EM ASIA CREDIT: MNI EM $ Refinancing - Asia

Feb-21 05:33

MNI EM $ Refinancing - Asia

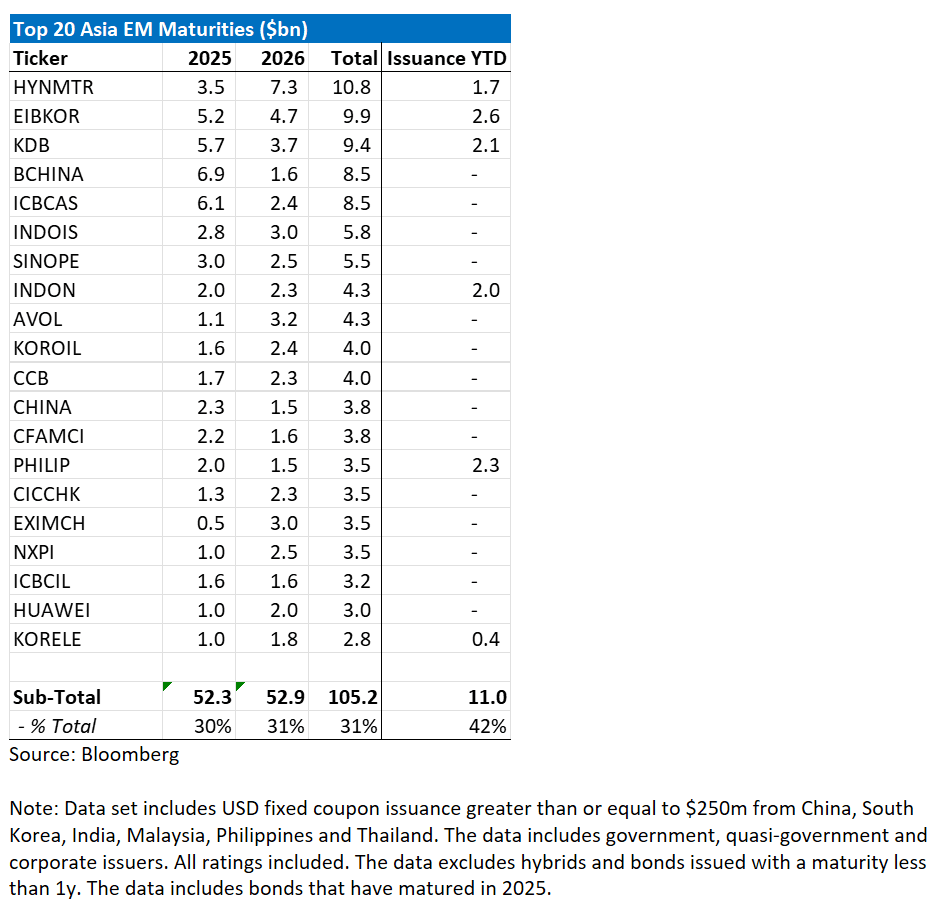

The table below ranks the top 20 issuers in Asia EM by USD bond maturities in 2025 and 2026. The data includes bonds that have matured. We also show year-to-date USD issuance for the same issuers.

The table serves as a guide to potential USD refinancing activity, though we recognise that issuers may also explore alternative funding options, including loans and local currency.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

CHINA: Country Wrap: China Tariffs Not off the Table.

Jan-22 05:22

- Taiwan’s December exports were up +20.8% YoY, marking the largest expansion since February 2022. (source: MNI – Market News)

- Trump Says He Could Hit China With 10% Tariff From Next Month (source: BBG)

- CNY: Yuan Reference Rate at 7.1696 Per USD; Estimate 7.2659

- Suggestions that China tariffs are not off the table rocked the major China bourses, all down today with the Hang Seng -1.30%, CSI 300 -0.95%, Shanghai -0.91% and Shenzhen -1.04%.

- Bonds: yields resumed their decline with the 10YR 1.647% (-2.5bps)

ASIA STOCKS: Equities Mixed, Tech Higher, China Equities Lower On Tariff Talk

Jan-22 05:08

- Asian equities are trading mixed today as investors weighed optimism around U.S. infrastructure and AI investment initiatives under President Trump against renewed tariff concerns on Chinese goods. Japan's Nikkei 225 and Taiwan's Taiex led gains, up 1.5% and 1.3%, respectively, boosted by tech stocks like SoftBank (+8.9%) and TSMC (+2.7%) following Trump's AI investment announcements. South Korea's Kospi added 1.2%, with nuclear energy and construction stocks rallying on expectations of increased U.S. infrastructure spending.

- In contrast, Chinese shares underperformed, with the CSI 300 down as much as 1.3% amid concerns over potential 10% tariffs on Chinese imports. Hong Kong's Hang Seng also dropped 1.3%, reflecting weaker sentiment in the region.

- Australia's ASX 200 is 0.35% higher, while In New Zealand, the NZX 50 was flat after inflation data showed annual CPI steady at 2.2%, while Pacific Edge fell 5% following U.S. legal challenges.

- The broad MSCI Asia Pacific Index edged up 0.2%, reflecting the uneven performance across the region.

JGBS: Cash Bond Twist-Flattener, BoJ Hike Almost Fully Priced

Jan-22 05:06

JGB futures are weaker and at session lows, -18 compared to settlement levels.

- The BoJ will announce its latest monetary policy decision this Friday, with expectations that it will move further along its policy normalization path. Both market consensus and our analysis suggest a 25bps rate hike as the most likely outcome.

- The BoJ raised rates twice in 2024, first in March and again in July. However, it has maintained a hold since then, largely due to market volatility, including significant yen swings after the July hike. Political uncertainty has also played a role, as the ruling coalition lost its majority in lower house elections late last year.

- Market expectations currently indicate: a 93% probability of a 25bp hike in January; a cumulative 96% chance by March; and a full 25bp increase priced by May 2025.

- Cash US tsys are ~1bp cheaper in today’s Asia-Pac session after yesterday’s bull-flattener.

- Cash JGBs have twist-flattened, pivoting at the 30-year, with yields 2bps higher to 2bps lower. The benchmark 10-year yield is 0.9bp higher at 1.203% versus the cycle high of 1.262%.

- Swap rates are ~2bps higher.

- Tomorrow, the local calendar will see Trade Balance, International Investment Flow and Tokyo Condominiums for Sale data alongside an Enhanced Liquidity Auction covering 1-5-year OTR JGBs.