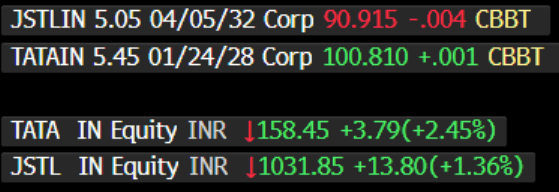

EM ASIA CREDIT: India looks to curb steel imports

"Steel cos jump up to 7% as DGTR backs safeguard duty" - BBG

- The Indian Directorate General of Trade Remedies (DGTR) has recommended for public consultation a 12% tariff on steel imports for an initial period of 200 days. U.S. Tariffs on China is creating a more inward supply in Asia, and local economies are looking to protect domestic industries. Overall neutral for India steel company spreads.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

ASIA STOCKS: Asian Equities Higher, As Tech Stocks Lead The Way

Asian equities advanced, with the MSCI Asia Pacific Index rising 0.8%, marking a fourth consecutive session of gains. Tech stocks led the rally, driven by Tencent, which surged to its highest level since 2021 after integrating DeepSeek’s AI model into WeChat search. Optimism around AI adoption and potential private-sector support from Chinese President Xi’s expected meeting with entrepreneurs further boosted sentiment.

- In Japan, the Topix gained 0.4% as strong earnings from Sony and Sanrio lifted sentiment, though automakers struggled after Donald Trump warned of potential US auto tariffs. Taiwan’s Taiex jumped 1.3%, with TSMC contributing to gains, while South Korea’s Kospi climbed 0.7%.

- China’s CSI 300 up 0.10% and Hong Kong’s HSI up 0.20% posted modest gains, while Chinese brokerage stocks rose on news of a government stake transfer to Central Huijin Investment.

- Meanwhile, Australian equities underperformed, with the ASX 200 falling 0.4%, pressured by insurance stocks on reports of potential political intervention. There has been a flurry of earnings out in Australia today with notable movers included a2 Milk (+18%) on strong earnings, Bluescope Steel (+9.3%) on better-than-expected results, and Bendigo & Adelaide Bank (-19%) after a revenue miss.

- Investors are also watching upcoming earnings from Alibaba, Baidu, and Rio Tinto, along with rate decisions from Australia and Indonesia.

STIR: BoJ-Dated OIS Pricing Extends February Firming

BoJ-dated OIS pricing continues to firm in February, with rates rising 1–6bps compared to late January levels, led by the October contract.

- Recent economic data from Japan, including today’s Q4 GDP (P) beat, and stronger-than-expected wage growth and household spending, has fueled speculation that the BoJ may accelerate and extend its rate hikes beyond prior market expectations.

- Markets currently assign a 2% probability to a 25bp hike in March, a cumulative 58% chance by June, and now fully price in a 25bp increase by September—a shift from late January when a hike wasn’t fully priced in until October.

Figure 1: BoJ-Dated OIS – Today Vs. Friday 31 January

Source: MNI – Market News / Bloomberg

RBA: MNI RBA Preview-February 2025: Cautious February Rate Cut

Download Full Report Here

- The RBA is set to begin an easing cycle with a 25bp rate cut on February 18 bringing the OCR to 4.10%. However, the decision is unlikely to be clear cut and as a result, the statement and press conference are likely to sound cautious.

- The decision may be framed as a reduction in policy restrictiveness due to lower-than-expected inflation rather than a desire to be stimulatory.

- A 25bp rate cut in April remains more than fully priced (117%), while the probability of a cut tomorrow stands at 83%.

- Q4 headline and trimmed mean inflation are likely to result in the updated staff forecasts being revised lower in at least 2025 and the mid-point of the band brought forward from Q4 2026.

- There is enough uncertainty regarding the outlook and strength in recent data to suggest that the tone around a February rate cut is likely to be cautious and that another move in April is unlikely, especially as it will be the first meeting with the new dual board structure.