FED: Uncertainty To Be Manifested In March's FOMC Meeting Communications (1/2)

Chair Powell on March 7 identified “four distinct areas” of government policy changes whose “net effect…will matter for the economy and for the path of monetary policy”: “trade, immigration, fiscal policy, and regulation”. The related uncertainty over the outlook is likely to manifest in March’s FOMC meeting communications in three main ways.

- First, while the most closely-eyed median Fed funds rate dots in the new quarterly projections are unlikely to change – still showing 50bp of cuts in each of 2025 and 2026 – the distribution is likely to shift. MNI regards the risks as mostly tilted to a more hawkish distribution versus December, which appears to be a difference from consensus as multiple analysts see risks weighed toward more rather than fewer cuts in the Dot Plot.

- We think that for 2025 at least, the higher dot submissions could rise in number while the lowest could diminish. The hawks are likely to become a little more hawkish in light of the lack of disinflation progress since the December meeting and some signs of rising inflation expectations, while the the doves have sounded less confident that inflation will pull back sufficiently to warrant more than 2 cuts this year. Regardless of any distributional changes, the lack of movement in the medians vs December is illustrative of a Committee that is somewhat paralyzed as it awaits outside events to unfold.

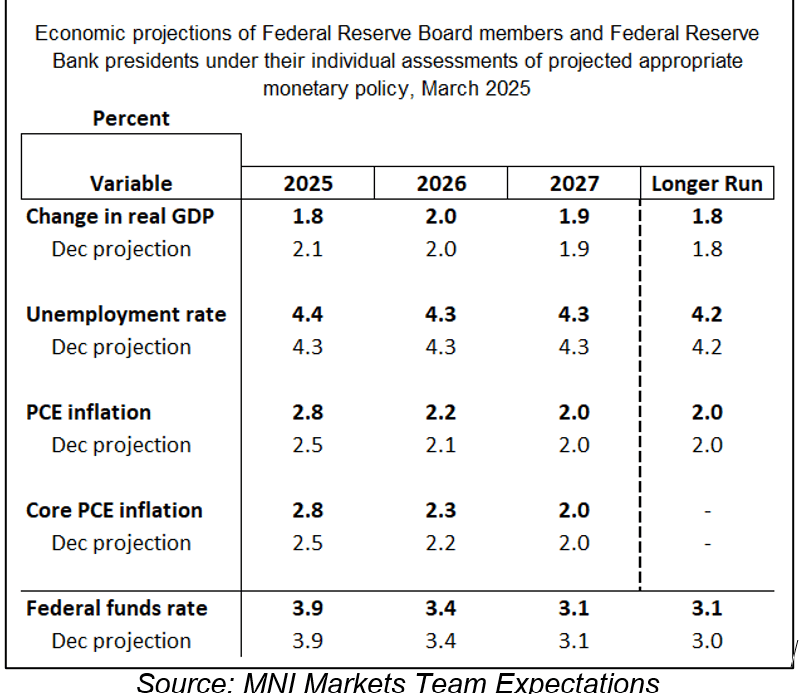

- Second, the macroeconomic projections will show higher inflation combined with lower growth this year. We anticipate a 0.3pp downgrade in the 2025 real GDP growth median, with the unemployment forecast ticking up 0.1pp as a result. Meanwhile, both core and headline PCE inflation forecasts are set to rise 0.3pp each, largely reflecting the impact of tariffs (though most FOMC members have said they expect it to have a one-off impact).

- Recent PCE readings haven’t been benign, and a tariff-led resurgence in inflation later this year – if only temporary – alongside a loosening in the labor market with weaker activity puts the FOMC in a difficult position, particularly if medium/long-term inflation expectations rise. As of September, the Fed looked very close to meeting both goals, helping make the case to start the rate cut cycle at that point – but there has been limited to no progress since that point. And on inflation, while FOMC officials have largely expressed confidence that it’s headed back to 2% sustainably, recent data and looming tariffs have discouraged even the biggest doves (Goolsbee, Waller, Williams).

- GDP growth in Q1 looks to be slower than in Q4, if not outright contractionary (per the Atlanta Fed’s GDP nowcast), in part due to tariff uncertainty. There is also the additional factor of government austerity under the Trump administration, which is likely to see federal spending and employment cut sharply – but there is not yet much tangible evidence of this in the data and there remains great uncertainty over the scope of cutbacks.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US: Senate Could Move First On Adopting Budget Resolution

Senate Majority Leader John Thune (R-SD) could bring the Senate Republican budget resolution to the floor this week, gaining the upper hand on strategy while the House of Representatives is on recess for the week. If adopted, the resolution would put the Senate firmly on its preferred two-bill reconciliation strategy.

- The Senate resolution provides roughly USD$300 billion in new border and defence spending, including funding to complete the US-Mexico border wall, but defers President Donald Trump's tax agenda until later in the year - a move that could risk delaying legislation to extend Trump's 2017 tax cuts until beyond the December 2025 sunset date for some provisions.

- Should Thune choose to begin procedural voting - likely starting Tuesday -, it would entail up to 50 hours of debate and a so-called 'vote-a-rama' on amendments that could drag on for hours over dozens of votes.

- House Speaker Mike Johnson (R-LA) and House Ways and Means Committee Chair Jason (R-MO) have petitioned Trump to oppose the Senate plan, however, Politico notes: "Vice President JD Vance, White House policy chief Stephen Miller and budget chief Russ Vought [are] among those favoring the Senate’s preferred two-bill approach."

- Thune said in an interview on Friday: “The House and the Senate operate differently, clearly, and we have procedural issues we have to deal with in the Senate. But … these efforts are going to, at some point — they’re going to merge.”

CANADA DATA: Foreign Demand For GoCs Ended 2024 On The Same Strong Note

- Foreign investment in Canadian securities in Dec. increased by CAD14.4B led by debt securities. Foreigners bought CAD13.9B of Federal government bonds, the highest since April 2020, to held offset the first drawdown in Canadian corporation bonds since Oct 2023.

- Canadian investment in foreign securities slowed to CAD3.8B from CAD17.6B in Nov. mainly due to debt securities.

- After two straight months of significant investments totalling CAD24.9B, Canadian investors sold CAD4.1B in US government bonds, the largest divestment since May 2023.

- In 2024, foreign investors bought 192.9B of Canadian securities led by record demand for federal government (+CAD100.3B) and corporate (+CAD78.9) bonds. Foreigners continued to sell equities for a second year in a row, CAD7.6B in 2024 mainly due to share retirements from acquisition activities after CAD48.3B in 2023.

FED: Harker Sees Rates On Hold But Skeptical Of January CPI Strength

Philly Fed’s Harker (non-voter, retiring in June) sounded modestly less dovish speaking a month on since his last comments, seeing reason to hold rates steady but without last month’s caveat that it won’t be "for long". That said, he viewed the January CPI strength with skepticism and still sees inflation on a downward path.

- "While I won’t commit to a specific timetable, I remain optimistic that inflation will continue a downward path and the policy rate will be able to decline over the long run."

- "All in all, the current data paints a picture of an American economy that continues to function from a position of strength," he said. Inflation is still elevated but moving in the right direction while labor is largely in balance, he said. "And these are reasons enough for holding the policy rate steady."

- Skepticism around CPI seasonality: “In the last decade, CPI inflation in January has surprised on the upside 9 out of 10 times. My conjecture is that seasonal adjustments are struggling to keep up with a fast-changing economy, and we need to parse the underlying trends from the month-to-month noise.”

- Full remarks here.