US: Only Half Of Republicans Believe Tariffs Will Be Economic Boon - Bloomberg

Feb-28 19:13

Bloomberg reports that, according to a new Harris Poll, American consumers are skeptical of President Donald Trump’s tariffs plans, stating that polling shows Trump risks "American consumer backlash."

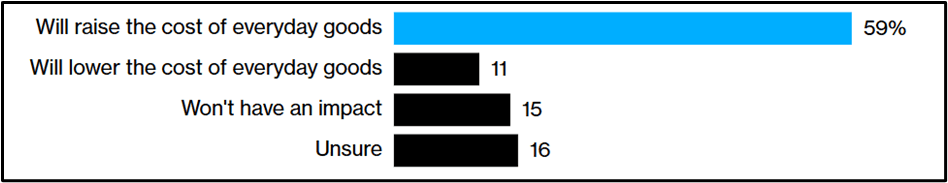

- According to Bloomberg, “Almost 60% of US adults expect Trump’s tariffs will lead to higher prices, according to a Harris Poll conducted for Bloomberg News. Some 44% say the levies are likely to be bad for the US economy — compared to 31% who say they’d be a boost.”

- Bloomberg adds: “Even within the president’s own party, many aren’t sold on his trade agenda. Only half of Republican respondents said the tariffs would be an economic boon.”

- The survey is the latest in a string of reports suggesting the electorate is largely unconvinced by the Trump administration's positive assessment of tariffs.

- Senator Ted Cruz (R-TX) said, signalling some dissent among GOP lawmakers over Trump's strategy: "No state has paid the price more for the [migrant] invasion over the last four years than Texas. That being said, trade with Mexico and Canada is enormously important to the Texas economy, and so I'm hopeful we will not see the tariffs go into effect — because Mexico and Canada will be actively assisting in securing the border."

Figure 1: Consumers Expect Trump's New Tariffs to Raise Prices, “How do you expect the additional tariffs to impact your household expenses?”

Source: Bloomberg, Harris Poll

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

FED: Statement: Surprise Hawkish Removal Of "Progress" In Inflation

Jan-29 19:12

See below for a comparison of the new FOMC Statement to the previous one released in December.

- The new Statement contains a hawkish-leaning surprise.

- While it was somewhat expected that the language on the labor market would change to reflect recent stabilization in conditions and the unemployment rate, we did not see many expectations that they would change the language characterizing inflation.

- They removed "has made progress toward the Committee's 2 percent objective", while retaining language saying that it "remains somewhat elevated".

- Arguably this is the most hawkish the language has been on inflation since "In recent months, there has been a lack of further progress toward the Committee's 2 percent inflation objective." (May 2024). In the meetings since then, they have noted "progress" on the inflation front, but not this time. The Statement introduced the "has made progress" toward 2% in November's statement, so that lasted for two meetings.

- This will be a key question for Powell at the presser.

US TSYS: Post-FOMC React: Yields Rebound With US$

Jan-29 19:08

- Treasuries gap lower after the FOMC left rate steady but removed reference to making progress towards inflation reaching goal. Guidance unchanged.

- Currently, the Mar'25 10Y contract trades -8 at 108-25 vs. 108-23.5 low, still well above initial technical support of 108-00/107-06 (Low Jan 16 / 13 and the bear trigger). 10Y yield climbs to 4.5790% high. Curves moving off flatter levels, 2s10s -.477 at 32.853 vs. 31.733 low.

- Cross asset update, BBG US$ index rebounds, currently +1.27 at 1302.46 from midday low of 1300.25; Gold weaker (2745.75 -17.74); Stocks near; prior lows (after Nvidia export curbs to Chima headlines) SPX Eminis at 6056.5 -40.0.

USD: Greenback a Touch Higher Following Release of FOMC Statement

Jan-29 19:07

- Greenback pops higher on the moderate hawkish lean in removing the reference to inflation making progress towards the goal, despite it remaining somewhat elevated. Most impacted in G10 was USDJPY, rising around 35 pips to 155.47 before paring 15 pips in the past couple minutes. EURUSD is on the back foot at levels just above 1.04, while the Aussie remains the weakest performer in G10, down a little over half a percent on the session. Focus turns to the press conference.