing

EURUSD has pulled back from its recent highs but for now, remains in a short-term bull cycle - a correction. The pair has pierced the 50-day EMA, at 1.0459. A clear break of the average would strengthen short-term bullish conditions and signal scope for a continuation higher near-term. Sights are on 1.0574, a Fibonacci retracement point. Initial support to watch is 1.0392, the 20-day EMA. A move through the EMA would signal a possible reversal.

BUND TECHS: (H5) Corrective Bull Cycle Still In Play

- RES 4: 133.86 High Jan 2

- RES 3: 133.10 50-day EMA

- RES 2: 132.57 High Jan 6

- RES 1: 132.04/22 20-day EMA / High Jan 22

- PRICE: 131.59 @ 05:34 GMT Jan 29

- SUP 1: 131.00 Low Jan 16 / 24

- SUP 2 131.00/130.28 Low Jan 16 / Low Jan 15 and the bear trigger

- SUP 3: 130.44 Low Jul 5 ‘24 (cont)

- SUP 4: 130.23 Low Jul 3 ‘24 (cont)

Bund futures are trading below their recent highs. The pullback appears corrective and a S/T bull cycle is in play. The Jan 15 rally highlighted a reversal signal - a bullish engulfing candle. It continues to suggest scope for a corrective phase that is allowing an oversold trend condition to unwind. Sights are on 132.04, the 20-day EMA. A clear breach of the average would strengthen the bullish theme. The bear trigger is 130.28, the Jan 15 low.

JGBS: Cash Bond Twist Flattener Ahead Of FOMC

JGB futures are little changed, +2 compared to settlement levels.

- In December 2024, the BoJ Board expressed caution about raising interest rates, yet proceeded with the rate hike a month later, the month's meeting minutes showed. A majority of BoJ members voted to maintain the uncollateralized overnight call rate at 0.25% while continuing government bond purchases of 4.9 trillion yen monthly.

- Demand to borrow Japanese bonds surged amid speculation of investors closing out bearish positions. The benchmark repurchase-agreement rate dropped to its lowest since August, signalling stronger demand to borrow bonds. The BoJ's bond lending surged to a 10-month high, with ¥8.6 trillion loaned out so far this week, to ease bond shortages. (per BBG)

- Cash US tsys are 1-2bps richer in today’s Asia-Pac session ahead of today’s FOMC meeting.

- The cash JGB curve hast twist-flattened, pivoting at the 5-year, with yields 1bp higher to 5bps lower. The benchmark 10-year yield is 1.1bp lower at 1.191% versus the cycle high of 1.262%.

- The swaps curve has bull-flattened, with rates flat to 5bps lower. Swap spreads are mostly tighter.

- Tomorrow, the local calendar will see International Investment Flow data alongside BoJ Rinban Operations covering 5-10-year, 25-year+ and Inflation Linked JGBs.