EU HEALTHCARE: Healthcare: Week in Review

Mar-21 15:33

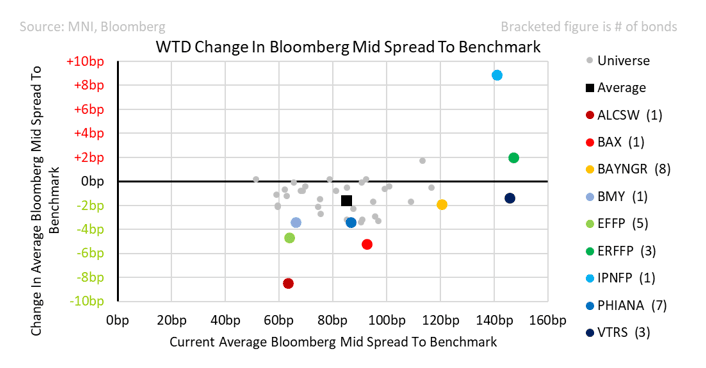

Healthcare outperformed slightly this week with a near 2bp move. We continue to see small pipeline adds in M&A but generally with small upfront commitments. In High Yield, €7.45bn of Opella (Sanofi Consumer Health) buyout debt is being marketed. Amgen was moved to outlook Positive by Fitch.

- Ipsen, a French Mid-Cap Pharma, brought a debut €500m 7yr. The company currently has no net debt but does have room to borrow up to €2.3bn with currently EBITDA multiples. The deal attracted an enormous 11x book and as such was able to price 5bps inside where we saw FV. After an initial move tighter on the break, the bond ended up 6bps wide to reoffer.

- Bayer had some good news with the State of Georgia passing a law to recognise federal labelling for weedkiller. This reduces litigation risk for Glyphosate and is part of a pattern we have reported on from other agricultural states. Bonds did not react, as this was only incremental; the Supreme Court will be the main decision to watch.

- Sandoz issued €500m 10yr on Monday when the market was still somewhat nervous. The deal came 8bps wide to our FV and managed to rally 5bps over the week.

- Pfizer completed its disposal of Haleon – the Consumer JV with Glaxo – raising $3.3bn cash in the process. Pfizer currently only has one EUR bond, but this was part of a 4-tranche €4bn issue in 2017.

- Reckitt was cut from outlook Positive to Stable with Moody’s citing baby-formula litigation as part of the rationale. Bear in mind that Abbott Labs is also a defendant in many of the same cases.

- Astra Zeneca pledged to invest $2.5bn in Chinese R&D facilities. This can be read as potentially positive for a resolution of the investigation into illegal drug importation of some of its employees.

- Johnson & Johnson are increasing Manufacturing, R&D and Investment spending to $55bn over 4 years, a 25% increase.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

MACRO ANALYSIS: Threat Of More Penal Tariffs On Autos & Pharma Downplayed [1/2]

Feb-19 15:31

- US President Trump’s latest threats late yesterday on large tariffs on autos (“in the neighborhood of 25%”) and pharmaceuticals and semiconductors (“25% and higher”) hasn’t been met with the same growth-negative market reaction in EU rates today as in previous episodes.

- On top of the offsetting theme from prospects of notable increases in EU defense spending, the continued pushing back of effective dates is also likely at play. The latest date of Apr 2 is a further delay from previously focused tariffs on iron/steel & aluminium (due Mar 12) and it tallies with the proposed report on reciprocal tariffs due Apr 1, with previously discussions potentially getting rolled up into these early April deadlines/discussions.

- The assumption seems to be that this is a continuation of a Trump’s negotiation strategy of proposing penal policies in order to strike a deal, but if these tariffs do start to grow in likelihood then it’s worth noting that the latest proposals are far more damaging than those on iron/steel & aluminium.

- EU exports of medicinal and pharmaceutical products to the US were worth 0.7% of EU GDP in 2024 whilst vehicle exports were worth 0.3% GDP vs just 0.1% GDP for iron/steel & aluminium.

- With Trump also focused on trade imbalances, the EU sees sizeable trade surpluses of 0.4% GDP (pharma), 0.2% GDP (vehicles) and 0.0% GDP (iron/steel & aluminium).

MNI EXCLUSIVE: MNI Speaks to Norwegian wage settlement committee chair

Feb-19 15:30

Geir Axelsen, Norwegian wage settlement committee chair and National Statistics head, on wage growth-On MNI Policy MainWire now, for more details please contact sales@marketnews.com

OPTIONS: Expiries for Feb20 NY cut 1000ET (Source DTCC)

Feb-19 15:30

- EUR/USD: $1.0315(E916mln), $1.0350(E895mln), $1.0370(E590mln), $1.0400-10(E2.9bln), $1.0425-40(E4.4bln), $1.0450(E1.4bln), $1.0520-25(E1.5bln)

- USD/JPY: Y151.00($514mln), Y151.80-00($1.1bln), Y152.45($515mln), Y154.00($3.0bln)

- GBP/USD: $1.2520(Gbp932mln)AUD/USD: $0.6325(A$549mln), $0.6350(A$685mln), $0.6375(A$858mln), $0.6400(A$424mln)

- USD/CAD: C$1.4100($655mln)l C$1.4175($716mln)

- USD/CNY: Cny7.2000($1.9bln), Cny7.2500($1.9bln), Cny7.3700($1.3bln)

Related bullets

Related by topic

Credit Sector

PFE

US

AZN

UK

IPNFP

France

SDZSW

Switzerland

BAYNGR

Germany

ABT

JNJ