CNH: USD/CNH Close To 200-day EMA Amid Trade Hopes, Broader USD Weakness

USD/CNH slumped to lows of 7.2315 in Thursday trade, while we track slightly higher in early Friday dealings, last near 7.2350. CNH rose nearly 0.70% for Thursday's session, just under USD index losses for the BBDXY and DXY indices. Spot USD/CNY finished up at 7.2430, leaving a negative CNH-CNY basis if current levels hold. The CNY CFETS was little changed for Thursday, the index at 99.93 (per BBG).

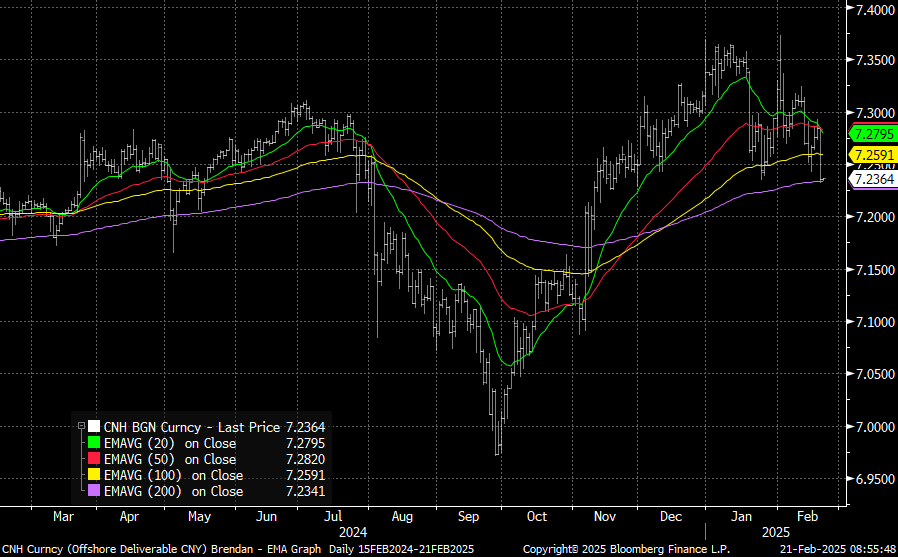

- For USD/CNH technicals, current spot is very close to the 200-day EMA, see the chart below. A clean break lower could see Nov 13 lows from last year at 7.2131 targeted, beyond that is the 7.2000 level. On the topside, the 100-day EMA is back around 7.2590, the 20 and 50-day EMAs back near 7.2800.

- Yesterday's CNH rally kicked off when US President stated a trade deal with China is possible. We also had comments from US Tsy Secretary Scott Bessent overnight, with "*BESSENT: ON ANY ACADEMIC MODEL, THE YUAN IS CHEAP" per BBG a notable comment. He added though domestic capital pressures persist. Bessent will speak with China Vice Premier He Lifeng today.

- Broader USD weakness, led by yen gains, no doubt saw some positive spill over to CNH. In the equity space, the Golden Dragon index rose 1.60% in US Thursday trade. Better Alibaba revenue outcomes boosted sentiment.

- On the data front, we await the 1yr MLF facility. No change is expected in the 2.0% rate.

Fig 1: USD/CNH Versus Key EMAs

Source: MNI - Market News/Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

AUSSIE BONDS: Cheaper, US Tsys Bull-Flatten But Yields Above Local Close Levels

ACGBs (YM -4.0 & XM -3.0) are cheaper. Meanwhile, the US Treasury curve bull-flattened following Monday’s holiday, as market focus remained on Trump administration policies post-inauguration. US yields ended 1-5bps lower but were above levels seen at the Australian market close.

- Data was limited: the January Philly Fed non-manufacturing survey was soft, and Canadian CPI came in below expectations.

- Cash ACGBs are 3bps cheaper with the AU-US 10-year yield differential at -14bps.

- Swap rates are 2-3bps higher, with EFPs slightly tighter.

- The bills strip has bear-steepened, with pricing flat to -3.

- RBA-dated OIS pricing is flat to 3bps firmer across meetings today. A 25bp rate cut is more than fully priced for April (108%), with the probability of a February cut at 68% (based on an effective cash rate of 4.34%).

- The local calendar is light this week after key December labour market data last Thursday. The highlights are the Westpac Leading Index today and S&P Global PMIs (P) on Friday. The focus is now on Q4 CPI data released on Wednesday, January 29.

- The AOFM plans to sell A$800mn of the 2.75% 21 June 2035 bond today and A$700mn of the 1.50% 21 June 2031 bond on Friday.

AUSSIE 3-YEAR TECHS: (H5) Corrective Bounce

- RES 3: 97.190 - High May 5 2023

- RES 2: 96.730/932 - High Sep 17 / 76.4% of Mar-Nov ‘23 bear leg

- RES 1: 96.190/360 High Dec 31 / High Dec 11

- PRICE: 96.110 @ 15:52 GMT Jan 20

- SUP 1: 95.830 - 1.000 proj of the Dec 11 - 20 - 31 price swing

- SUP 2: 95.760 - Low 14 Nov ‘24

- SUP 3: 95.480 - Low Jan 11 2023 and a major support

A bear cycle in Aussie 3-yr futures remains intact and short-term gains are considered corrective. The recent move down reinforces the bear theme and the contract has traded through the December low. A deeper sell-off would refocus attention on 95.760, the 14 Nov ‘24 low. On the upside, a clear reversal would instead signal scope for an extension towards 96.190, the Dec 31 high, and 96.360, the Dec 11 high.

NEW ZEALAND: Non-Tradeables Lowest Since 2021, Feb 50bp Rate Cut Likely

Q4 NZ CPI was close to Bloomberg consensus expectations at 0.5% q/q and 2.2% y/y after 0.6% & 2.2% in Q3, above the RBNZ’s November forecast of 0.4% & 2.1%. The slightly higher outcome was driven by international airfares with the volatile component accounting for almost a quarter of the quarterly increase. With the data printing close to the RBNZ’s projections and non-tradeables easing, another 50bp cut on February 19 seems likely given the weakness of the economy.

- Headline inflation was impacted by a number of volatile components, such as airfares & cars, and so the underlying measures are likely to be the focus of the RBNZ with its own sector factor model estimates due at 1500 NZDT (1300 AEDT) today.

- Domestically-driven non-tradeables were slightly lower than expected rising 0.7% q/q and 4.5% y/y, the lowest quarterly rate since Q3 2020, and below the RBNZ’s projections of 0.8% & 4.7%. It rose 1.3% q/q and 4.9% y/y in Q3. Rents continue to grow strongly rising 0.8% q/q making a 15% contribution to Q4 CPI. Services prices rose 1.4% q/q and picked up to 4.8% y/y from 4.5%, still elevated.

- Stats NZ notes that excluding petrol prices, which fell 9.2% y/y, headline inflation would have been higher at 2.7% y/y.

- Vegetable prices were down 14.6% y/y. Thus the CPI ex food rose 0.8% q/q and 2.4% y/y.

- Tradeables were higher at +0.3% q/q but still down 1.1% y/y after -0.2% & -1.6%. This quarterly rise was the first since Q3 2023 suggesting that the disinflationary impact from goods prices is over. It was also higher than the RBNZ projected (-0.2% & -1.5%). Goods prices were flat though to be up 0.6% y/y.

NZ CPI y/y%