FRANCE DATA: Lacklustre Domestic Demand In Q4 And Goods Spending In January

Feb-28 10:42

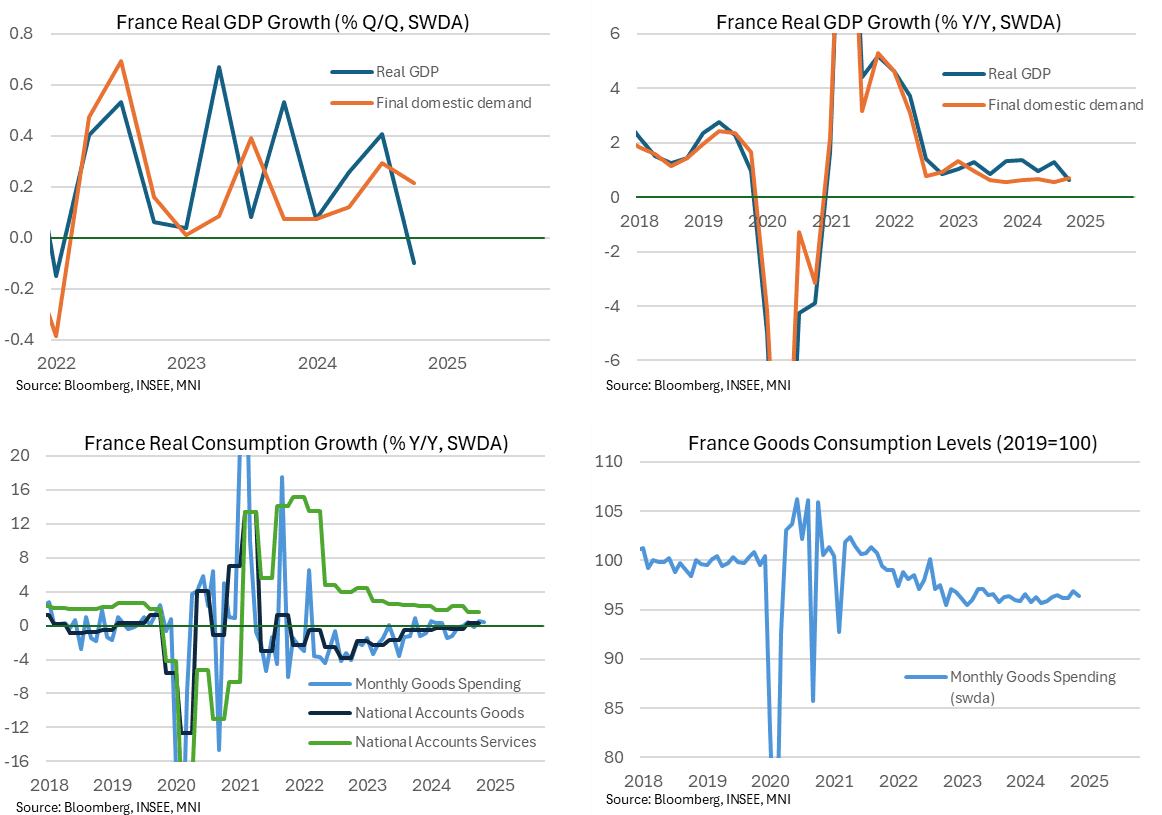

- French GDP was confirmed at -0.1% Q/Q non-annualised in the final Q4 release as expected, although the year-on-year was revised a tenth lower to 0.6% Y/Y.

- As noted in last month’s flash release, the pullback from 0.4% Q/Q in Q3 was “partly due to the backlash of the Paris Olympic and Paralympic Games which fuelled the economic growth in the previous quarter.”

- Details show some tweaks to the composition for growth: with downward revisions for final demand (0.2pp vs 0.3pp in the flash) and stock variation (-0.3 vs -0.1pp) and an upward revision for net exports (0.0pps vs -0.2pps).

