AUSSIE BONDS: Subdued Data-Light Session

Mar-21 01:44

ACGBs (YM -1.0 & XM -2.5) are weaker and at or near Sydney session cheaps on a data-light day.

- "Australian Treasurer Jim Chalmers will deliver a pre-election budget on Tuesday, aiming to balance voter appeasement with spending control to avoid rekindling inflation." (see link)

- Cash US tsys are little changed after yesterday's modest gains. It was a relatively subdued session on Thursday with the markets continuing to digest the FOMC's stance.

- Cash ACGBs are 1-2bps cheaper with the AU-US 10-year yield differential at +15bps.

- Swap rates are 1-2bps higher.

- The bills strip is flat to -3 across contracts, with a steepening bias.

- RBA-dated OIS pricing is little changed across meetings today. A 25bp rate cut in April is given a 5% probability, with a cumulative 66bps of easing priced by year-end (based on an effective cash rate of 4.09%).

- Next week, the AOFM plans to sell A$300mn of the 4.75% 21 June 2054 bond on Monday, A$800mn of the 3.50% 21 December 2034 bond on Wednesday and A$700mn of the 1.25% 21 May 2032 bond on Friday.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

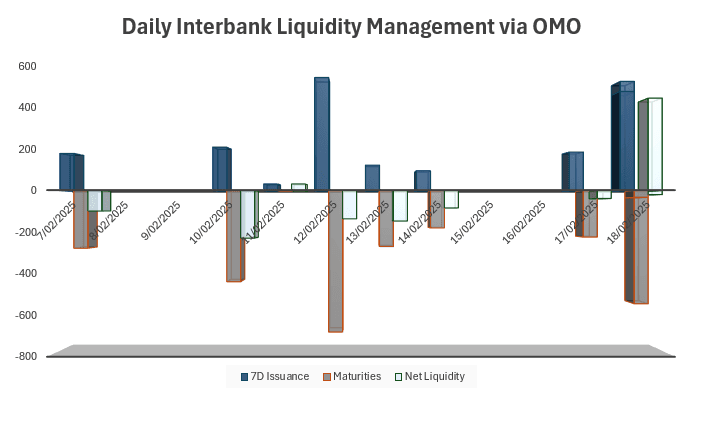

CHINA: Central Bank Withdraws Liquidity via OMO

Feb-19 01:41

- PBOC issued CNY538.9bn of 7-day reverse repo at 1.5%.

- Today’s maturities CNY558bn.

- Net liquidity withdrawal CNY19.1bn.

- The PBOC controls and maintains liquidity via the issuance of reverse repo.

- The CFETS Pledged Repo Deposit Institutions 7 Day Index was at 1.74% following yesterday’s close of 2.34%.

- China’s Overnight Interbank repo rate was 1.88% and the 7-day at 2.30%

RBNZ: RBNZ Prepared To Ease Further But May Slow The Pace

Feb-19 01:41

The RBNZ’s MPC cut rates by 50bp to 3.75% as was expected. This brings cumulative easing to 175bp and it appears that it is prepared to ease further in 2025 if the economy develops as it expects. It has an additional 50bp of 2025 easing in its updated OCR profile than in November. It is now forecast to end this year at around the mid-point of the 2.5-3.5% range that the RBNZ estimates as neutral, down from just above 3.5%. This has been brought forward by over a year.

- The updated OCR profile suggests there is likely to be a slowdown in the pace of easing to 25bp but the current economic outlook is implying 25bp cuts at both the April 9 and May 28 meetings. There could be another 25bp in H2. The path remains consistent with Governor Orr’s view in November that rates don’t need to go below neutral to be stimulatory.

- The outlook is consistent with inflation remaining within the 1-3% target band over the medium-term thus giving the MPC room to cut rates another 50bp today. It did note though that inflation is likely to be “volatile in the near term, due to the lower exchange rate and higher petrol prices”. It revised up its 2025 inflation forecasts with Q1 now at 2.4% up from 2.0% but Q4 only 0.1pp higher at 2.5%. The midpoint has been pushed out to mid-2027.

- Heightened uncertainty from geopolitics and trade policy was highlighted with it likely to “weigh” on investment and the “net effect” on NZ inflation “currently unclear” but having inflation close to the target mid-point puts the RBNZ in the “best position” to respond.

- Employment is now expected to pick up in H2 this year as growth recovers. However, the unemployment rate forecasts are little changed with the peak still at 5.2% in H1 2025. Quarterly GDP projections were little changed.

MNI: CHINA PBOC CONDUCTS CNY538.9 BLN VIA 7-DAY REVERSE REPO WEDS

Feb-19 01:26

- CHINA PBOC CONDUCTS CNY538.9 BLN VIA 7-DAY REVERSE REPO WEDS