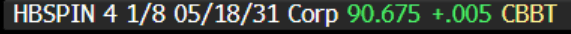

EM ASIA CREDIT: JSW Hydro (HBSPIN, Ba1/NR/BB+) - JSW Energy signs 1,600MW PPA

Mar-14 01:57

"*JSW ENERGY POWER PURCHASE PACT WITH WEST BENGAL CO FOR 1600MW" - BBG

- JSW has signed a 1,600MW greenfield thermal power project in West Bengal, which is expected to be operational in in 5 years.

- The project is the largest power purchase agreement for JSW.

- The company is currently building around 7.5GW of power projects, with current generation at 10GW. The the target is for 20GW by 2030.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US TSYS: Yields Little Changed Ahead Of CPI & Powel Testimony

Feb-12 01:53

- Tsys are doing very little today, with front-end tsys futures unchanged. There has been small buying of FV & TY call options, however nothing major. TU is unch at 102-22⅜, while TY is +00+ at 108-31.

- A bull phase in futures remains in play despite the run lower off recent highs. This leaves the TY contract holding the bulk of its latest gains. The contract traded through the 50-day EMA of 109-10+ earlier in the month, which highlights potential for a stronger reversal and sights are on a climb above the 110-00 handle. On the downside, initial firm support to watch is unchanged at 108-20+, the Feb 4 low. Clearance of it would signal a reversal and the end of the corrective cycle.

- Cash tsys are little changed so far today, with the 10yr trading at 4.531%.

- January core CPI is expected to rise by 0.3% m/m, from a 0.4% m/m rise in Dec. Powell’s will also be speaking at the two-day testimony marathon

- US CPI Preview - ( USCPI_Prev_Feb2025_e3ccd233d6.pdf )

AUD: A$ Generally Range Trading Ahead of US CPI But Stronger Against Yen

Feb-12 01:51

AUDUSD has been trading in a narrow range today between 0.6288 and 0.6300 and is currently up to 0.6299. The USD index is 0.1% higher driven by a weaker yen but other currencies are little changed as markets wait for January US CPI out later today.

- With the yen underperforming, AUDJPY is up 0.7% to 96.62, close to the intraday high.

- Aussie is little changed against other major currencies with AUDNZD down 0.1% to 1.1124, near its low, AUDEUR around 0.6079 and AUDGBP at 0.5059.

- Equities are mixed today with the ASX up 0.2%, Hang Seng +1.1 but CSI 300 down 0.1%, while the S&P e-mini is flat. Oil prices are lower with WTI -0.35% to $73.06/bbl. Copper is 0.3% lower and iron ore is around $106/t.

- Later Fed Chair Powell testifies to the House financial services committee and the Fed’s Bostic and Waller also speak. January US CPI prints and Bloomberg consensus is expecting no change in the headline at 2.9% but for core to ease 0.1pp to 3.1% (see MNI US CPI Preview). January budget and real earnings data are also out. The ECB’s Elderson speaks at an MNI Connect event and BoE’s Greene appears.

FOREX: Yen Weakness Continues, Steady Trends Elsewhere

Feb-12 01:37

G10 focus remains centred on yen weakness. USD/JPY has risen back above 153.40 (session highs 153.46). This has been enough to push USD indices higher, the USD BBDXY last near 1301.7. There has been little aggregate shifts elsewhere in the G10 space.

- USD/JPY opened near 152.50, so is nearly 100pips higher versus these levels. We noted earlier the higher core backdrop from Tuesday was a yen headwind, although US yields sit down slightly for Wednesday trade so far.

- Hong Kong equity sentiment has opened up firmer, but trends are mixed elsewhere, while US futures aren't too far away from flat.

- BoJ Governor Ueda is before parliament at the moment, but hasn't delivered any market moving headlines so far.

- Yen weakness is driving crosses higher. AUD/JPY is back above 96.50, close to early Feb highs. EUR/JPY is closing in on 159.00

- For USD/JPY technicals, we are back close to the 100-day EMA, but the 50-day (around 154.70) is seen as more important resistance.

- AUD/USD was last near 0.6295, little changed, while NZD/USD has ticked up towards 0.5660.

- We had housing finance figures for Australia earlier, which continued to rise, but hasn't impacted FX sentiment.

- Later on we get preliminary Japan machine tool orders, but greater focus will rest with tonight's US CPI print.