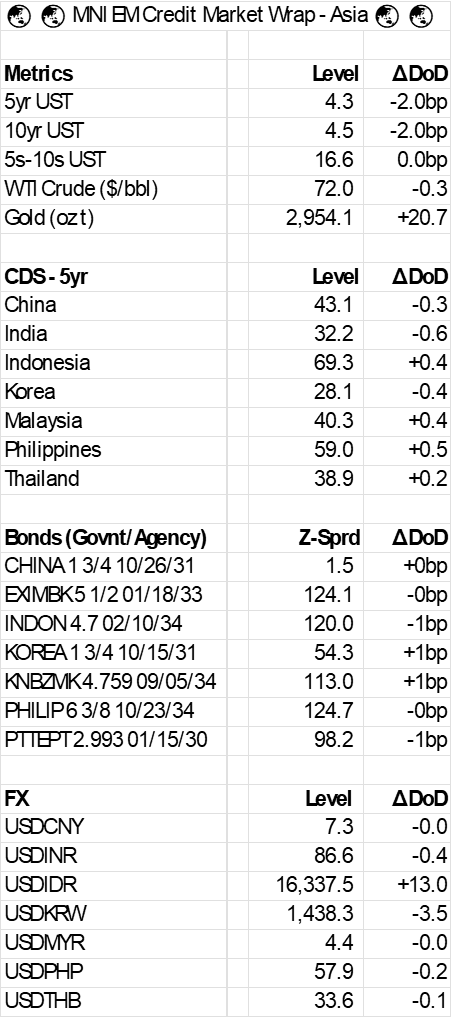

EM ASIA CREDIT: MNI EM Credit Market Wrap - Asia

** The main stories out of the region**

The 10yr U.S. treasury yield is closing 2bp lower in Asia hours with Thursday's upcoming schedule the Philly Fed manufacturing survey alongside weekly jobless claims.

Asia EM govie/agency bonds were mostly unchanged today, with no particular outliers, perhaps a small bias for wider spreads.

China and HK equities struggled today, with some of the heat taken out of the tech rally.

In terms of newsflow, Lenovo results came ahead of consensus, though we note bonds are at all time tights. Meituan stated it planned to pay workers social security, negative for the cost base, but somewhat mitigated by a slow roll out. LG Electronics had its Moody's outlook raised to Positive on the back of improvements at its display business. Finally, we had some

bank results, including from Metrobank (Philippines), Bank of East Asia (China) and AMMB Holdings (Malaysia). Overall solid results, neutral for spreads.

In terms of supply, the Mirae $ 3yr benchmark was priced at T+95bp, it came with an IPT of T+125bp.

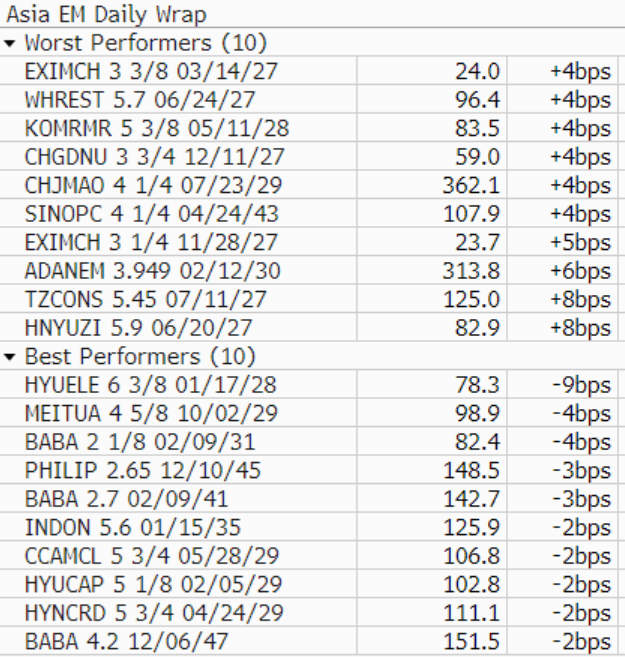

Best & Worst Performers

Source: Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EGB SYNDICATION: 5/15-year LITHUN EMTN: Guidance

- EUR Benchmark 5Y Fixed (Jan. 28, 2030) MS+70 Area

- Coupon: Annual, act/act ICMA

- EUR Benchmark 15Y Fixed (Jan. 28, 2040) MS+145 Area

- Coupon: Annual, act/act ICMA

- Issuer: Lithuania Government International Bond (LITHUN)

- Settlement: Jan. 28, 2025

- Bookrunners: BNPP (B&D), BofA, JPM

- Co-Lead (no books): SEB Lithuania

- Investor presentation.

- Timing: May price today.

Details as per Bloomberg

OPTIONS: Two-Way USD Risk, Duelling Tariff Headlines Trigger Sizeable Flow

- Yesterday's FX derivatives volumes were seriously impressive considering the US market holiday, with over $110bln notional crossing the DTCC thanks to the USD sell-off, with tariff target currencies (namely EUR, CAD and CNY) leading the way.

- While relief was evident in the spot rally for EUR, CAD and others - short-end vol markets have not followed, with USD risk reversals and butterfly vol holding at much more cautious levels, somewhat vindicated by the follow-up from Trump overnight and his warning of 25% tariffs on USMCA nations to combat migration flow.

- As such, while USD/CAD sold off on the initial memo headlines yesterday, net upside demand via options is still evident, tipping the put/call skew toward calls. Over $4bln notional has traded in calls with strikes at 1.45 or above, positions which will have benefited from the bounce off the 1.4262 low yesterday.

- This raises the risks around Canadian politics, and increases the importance of Trudeau's succession, with tariff strategy comments on the candidates' campaign trail likely market movers.

GILTS: Off Early Highs, Syndication Eyed

The early uptick in gilts fades, as participants assess the mixed labour market data (soft quantity readings vs. firmer-than-expected private wages) and the latest developments in the U.S. tariff playbook.

- Futures peaked at 91.79 before fading back to ~91.60.

- Initial resistance at the January 17 high (91.96) untested.

- That leaves the bearish technical trend intact in the contract, initial support at the January 16 low (90.68).

- Yields flat to 1bp lower.

- Spread to Bunds 1bp wider at 214bp.

- The DMO has released the minutes of yesterday's consultations with gilt market participants, details available in a previous bullet.

- BoE-dated OIS showing ~63bp of cuts through year-end, matching pre-gilt open levels, 1bp more dovish on the day.

- SONIA futures flat to +2.0, back from early highs.

- On the lookout for the syndicated tap of the 4.375% Jan-40 gilt. Bookrunners have indicated this will likely be today’s business, in line with our own expectation.