EM ASIA CREDIT: SK Hynix (HYUELE, Baa2/BBB/BBB) - Korea to support tech sector

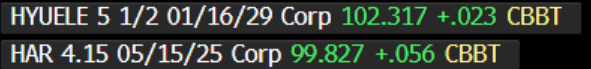

SK Hynix (HYUELE, Baa2/BBB/BBB)

"*KOREA ANNOUNCES DETAILS ON $34B FUND TO SUPPORT CHIP, BATTERIES" - BBG

- The government will provide low cost loans to the tech industry via the Korea Development Bank, as well as buy equity stakes. The fund size is KRW50T ($34bn). The plan still requires approval of parliament. Neutral for spreads.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

AUSTRALIA DATA: Private House Approvals Stay Weak

December building approvals printed below expectations due to weakness in the private houses component. The number of approvals rose 0.7% m/m with annual growth rising 12.2% up from 3.6%. The solid result was due to the volatile multi-unit component which increased 15.2% m/m to be up 42.7% y/y, whereas houses fell 3% m/m, the third consecutive decline, to be down 1.8% y/y. With the working age population rising 127k over Q4 and housing shortages persisting, building approvals need to rise to improve affordability and lower rental inflation.

- The fall in the number of private house approvals was broad-based across states, with only NSW recording an increase. The rise in apartment approvals was concentrated in NSW and Queensland.

- New home inflation has been moderating and in December the value of total residential building approved fell 0.9% m/m despite a rise in the total number of approvals.

Australia number of dwelling approvals y/y%

FOREX: USD Index Close To Cycle Highs, A$, NZD & CAD Around Session Lows

The USD remains on the front foot, the BBDXY index up over 1%, last near 1322. This is just short of levels above 1323, which have marked highs back to 2022.

- AUD and NZD are marginally the weakest performers at this stage. AUD/USD is down to 0.6110, which were levels last seen in 2020. NZD/USD is around 0.5535, but hasn't tested sub 2022 lows near 0.5500 yet. Both currencies are around 1.75% weaker so far today.

- We just had the Caixin manufacturing print for China which was below forecasts at 50.1, against 50.6 expected. Earlier Australian data was better than expected from a retail sales standpoint, but this has had little lasting impact on AUD.

- EUR/USD is near 1.0235/40, comfortably above 1.0141, which was recorded not long after today's open, no doubt when liquidity has been lighter. Earlier remarks from Trump reiterated recent threats on tariffs against the EU, stating they were definitely happening but not providing a time line. EUR options activity has been dominating so far, although with a mixture of strike levels above and below current spot levels.

- Trump also stated in the earlier remarks he will speak to the leaders of Canada and Mexico Monday morning local US time. This remark saw a brief dip in USD/CAD, but moves under 1.4700 have been supported. We were last around session highs at 1.4750.

- Markets will be hoping such calls lead to negotiations and lowered tariff levels. USD/CAD FX options activity has been skewed towards higher USD call levels

- USD/JPY is higher, back to 155.80, up around 0.40%, so still outperforming broader USD gains. The rise up in US yields at the front end, is helping US-JP 2yr differentials, but back end yields are down slightly. US equity futures remain in the red. Regional equity markets are mostly down as well.

CHINA: CAIXIN PMIs Weaker than Expected.

- There may be little to take away from today’s January Caixin PMI as it will be directly impacted by China’s Lunar New year holiday period, but it may also point to the impact of the impending trade war between the US and China.

- The CAIXIN PMI for January came in at +50.1 down from +50.5 in December.

- The Caixin China General Services PMI is based on data compiled from monthly replies to questionnaires sent to purchasing executives in over 400 private service sector companies.

- The Caixin therefore provides a real time insight how private companies are at present and the data suggests that worrying trends could be evolving.

- That said, this year’s Lunar New Year celebrations are earlier than usual so it is likely that this data release may be looked through by authorities before considering their next move to support the economy.