POWER: Jan Hits Lowest in Month, Spot to Fall Next Week on Wind, Temps

Poland’s Jan 25 power contract has fallen for its second consecutive session to hit its lowest level since 12 November, with the contract down by around 2.1% on the week amid price falls in both emissions, coal and forecasts suggesting sustained above seasonal temperatures towards the end of December. Spot Prices could also still be weighed down next as wind is expected between 57-75% load factors over 16-20 Dec.

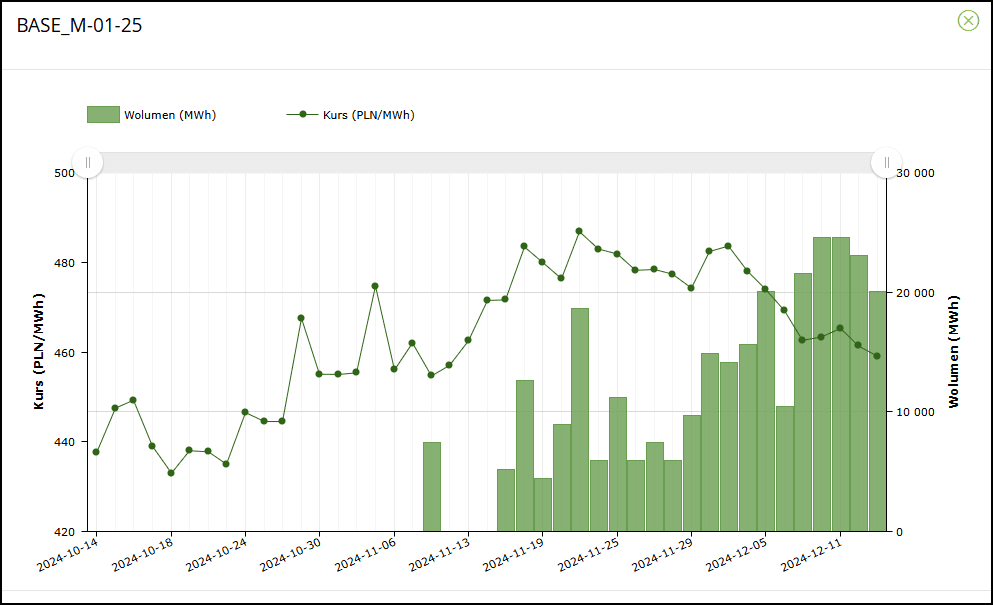

- Poland Jan25 baseload power settled at PLN459.06/MWh compared to its settled price of PLN461.34/MWh on 12 Dec, according to data on Polish power exchange TGE.

- The contract has fallen to its lowest price since 12 November, when it settled at PLN457/MWh.

- EUA DEC 24 down 1.8% at 64.89 EUR/MT

- Rotterdam Coal JAN 25 down 0.2% at 109.45 USD/MT 14:19 BST

- Average temperatures in Warsaw are still seen flipping above the norm on 15 Dec to climb as high as 7.5C on 17 Dec before slowly declining to be between 1.9-6.7C over 18-27 Dec– however still well above the norm at just under 0C over the same period.

- The Jan 25 contract traded 27 times in 27 lots from 31 lots exchanged in the previous session.

- Jan opened at PLN459/MWh - the low for the day -before rising to a daily high of PLN459.45/MWh in the middle of the session and dropping to PLN459.10/MWh at the end of the session.

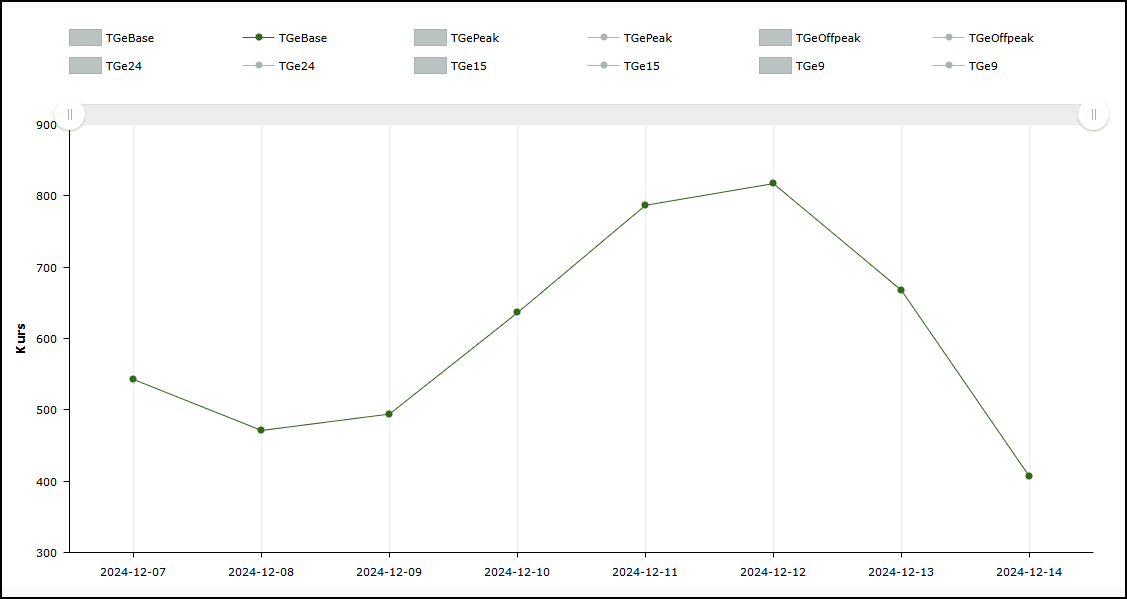

- Closer in, the day-ahead continued downward for the second session to drop to PLN406.43/MWh for Saturday delivery from PLN667.40/MWh for Friday as wind is expected to rise 4.01GW tomorrow compared to 0.742GW today.

- Demand is also expected to drop on the day to around 19.65GW from 21.78GW today.

Looking slightly ahead, wind is expected at 6.97GW, or a 75% load factor on 16 December (Mon) – which could keep gains limited from rising demand.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EURIBOR OPTIONS: Large call spread vs put

ERM5 98.25/98.50cs vs 97.50p, bought the cs for half in 26.9k.

EQUITIES: US Cash opening calls

SPX: 5,997.4 (+0.2%); DJIA: 44,005 (+0.2%/+94pts); NDX: 21,105.4 (+0.2%).

GILTS: Front End Outperforms Following U.S. CPI

Gilts bid alongside Tsys since the U.S. CPI.

- Futures to fresh session highs at 93.98, still comfortably below yesterday’s peak.

- Modest outperformance for gilts vs. Bunds since the U.S. CPI data given their typical higher beta to moves in Tsys.

- 10s now a little over 2bp tighter vs. Bunds on the day, last ~211bp, although gilts underperform Tsys by 3bp.

- Outright yields now 3-5bp lower on the day, 2s outperform on dovish repricing in the short-end.

- BoE-dated OIS 0.5 to 9bp more dovish through end of ’25 (vs. pre-data levels), showing ~3bp of cuts for next month, 27.5bp through March, 47.5bp through June and 64.5bp through December ’25.

- SONIA futures flat to +3.5.