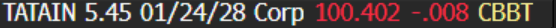

EM ASIA CREDIT: Tata Steel (TATAIN, NR/BBB/NR) looking to issue in INR

Tata Steel (TATAIN, NR/BBB/NR)

"*NEW DEAL: TATA STEEL SOUNDS OUT BANKERS FOR INR30B BOND SALE" - BBG

- Following on from our recent comment - Tata Steel is indeed focused on coming to the market in INR.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EURUSD TECHS: Bearish Trend Sequence Intact

- RES 4: 1.0630 High Dec 06

- RES 3: 1.0513 50-day EMA

- RES 2: 1.0437/58 High Jan 6 / High Dec 30

- RES 1: 1.0374 20-day EMA

- PRICE: 1.0223 @ 06:05 GMT Jan 11

- SUP 1: 1.0201 61.8% of the Sep ‘22 - Jul ‘23 bull leg

- SUP 2: 1.0138 1.764 proj of the Sep 25 - Oct 23 - Nov 5 price swing

- SUP 3: 1.0122 2.0% 10-dma envelope

- SUP 4: 1.0031 2.000 proj of the Sep 25 - Oct 23 - Nov 5 price swing

The trend condition in EURUSD remains bearish and recent short-term gains have proved to be a correction. Friday’s move lower resulted in a print below 1.0226, the Jan 2 low. The pair is trading at its lows and a clear break of 1.0226 would confirm a resumption of the downtrend and mark an extension of the price sequence of lower lows and lower highs. Sights are on 1.0201 next, a Fibonacci retracement. Resistance to watch is 1.0458, Dec 30 high.

BUND TECHS: (H5) Bear Cycle Remains Intact

- RES 4: 137.75 Low Dec 10

- RES 3: 135.15 High Dec 13

- RES 2: 133.26 20-day EMA

- RES 1: 131.71/132.57 High Jan 9 / 6

- PRICE: 130.76 @ 05:43 GMT Jan 13

- SUP 1: 130.58 Low Nov 6 ‘24 and a key support (cont)

- SUP 2 130.44 Low Jul 5 ‘24 (cont)

- SUP 3: 130.23 Low Jul 3 ‘24 (cont)

- SUP 4: 130.00 Psychological round number

The trend in Bund futures remains bearish and last week’s extension reinforces this theme. The contract has cleared key support at 132.00, the Nov 6 low. The clear break of this level strengthens a bearish theme. Sights are on the 130.00 handle next. Key short-term resistance is at 133.26, the 20-day EMA. Gains would be considered corrective and allow an oversold condition to unwind.

EQUITIES: Asian Equites Fall Following US Jobs

Asian markets declined as stronger-than-expected US jobs data dampened hopes for further Fed rate cuts, with the MSCI Asia Pacific Index down 1.1% and benchmarks in Hong Kong, Taiwan, and South Korea leading losses. Chinese stocks extended declines despite record-high exports, with investors awaiting more pro-consumption policies. Brent crude rose above $81 a barrel after aggressive US sanctions on Russia, adding inflationary pressure for central banks.

- India's Nifty 50 and Sensex slumped to multi-month lows, pressured by surging oil prices, rising Treasury yields, and weak earnings growth, with financial services stocks driving the decline.

- GS strategists remain bullish on Chinese stocks, predicting a 20% rise by year-end despite recent market turmoil. They expect sentiment and liquidity to improve by late Q1 2025 due to better tariff and policy clarity. Goldman recommends government consumption proxies, exporters benefiting from a weaker yuan, and select tech, infrastructure, online retail, media, and healthcare stocks, while upgrading consumer services to overweight.

- Apple's Chinese suppliers saw their shares drop after analyst Ming-Chi Kuo projected 2025 iPhone shipments at 220-225m units, below Wall Street's 240m consensus. Apple shares fell 2.4% on Friday following the report. Key suppliers, including AAC Technologies (-3.8%), Hon Hai (-4.1%), Quanta (-3.7%), and GoerTek (-2.6%), experienced declines here in Asia

- Traders now expect limited Fed rate cuts in 2025, with fed fund futures now pricing in just a single rate cut around the Oct/Dec meetings the markets remain cautious ahead ahead of key US inflation data this week.

- APAC markets: Japanese equities closed, South Korea's KOSPI is -1%, KOSDAQ -1.20%, Taiwan's TAIEX -2.10%, Hong Kong's HSI -1.15%, China's CSI 300 -0.45%, Australia's ASX200 -1.30%, New Zealand's NZX50 -0.55%