SPAIN DATA: IP Begins Year On Weak Footing

Spanish industrial production fell 1.0% on a monthly and annual basis in January (vs 1.1% M/M and 2.0% Y/Y prior). Both readings were quite a bit weaker than consensus of -0.2% M/M and 1.3% Y/Y, but note that only four analysts submitted forecasts for the M/M print and five for the Y/Y.

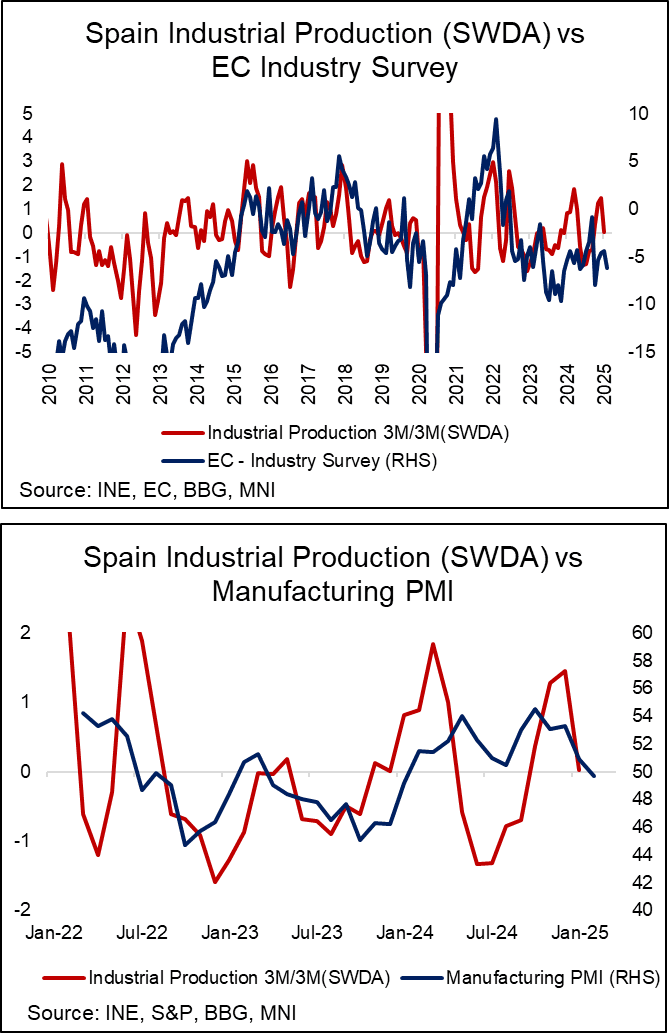

- On a 3m/3m basis, IP was flat in January (vs 1.5% prior), the weakest pace in four months. While a volatile series, the developments track waning momentum in the EC industry sentiment and manufacturing PMI surveys. A reminder that the February manufacturing PMI inched into contractionary territory for the first time in 13 months in February.

- 3m/3m growth in consumer goods IP was 0.5% (vs 1.0% prior), while intermediate goods (0.6% vs 0.6% prior) and energy (0.3% vs 0.6% prior) also saw positive readings. This was offset by a 1.0% pullback in capital goods IP (vs +0.6% prior).

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

SPAIN DATA: Composite PMI Still Comfortably Expansionary Despite Services Miss

The Spanish services PMI was a little weaker-than-expected at 54.9 (vs 56.8 cons, 57.3 prior). Taken alongside a lower-than-expected manufacturing PMI on Monday, the composite index ticked down to 54.0 (vs 55.9 cons, 56.8 prior). The composite index has nonetheless been in expansionary territory since November 2023, notably outperforming other major Eurozone economies.

We highlight that input price increases were passed through to output charges in January. A similar dynamic was also seen in the manufacturing PMI.

Key notes from the release:

- “The rate of growth in new business in January was rapid, rising to its highest level since April 2023. Panellists noted that demand for their services was strong, and that commercial activities had helped to support new business gains”…. “Latest data did however suggest that growth was centred on domestic markets”

- “In response to higher overall workloads, service providers chose to take on additional staff at a rapid and accelerated pace”.

- “Panellists also noted an upturn in typical labour expenses during January”… “Suppliers were also reported to have increased their prices”… “firms increased their output charges in response to higher operating expenses”.

EQUITIES: EU Bank index highest since 2011

- While most of the calls for Cash Equities were on the downside and into negative territory, Banking index should again be watched, this is one of the most interesting chart at the start of 2025, SX7E is now breaking through 163.66, was not only last Week's high but its highest level since July 2011.

- Next upside is now seen at 166.10, the July 2011 high.

SILVER TECHS: Pierces Resistance

- RES 4: $34.903 - High Oct 23 and the bull trigger

- RES 3: $33.450 - 76.4% of the Oct 23 - Dec 19 ‘24 bear leg

- RES 2: $33.000 - Round number resistance

- RES 1: $32.552 - 61.8% of the Oct 23 - Dec 19 ‘24 bear leg

- PRICE: $32.361 @ 08:15 GMT Feb 5

- SUP 1: $30.651 - 50-day EMA

- SUP 2: $29.704 - Low Jan 27

- SUP 3: $28.748 - Low Dec 19 and bear trigger

- SUP 4: $28.446 - 76.4% retracement of the Aug 8 - Oct 23 bull cycle

Silver is trading higher this week. Key resistance at $32.338, the Dec 12 high, has been pierced. Clearance of this level would highlight a stronger reversal. This would cancel a recent bearish theme and open $32.552, a Fibonacci retracement. Clearance of this level would expose the $33.00 handle. On the downside, initial firm support lies at $30.651, the 50-day EMA and a pivot level. A clear break of the EMA would reinstate the recent bearish theme.