HYBRIDS: Hybrids: Week in Review

Feb-28 08:58

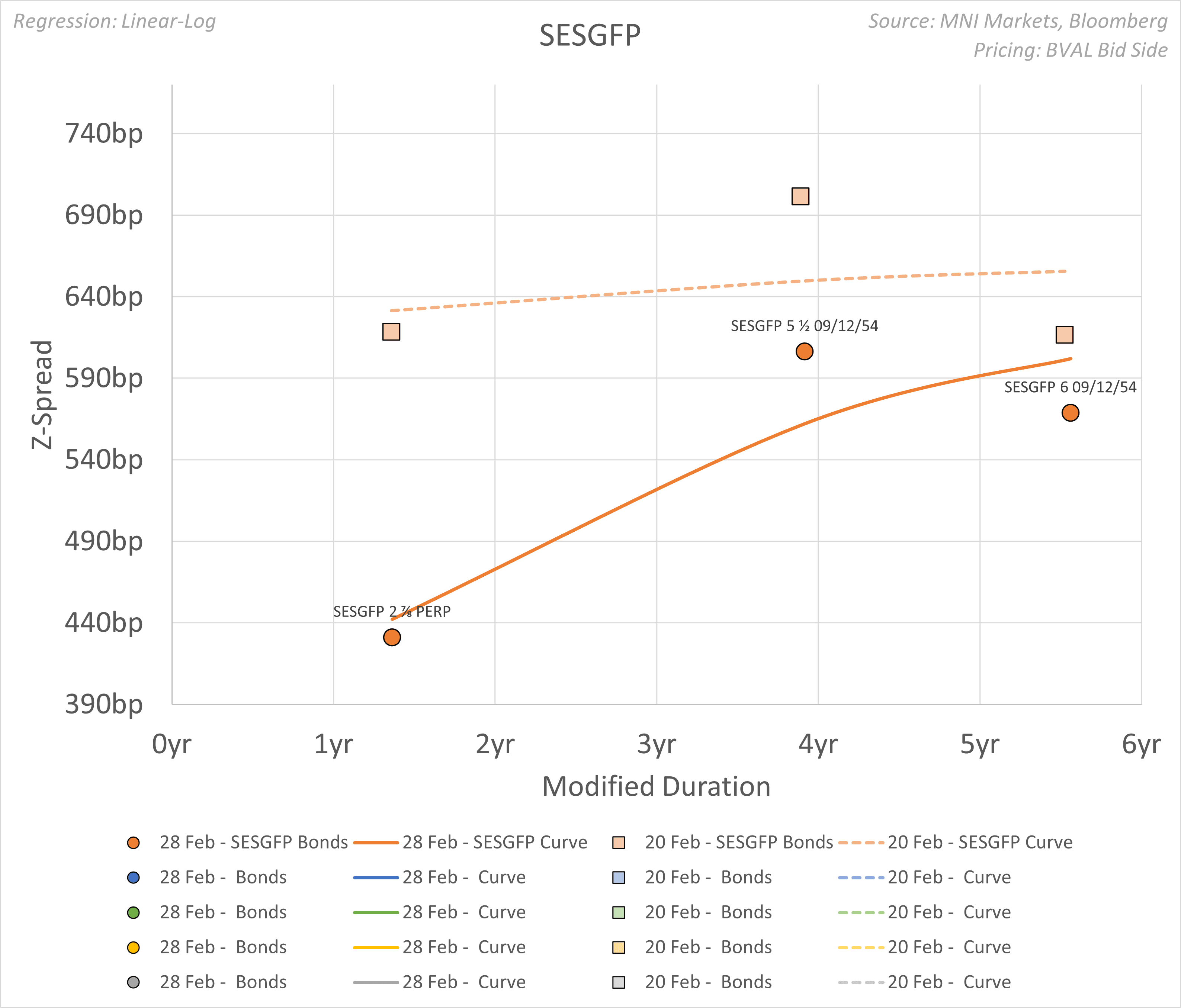

- SES rallied this week on stable earnings and a reiteration from management to get leverage back below 3x. At time of writing, the front dates outperformed with SESGFP 2.875 Call26 +1.83pts vs the SESGFP 6% Call32 +1.67pts.

- BP had its Capital Markets Day with a significant pull-back in Green projects and a commitment to focus on its core Oil & Gas offering. The company is guiding for a reduction in Net Debt to the $14-18bn range from $23bn. For Hybrid investors, it is important to note that it explicitly mentioned the ability to reduce outstanding notional by 25%. BPLN Call29 & Call31 were 17-25c better.

- With BP in mind, Orange was a reminder of S&P’s rules for reducing the stack of Hybrids. ORAFP Call25 was redeemed without replacement, but S&P opined that the intermediate equity content of the remaining bonds would be unaffected as less than 10% was redeemed within one year and less than 25% within ten years.

- Adecco ADENVX 1% Reset27 was +80c this week as the conference call following results emphasised that “the immediate priority is deleveraging…… at or below 1.5x ND/EBITDA by end of 2027 [from 2.8x]”

- Bayer perps were another 25c higher in 3 of the ISINs as confidence in the ModernAgAlliance lobbying effort filtered into the equity market. The share price rallied above €23 for the first time since November. Early days though and the Supreme Court will be the main event of the year to watch.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

STIR: Citi Expect Euribor/SOFR Correlation To Re-establish Itself Through '25

Jan-29 08:48

Citi believe that “the inference for the € front-end from a neutral FOMC meeting would likely be limited.”

- They note that “while both € and $ STIR futures have re-priced aggressively since the 18 Dec FOMC, whites drove the cheapening on the Euribor strip, while the SOFR selloff has been led by blues and golds.”

- They go on to suggest that “the lack of compelling co-movement between the two front-ends has emerged over the last couple of weeks, more so in reds.”

- However, they think “that a common richening trend will be asserted in the second half of the year.”

- Given that their economists “still expect slowing inflation and growth to ultimately lead to five 25bp cuts beginning in May for the Fed. While for the ECB, their expectation is for continued 25bp cuts until an expansionary 1.5% depo rate is reached in September.”

SEK: Light SEK Weakness Following Riksbank Decision, Press Conference In Focus

Jan-29 08:42

SEK saw a small knee-jerk weakening following the Riksbank decision, but EURSEK and NOKSEK have since moved off intraday highs.

- This reaction is unsurprising: The 25bp cut was not quite fully priced into markets as of yesterday, but the lack of forward guidance in the policy statement has countered some of the dovish signal from the rate decision itself.

- The tone of Governor Thedeen’s press conference at 1000GMT/1100CET will be key in shaping the overall reaction in the krona.

- Looking ahead, key focus will be on the January meeting minutes (released February 4). It will be interesting to see if the more dovish Executive Board members (Breman, Jansson and Bunge) signal a willingness to deliver more cuts in H1 ’25, which would be more aggressive than the December MPR rate path.

EURIBOR OPTIONS: Large Call Spread

Jan-29 08:39

ERM5 98.12/98.25cs, bought for 0.5 in 30k.

Related bullets

Related by topic

SESGFP

France

Credit Sector

BAYNGR

Germany

ADENVX

Switzerland

ORAFP

BPLN

UK