- It leaves latest trends showing real GDP at -0.1% Q/Q and 0.6% Y/Y, with final domestic demand firmer on the quarter at 0.2% Q/Q but barely any different at 0.7% Y/Y.

- As for more timely measures, real consumer spending for January wasn’t quite as weak as expected, but at -0.5% M/M (cons -0.7%) it was still a sizeable pullback from the 0.7% M/M step higher in Dec (all swda data) along with some downward revisions.

- These monthly data continue to paint a bleak picture, with sales just 0.4% Y/Y higher after a weak trend and levels still some 3-4% lower than pre-pandemic levels. The below charts show how services consumption, of 1.5% Y/Y in Q4, has been driven overall consumption compared to goods consumption of just 0.3% Y/Y in Q4.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EGBS: Bund Futures Off Session Highs As Euro Equities Find A Base

Jan-29 10:42

Bund futures are +29 ticks at 131.70, off earlier session highs as European equities find a short-term base. The downtick in crude oil futures is somewhat offset by a ~3% rally in natural gas, limiting the feedthrough into core EGBs.

- The 10-year OAT/Bund spread has widened back to ~74bps after reaching a low of 72bps earlier. Markets are digesting a rift between the Socialists and the government, following PM Bayrou’s comments around immigration yesterday.

- German cash yields are 2-3bps lower across the curve. E4.5bln of the 10-year 2.50% Feb-35 Bund was sold this morning.

- Eurozone lending to households and firms accelerated in December, in a signal that ECB policy rate cuts are continuing to be fed through the real economy.

- 10-year peripheral spreads to Bunds have tightened alongside the equity rally. The 10-year BTP/Bund spread has fully retraced the widening seen into yesterday’s close, now ~2.5bps tighter at ~107bps. Yesterday’s widening came on news that PM Meloni has been placed under investigation in a case relating to the repatriation of a Libyan police officer.

- Broader global focus turns to the BoC and Fed decisions later today, before the ECB decision tomorrow (a 25bp cut remains essentially fully priced in ECB-dated OIS).

OUTLOOK: Price Signal Summary - S&P E-Minis Trend Needle Points North

Jan-29 10:40

- In the equity space, the S&P E-Minis contract remains above Monday’s low. Key short-term support to watch lies at 5961.75, the Jan 16 low (pierced). For now, the recent sharp pullback appears corrective, however, a clear breach of 5961.75 would strengthen a bearish threat and signal scope for a deeper retracement, towards 5943.94, 61.8% of the Jan 13 - 24 bull leg. Key resistance is 6178.75, the Dec 6 high.

- A bull cycle in the EUROSTOXX 50 futures contract remains intact and the move lower from last Friday’s high, appears to have been a correction. A deeper retracement would allow an overbought trend condition to unwind. Moving average studies are in a bull-mode set-up highlighting a dominant uptrend. The first important support to watch is 5108.69, the 20-day EMA. A resumption of the uptrend would open 5298.50, the 1.500 projection of the Nov 21 - Dec 9 - 20 price swing.

GILTS: Underpinned Despite Soft Green Auction

Jan-29 10:38

Gilts hold the bulk of the opening rally.

- Futures last +42 at 92.51, just off session highs (92.54).

- Short-term bullish correction within the longer run bearish technical theme remains intact.

- Initial support and resistance 91.10/92. 68.

- Yields 3.5-4.5bp lower, 10s lead the rally.

- Spread to Bunds continues to hover around 204bp, which represents the early November closing low. A break (on a closing basis) would expose the psychological 200bp marker.

- GBP STIRs hold the early dovish repricing.

- BoE-dated OIS showing ~72.5bp of cuts through ’25 vs. 69bp late yesterday.

- SONIA futures flat to +4.5.

- 8-Year green gilt supply saw a softish demand/pricing mix.

- No meaningful market input from Chancellor Reeves pro-growth speech.

- Macro and cross-market cues will be eyed for the remainder of today, with the UK data calendar subdued through the remainder of the week.