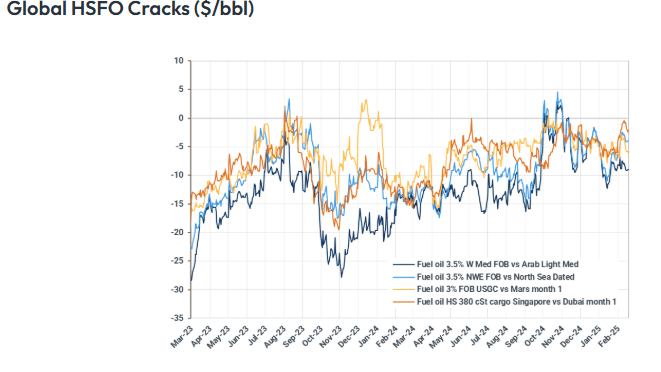

OIL PRODUCTS: Global HSFO Cracks Likely to Get Support: Kpler

Global HSFO cracks have been weakening in recent weeks but are expected to find support in coming weeks, Kpler said.

- Discussions between the US and Russia on a potential resolution to the Ukraine war which could ease supplies of Russian fuel oil.

- Coming support is expected to come from rising offline refinery capacity in Russia this month, coupled with ongoing maintenance at Middle Eastern refineries, Kpler added.

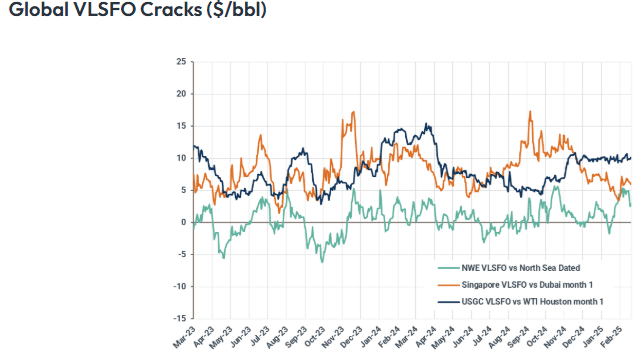

- Meanwhile, VLSFO cracks likely lack the necessary support for a sustained recovery amid increased regional production and subdued demand.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GBPUSD TECHS: Trading Below Resistance At The 50-Day EMA

- RES 4: 1.2667 High Dec 19

- RES 3: 1.2610 38.2% retracement of the Sep 26 ‘24 - Jan 13 swing

- RES 2: 1.2576 High Jan 7

- RES 1: 1.2517/23 50-day EMA / High Jan 27

- PRICE: 1.2432 @ 16:27 GMT Jan 29

- SUP 1: 1.2392/2294 20-day EMA / Low Jan 23

- SUP 2: 1.2229 Low Jan 21

- SUP 3: 1.2100 Low Jan 10 and the bear trigger

- SUP 4: 1.2087 0.764 proj of the Sep 26 - Nov 22 - Dec 6 price swing

A bull cycle in GBPUSD remains in play and the pair is trading closer to its recent highs. The 20-day EMA has been breached and attention is on the 50-day EMA, at 1.2517 and an important resistance. Clearance of the average would highlight a stronger bull cycle. Medium-term trend signals are unchanged, they remain bearish. A reversal lower would refocus attention on 1.2100, the Jan 10 low and bear trigger.

US: FED Reverse Repo Operation

RRP usage inches up to $121.842B this afternoon from $112.760B yesterday. Compares to Monday's usage of $92.863B - the lowest level since mid-April 2021. The number of counterparties rises to 35 from 28 prior.

FED: Uncertainty To Keep Fed Patient, Inflation Key To March Cut Potential(2/2)

That being said, there have been no concrete announcements on the trade front, only proposals. The most immediate is the potential imposition of tariffs on Mexico and Canada on February 1, whose near-term nature alone merits a cautious approach by the Fed this month (and even here, the deadline and the tariffs don't seem to be set in stone).

- April 1 is another key date, by which time Trump has ordered reports on a broad variety of trade related topics, which are expected to lay the groundwork for future tariffs. So uncertainty will probably prevail until well into Q2, giving the Fed yet more reason to hold off on action.

- A less onerous tariff regime than feared could provide some impetus for the Fed to resume cuts. But the other two major areas of relevant policy – fiscal and immigration – aren’t likely to provide a clear picture for at least a few months either, and arguably these will have the larger macro impact. And indeed a relief on the tariff front could have a growth-positive, dollar-negative angle that adds to the case for being patient on cuts.

- Fiscal expansion was a key factor behind higher inflation in the pandemic cycle, and a fresh round of tax cuts on top of the long-assumed extensions are a big reason for post-election private sector exuberance. It could take months for Congress and the White House to emerge with a concrete fiscal package.

- And on immigration, FOMC members from hawks to doves have noted that supply-side labor market expansion helped keep the labor market from getting too tight in the recovery from pandemic recovery– the implication being that slower (or negative) immigration growth could lead to weaker growth and higher inflation.

- Powell’s unlikely to be pinned down on any of these matters: we expect vague language as usual, with some variation of his November press conference comment “we don’t guess, we don’t speculate, and we don’t assume”.

- It looks likely at this point that they will not be in a position to make any concrete assumptions until at least the May meeting. As we noted previously, that doesn't preclude a March cut, but such a decision will probably depend on two convincingly weak inflation reports between now and then.