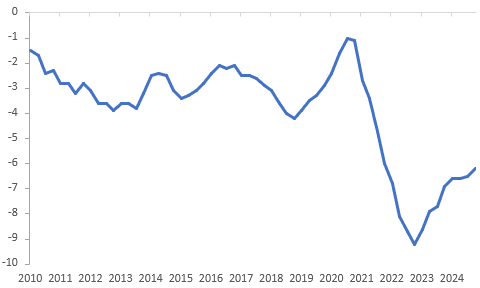

NEW ZEALAND: Strong Export Growth Drives Narrower Deficits

The Q4 current account deficit was slightly wider than expected at $7.037bn but significantly narrower than Q3’s $10.84bn. As a share of GDP it fell 0.3pp to 6.2% YTD, the lowest in three years and down 0.7pp from 2023. There was strong growth in both goods and services exports with the total up 5.4% q/q and 10.4% y/y. Imports were not as robust but still rose 2.9% q/q.

NZ current account to GDP % YTD

- Merchandise exports rose 3.8% q/q to be up 9.0% y/y in Q4 after 4.4% y/y, driven by dairy and meat. Services jumped 9% q/q to be up 13.4% y/y due to increased spending by overseas tourists while in NZ.

- Statistics NZ observed that travel exports were higher than Q4 2019 for the first time. Visitor numbers are still below pre-pandemic levels but spending is now stronger.

- Goods imports increased 3% q/q to be up 2.1% y/y after -2.4% y/y, while services rose 2.8% q/q to be up 8.7% y/y following 7.1% y/y.

- This resulted in the trade deficit narrowing $0.55bn to $1.71bn, the smallest since Q2 2021.

- There was a net outflow of $3.2bn from the financial account in Q4. As the deficit is expected to be financed by net inflows, Statistics NZ notes that the contradictions in the accounts show the difficulty in measuring investment transactions.

NZ exports vs imports y/y%

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

AUSSIE BONDS: Slightly Richer, US Tsys Rally Friday On Weak Retail Sales

ACGBs (YM +1.0 & XM +1.0) are slightly richer after a significant downside surprise to US retail sales data contributed to the rally in US tsys and weighed on the US dollar.

- The US 2-year yield fell 5bps to 4.26%, while the 10-year finished at 4.48%, also 5bps lower.

- Tomorrow’s RBA decision takes centre stage this week, with economists widely anticipating a 25bp rate cut.

- The RBA statement and updated forecasts will be released at 1430 AEDT with Governor Bullock’s press conference at 1530 AEDT.

- There are also Q4 wages on Wednesday and January jobs data on Thursday.

- The Q4 WPI is forecast to post another 0.8% q/q rise bringing the annual rate down to 3.2% from 3.5% in Q3.

- January employment is projected to rise 20k on Thursday after 56.3k the previous month, which would drive the unemployment rate up 0.1pp to 4.1%.

- Cash ACGBs are 1bp richer with the AU-US 10-year yield differential at -7bps.

- Swap rates are flat to 1bp lower.

- The bills strip is little changed.

- This week, AOFM plans to sell A$800mn of the 2.75% 21 June 2035 bond on Wednesday and A$700mn of the 2.50% 21 May 2030 bond on Friday.

CHINA: January New Loans Rise in Hopes that Risk Appetite is Returning.

- China saw an increase in in new Yuan loans, despite the impact of an earlier Lunar New Year break.

- January new loans surged by CNY5.13tn ahead of expectations of CNY4.5tn.

- Aggregate financing rose by CNY7.06tb, again higher than forecasts.

- Despite the better than expected results, the underlying details shows that the impact of increasing government bond sales are a major input into the data improvement.

- Whilst typically January is slow for new loans, this year it was stronger – a sign potentially that risk appetite could be on the improve with better than expected corporate loans, but new mortgages declining YoY.

NEW ZEALAND: Another 50bp Rate Cut Expected On Wednesday

The RBNZ decision is announced on Wednesday and it is widely expected to cut rates 50bp again to 3.75%. Revised staff forecasts will also be published with the decision at 1200 AEDT/1400 NZDT and Governor Orr’s press conference taking place at 1300 AEDT/1500 NZDT.

- All 22 analysts surveyed by Bloomberg are forecasting a 50bp rate cut and the RBNZ shadow board is recommending 50bp of easing.

- Q4 input/output PPIs are also on Wednesday. They rose 1.9% q/q and 1.5% q/q in Q3 respectively.

- On Tuesday, the RBNZ’s household inflation expectations survey is released for Q1. The series tend to run above the business survey, released last week at about 2%, and in Q4 most timeframes were around 3% on a median basis.

- Trade data for January is on Friday. The deficit has been slowly improving and YTD it was NZ$7.67bn in December. In 2024, the US became NZ’s second most important export destination pushing Australia to third.