ENERGY: Trump Gives Iran 2-Month Nuclear Deal Deadline: Axios

Mar-19 17:02

"*TRUMP GAVE IRAN 2-MOS DEADLINE FOR NUCLEAR DEAL IN LETTER:AXIOS" - bbg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US 10YR FUTURE TECHS: (H5) Remains Above Last Week’s Lows

Feb-17 16:58

- RES 4: 110-25 High Dec 12

- RES 3: 110-19 76.4% retracement of the Dec 6 - Jan 13 bear leg

- RES 2: 110-14 High Dec 14

- RES 1: 110-00 High Feb 7 and the bull trigger

- PRICE: 109-07 @ 16:46 GMT Feb 17

- SUP 1: 108-04/00 Low Feb 12 / Low Jan 16

- SUP 2: 107-06 Low Jan 13 and the bear trigger

- SUP 3: 107-04 Low Apr 25 ‘24 and a key support

- SUP 4: 106-11 2.00 proj of the Oct 1 - 14 - 16 price swing

Treasury futures remain above last week’s lows and price has risen above the 50-day EMA. A continuation higher would expose key resistance and a bull trigger at 110-00, the Feb 7 high. For bears, recent weakness resulted in a break of 108-20+, the Feb 4 low, highlighting the end of the corrective cycle between Jan 13 - Feb 7. A continuation lower would open 108-00, the Jan 16 low, and expose 107-06, the Jan 13 low and bear trigger.

UK DATA: Labour Market / Inflation Preview

Feb-17 16:57

- It’s another key week for UK data with labour market data (Tues), CPI (Wed) and the flash PMI (Fri) all due for release this week.

- Inflation is expected to pick up (both headline and services) - largely driven by a reversal in the timing-induced soft airfares print, but private school VAT and bus fares are likely to contribute too.

- On the labour market side, a rise in official AWE earnings data has been down downplayed in recent BOE communications as being inconsistent with other wage releases.

- We therefore take a deep dive into the alternative HMRC PAYE data.

GERMAN DATA: Weekly Activity Continues Recovery Amidst Less Restrictive Policy

Feb-17 16:21

- ECB officials have been looking to downplay neutral rate deliberations, with the deposit rate at 2.75% and staff research pointing to neutral range of 1.75-2.25% (which the market sees reaching the top of this band in June and mid-point in October).

- ECB President Lagarde, whilst aligning herself to this 1.75-2.25% range, has been keen to point out that this hasn’t been meaningfully discussed in Governing Council meetings, being “entirely premature” for debate whilst policy is currently restrictive (a term our policy team sees remaining in place - see MNI SOURCES: ECB Likely To Tweak Language, Keep "Restrictive" - Feb 4).

- However, with Lagarde pledging the bank “will be looking out of the window” as part of its clear data dependent stance, we watch for high frequency metrics that suggest policy could be starting to be less restrictive.

- Germany is a good starting point here, clearly underperforming its major Eurozone country counterparts for some time now (not least Q4 real GDP growth at -0.2% Y/Y vs 0.9% for the Eurozone, with Spain 3.5% Y/Y, France 0.7% Y/Y and Italy 0.5% Y/Y).

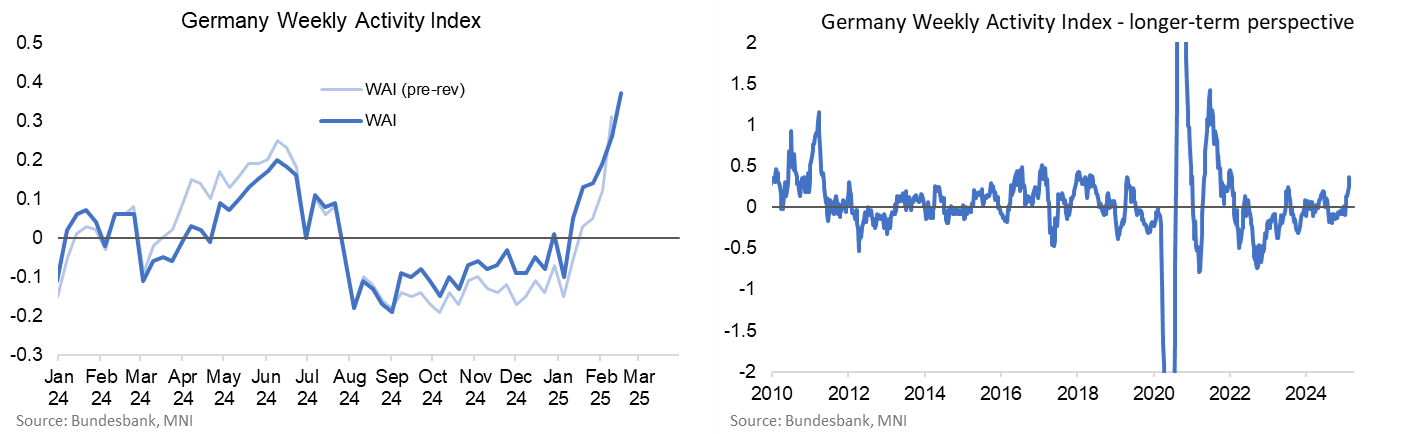

- To this end, we note an impressive increase in the Bundesbank’s weekly activity index since January, an indicator that collates a range of non-traditional inputs.

- Rising to 0.37 in today’s weekly update from a downward revised 0.26 (initial 0.31), it set a fresh high since early 2022. It indicates trend-adjusted economic activity in the 13 weeks to Feb 16th was 0.4% higher than in the preceding 13 weeks, translating to quarterly GDP growth of 0.9% per the press release.

- We caution putting too much weight on this measure, not least because of its wide-ranging revisions (see chart) and GDP tracking (see press release), but it nevertheless bears watching other more traditional releases for a similar improvement in the months ahead.