EU CREDIT SUPPLY: Korea Electric Power (KORELE, Aa2/AA/AA-) - $ 3y Fair Value

Credit Supply: Korea Electric Power (KORELE, Aa2/AA/AA-) - FV

New Issue: $ benchmark 3y

IPT: T+90

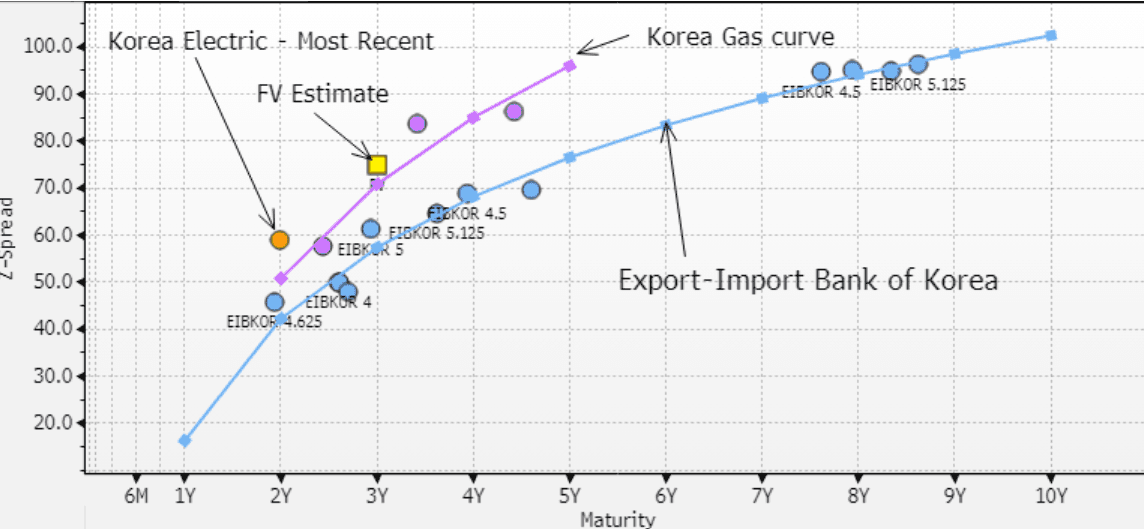

FV: T+50 (zprd c. 75bp)

KEPCO is a highly rated (Aa2/AA), Korean electricity producer, majority owned by the Korean state and a strategic asset. We expect state support if and when needed. As referenced below, we make our assessment of fair value versus peer, Korea Gas (KORGAS), also majority state owned and similarly rated.

KEPCO previously issued dollars in January '24 (1/27s), which trades around 10bp wide of the KORGAS curve in z-sprd terms, but we note it’s a relatively large size ($1.2bn). In our assessment, we clean things up a bit by eliminating bonds issued beyond 3 years to get to a more liquid curve.

As illustrated in the chart (below) we believe that FV is likely to be a few bp wide of the KORGAS curve, with the 3y FV at around T+50bp (z+75bp). Though its worth highlighting that the original announcement was for a dual tranche 3y & 5y, and investor interest might be subdued given uncertainty around tariffs.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US TSYS: Slightly Richer Ahead Of JOLTS & ISM Services Data

TYH5 is 108-18+, 0-01+ from NY closing levels.

- According to MNI’s technicals team, the trend condition in 10-year futures remains bearish. Recent weakness reinforces the current bear cycle - the contract has traded through key short-term support and the bear trigger at 109-02+, the Nov 15 low. The breach confirms a resumption of the downtrend and opens 108.00, a Fibonacci projection. Short-term gains are considered corrective below the 109-10+ 20-day EMA.

- Cash bonds are 1-2bps richer in today’s Asia-Pac session after yesterday’s modest bear-steepener.

- Tuesday’s US data calendar includes JOLTS, ISM Services and Tsy 10Y Re-Open.

AUSSIE BONDS: Slightly Cheaper, Subdued Session, CPI Monthly Tomorrow

ACGBs (YM -2.0 & XM -1.0) are slightly weaker in a relatively subdued Sydney session.

- Outside of the previously outlined building approvals, there hasn't been much by way of domestic drivers to flag.

- Cash US tsys are 1-2bps richer in today’s Asia-Pac session after yesterday’s modest bear-steepener. Tuesday’s US data calendar includes JOLTS, ISM Services and Tsy 10Y Re-Open.

- Cash ACGBs are 1bp cheaper with the AU-US 10-year yield differential at -14bps.

- Swap rates are 2-3bps higher.

- The bills strip has bear-steepened, with pricing flat to -6 across contracts.

- RBA-dated OIS pricing is flat to 4bps firmer, with late 2025 leading. A 25bp rate cut is more than fully priced by April (108%), with a February cut at a 58% chance.

- November CPI is released tomorrow and is likely to be watched closely ahead of Q4 data on January 29. It will also include more updates for services components than the October release. Bloomberg consensus is forecasting the headline to pick up 0.1pp to 2.2%. The trimmed mean was 3.5% the previous month.

- The local calendar shows retail sales and trade balances on Thursday.

- AOFM Bond issuance is expected to resume in the week beginning 13 January 2025.

GOLD: Holding Within Recent Ranges, Simple 100-day Support Zone Intact

Gold is a touch higher in the first part of Tuesday trade. Bullion was last near $2640, up a touch for the session, but remaining well within Monday's intra-session ranges. Dips sub the simple 100-day MA (last near $2626) have been supported in recent months. This is helping keep a modest uptrend in play, but Nov/Dec highs from 2024, above $2700 are still some distance away.

- Cross asset trends have been mixed so far today, with the aggregate USD indices little changed, while US yields are down a touch. Regional equities are mostly higher outside of a Hong Kong drop.

- Onshore China media has highlighted analysts stating that central bank allocation to gold is likely to continue in 2025 (per CSJ, see this BBG link). This has been a key source of support for bullion in recent years.