LATIN AMERICA: MNI EM Credit Market Wrap - LATAM (21 Mar)

Source: BBG

Measure Level Δ DoD

5yr UST 4.00% -1bp

10yr UST 4.25% +1bp

5s-10s UST 24.3 +2bp

WTI Crude 68.2 +0.1

Gold 3021 -24.2

Bonds (CBBT) Z-Sprd Δ DoD

ARGENT 3 1/2 07/09/41 936bp +15bp

BRAZIL 6 1/8 03/15/34 267bp +6bp

BRAZIL 7 1/8 05/13/54 350bp +2bp

COLOM 8 11/14/35 391bp +6bp

COLOM 8 3/8 11/07/54 471bp +5bp

ELSALV 7.65 06/15/35 450bp +3bp

MEX 6 7/8 05/13/37 270bp +3bp

MEX 7 3/8 05/13/55 329bp +2bp

CHILE 5.65 01/13/37 159bp +3bp

PANAMA 6.4 02/14/35 328bp +10bp

CSNABZ 5 7/8 04/08/32 555bp +4bp

MRFGBZ 3.95 01/29/31 302bp +3bp

PEMEX 7.69 01/23/50 658bp +12bp

CDEL 6.33 01/13/35 202bp +1bp

SUZANO 3 1/8 01/15/32 199bp +2bp

FX Level Δ DoD

USDBRL 5.71 +0.03

USDCLP 926.89 -1.31

USDMXN 20.2 +0.08

USDCOP 4144.55 -27.51

USDPEN 3.64 +0.01

CDS Level Δ DoD

Mexico 137 3

Brazil 191 1

Colombia 225 10

Chile 64 2

CDX EM 97.23 (0.13)

CDX EM IG 100.88 (0.01)

CDX EM HY 93.11 (0.31)

Main stories recap:

· EM opened weaker in Asia and stayed that way throughout the day with higher beta CEEMEA names about 20 bps wider while in Latam benchmark bond spreads were generally 3-5 bps wider.

· From a macro perspective, anxiety percolated below the surface with some bellwether US companies like Fedex, Nike and Lennar disappointing in their outlook and NY Federal Reserve President John Williams remarking about uncertainty for the US economic outlook.

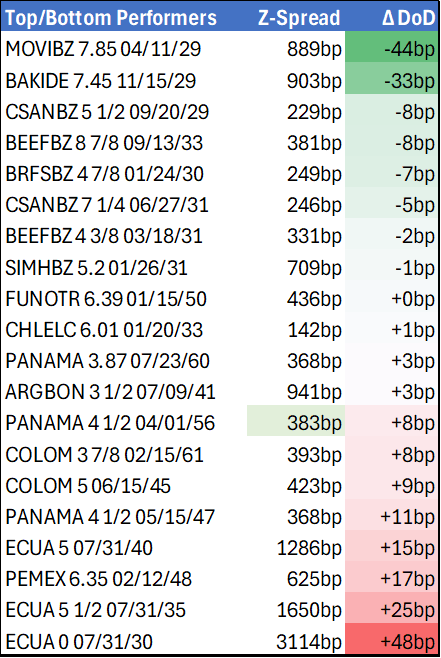

· Market driven underperformance in Latam was led by Pemex and Argentina with little news to drive the move while Ecuador drifted almost ¾ pt lower ahead of the April 13 presidential election.

· Colombia bonds widened out 8bps with the new finance minister failing to address fiscal spending concerns but instead focused on tax reform which has failed to gain traction in the recent past.

· Brazilian vehicle leasing company Movida reported better than expected 4Q 2024 earnings that led the bonds to rise more than a point.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

AUDUSD TECHS: Bulls Remain In The Driver’s Seat

- RES 4: 0.6471 High Dec 9 ‘24

- RES 3: 0.6429 High Dec 12 ‘24

- RES 2: 0.6414 38.2% retracement of the Sep 30 ‘24 - Feb 3 bear leg

- RES 1: 0.6384 High Dec 13

- PRICE: 0.6347 @ 16:15 GMT Feb 19

- SUP 1: 0.6305/6231 50-day EMA / Low Feb 10

- SUP 3: 0.6171/6088 Low Feb 4 / 3

- SUP 3: 0.6045 1.500 proj of the Sep 30 - Nov 6 - 7 price swing

- SUP 4: 0.6000 Round number support

AUDUSD is trading at its recent highs and a bull theme remains intact. The pair has cleared 0.6331, the Jan 24 high and a key short-term resistance. The breach highlights a stronger reversal and paves the way for gains towards 0.6414, a Fibonacci retracement. Note that moving average studies remain in a bear-mode position. This suggests the latest recovery is a correction. Initial firm support to watch is 0.6231, the Feb 10 low.

