OPTIONS: Limited, Mixed Trade Thursday Includes Bobl Upside

Mar-20 17:52

Thursday's Europe rates/bond options flow included:

- OEK5 117.50/118.50 call spread vs. 116.50/115.50 put spread paper paid 11 on 2K for the call spread, 44% delta

- RXM5 128/127/125/124 'wide' body put condor paper paid 26.5 & 27 on 2.5K

- ERM5 97.625/97.50 put spread paper paid 1.75 on 10k

- ERM5 97.75/98.00/98.25 call fly 4K given at 6.75

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

CANADA: GoC Yields Fade Latest Climb In Tsy Yields

Feb-18 17:49

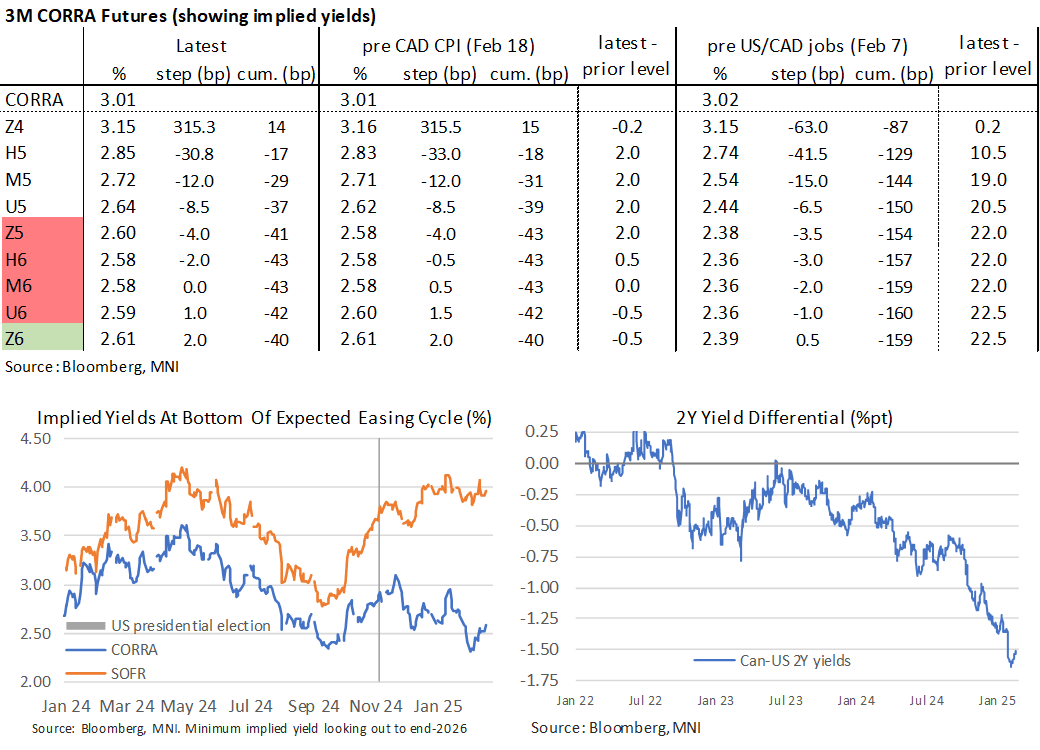

- GoC yields have completely faded the recent renewed climb in Treasury yields, unwinding the further increase in Can-US yield differentials seen after today’s stronger than expected CAD CPI inflation.

- 2Y yields have limited post-CPI releases to +1bp for +6.6bp from Friday’s close, vs +1.5bp and +3.4bp respectively for Treasuries (both following Family/Presidents’ Day holidays).

- Can-US 2Y yield diff at -150.5bps (+3.2bp since Fri) vs early Feb fresh multi-decade lows of -164bps.

- BoC-dated OIS sees 8-9bp of cuts for the Mar 12 decision vs 12-13bp pre-CPI.

- 3mth CORRA implied yields are 2bp higher post-CPI for 2025 contracts (for as much as 7.5bp higher on the day) whilst the terminal of ~2.6% in early 2026 points to ~40bp of cumulative cuts for the cycle (BoC neutral estimates between 2.25-3.25%).

FED: US TSY 52W AUCTION: NON-COMP BIDS $1.294 BLN FROM $48.000 BLN TOTAL

Feb-18 17:45

- US TSY 52W AUCTION: NON-COMP BIDS $1.294 BLN FROM $48.000 BLN TOTAL

US TSYS: Heading Lower Again On Confluence Of Factors

Feb-18 17:21

- Treasuries have pushed to fresh session lows in recent trade, with not much by way of headlines but WTI futures continuing to push higher and today’s solid slate for corporate issuance possibly also weighing.

- The initial move to fresh lows also coincided with the first round of today’s heavy bill issuance, which included the small bid-to-cover for a 26-week since Mar 202.

- 13-week bill auction: Today saw 2.81x, vs 3.01x (Feb 10), 2.65x (Feb 3) and 3.18x (Jan 27).

- 26-week bill auction: Today saw 2.63x vs 2.86x (Feb 10), 3.04x (Feb 3) and 2.92x (Jan 27).

- Cash yields are now 3.2-5.8bp higher on the day, with 5-10Y tenors leading increases from a combination of real yields (+3.8bp for 10Y) and breakevens (+1.6bp for 10Y).

- These moves are only helping reverse the dovish impact from a particularly soft retail sales report on Friday.

- TYH5 has seen session lows of 108-29 (-13), still off Friday’s pre-retail sales low of 108-26 and support not seen until 108-04 (Feb 12 low) before 108-00 (Jan 16 low).

- Ahead, round two of post-holiday bill issuance with $80bn 6-wk bills & $48bn 52-wk bills at 1300ET, along with outgoing Fed Vice Chair for Supervision Barr on AI and financial stability (text + Q&A).

- It’s followed after the close by President Trump and Musk in a Fox News interview at 2100ET. The sit-down with Sean Hannity is set to focus on the Musk-led DOGE and Trump's first 100 days in office.