FED: Jan FOMC Minutes: Gov't Policy Uncertainty For Inflation (3/3)

Government policy shifts were indeed a key risk to inflation for FOMC participants: "other factors were cited as having the potential to hinder the disinflation process, including the effects of potential changes in trade and immigration policy as well as strong consumer demand" while "business contacts in a number of Districts had indicated that firms would attempt to pass on to consumers higher input costs arising from potential tariffs".

- Interestingly though, downside growth risks from government policy shifts didn't appear to be considered, but upside risks were:

- "Participants pointed to various risks to economic activity and employment, including downside risks associated with an unexpected weakening of the labor market, a weakening of consumers' financial positions, or a tightening of financial conditions, as well as upside risks associated with a potentially more favorable regulatory environment for businesses and continued strength in domestic spending."

- And on employment, "participants judged that labor market conditions had remained solid and that those conditions were broadly consistent with the Committee's goal of maximum employment... Nonetheless, participants generally noted that labor market indicators merited close monitoring" (though it's not clear in what direction it merits monitoring).

- Separately, the framework review discussion is discussed in some detail, confirming some of the previous Fed participants' discussions:

- "Participants highlighted as areas of consideration the statement's focus on the risks to the economy posed by the ELB, the approach of mitigating shortfalls from maximum employment, and the approach of aiming to achieve inflation moderately above 2 percent following periods of persistently below-target inflation...Participants also mentioned aspects of the statement that they thought should continue to be emphasized—including the Committee's firm commitment to achieving maximum employment and 2 percent inflation, as well as the importance of keeping longer-term inflation expectations well anchored."

FED: Jan FOMC Minutes: Cautious Inflation Optimism (2/3)

The "vast majority" of the FOMC saw risks to the dual-mandate objectives in January as "roughly in balance" (same as in December), though "a couple commented that the risks to achieving the price stability mandate currently appeared to be greater than the risks to achieving the maximum employment mandate. Participants generally pointed to upside risks to the inflation outlook."

- The Committee's views on inflation seemed cautiously optimistic: "Inflation remained somewhat elevated...relative to the Committee's 2 percent longer-run goal, and progress toward that goal had slowed over the past year", a sentiment echoed by Chair Powell in the post-meeting press conference.

- "Many" participants "emphasized that additional evidence of continued disinflation would be needed to support the view that inflation was returning sustainably to 2 percent", with core goods price disinflation fading but housing services inflation and market-based measures of core nonhousing services inflation declining: "participants expected that, under appropriate monetary policy, inflation would continue to move toward 2 percent, although progress could remain uneven."

- And there was even anticipation of potential seasonal effects boosting the early 2025 inflation readings - which indeed may have played out in the January data:

- "Some participants remarked that reported inflation at the beginning of the year was harder than usual to interpret because of the difficulties in fully removing seasonal effects, and a couple of participants commented that any increase in reported inflation in the first quarter due to such difficulties would imply a corresponding decrease in reported inflation in other quarters of the year."

- While short-term inflation expectations had "increased recently", longer-term expectations had remained "well anchored".

- The staff's economic projections were little changed, using the "same preliminary placeholder assumptions for potential policy changes that were used for the previous baseline forecast, and continued to note elevated uncertainty regarding the scope, timing, and potential economic effects of possible changes to trade, immigration, fiscal, and regulatory policies."

- That means similar inflation in 2025 as in 2024, "as the effects of the staff's placeholder assumption for trade policy put upward pressure on inflation this year. After that, inflation was projected to decline to 2 percent by 2027."

- Nonetheless, staff see "uncertainty around the baseline projection as similar to the average over the past 20 years", unchanged from the December minutes' assessment.