EU CONSUMER STAPLES: Walgreen Boots: flat for change

(WBA: B1 CW Neg/BB- CW Neg) {WBA US Equity}

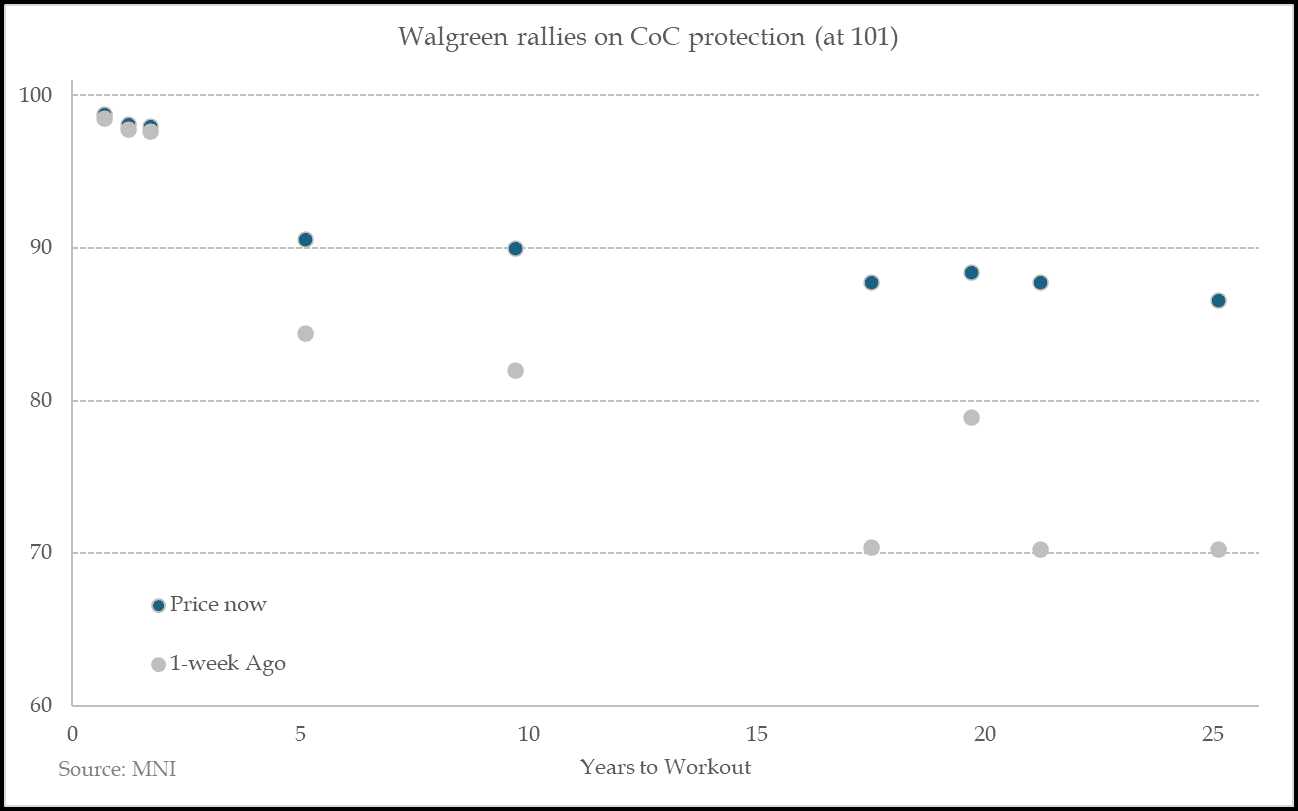

- First session in a ~week where it is more or less flat - levels below and they did slip 3-4pts yesterday.

- Worries are Sycamore will find a way through the docs - and is highly motivated to. The 50s on a 4.1% coupon is cheaper than where the US government borrows at.

- One such way being floated is for it to attempt to secure the debt (currently all bonds unsecured) which may help it hold off a rating downgrade - required to trigger CoC.

- Questions remain on how much of loss-observing unsecured debt would exist underneath it (raters are unlikely to uplift a secured heavy stack). Financing plans it detailed in the 8k the other day are scattered with entirely secured facilities. For reference, Walgreens issuer rating is (+1/0) higher to unsecured at (Ba3 CW Neg/BB- CW neg).

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

STIR: Midmorning SOFR Option Update

Volume gradually picking up this morning, leaning towards downside puts as accts fade the bid in underlying off early session lows. Projected rate cuts through mid-2025 look steady to mildly higher vs. this morning's levels (*) as follows: Mar'25 at -1.9bp (-2.5bp), May'25 steady at -7.3bp, Jun'25 at -16.4bp (-15.5bp), Jul'25 at -21.6bp (-20.1bp).

- +2,500 SFRM5/SFRU5 95.68/97.00 call spd strip 43.00

- +4,000 SFRM5 95.50/95.62 put spds, 0.5 vs. 95.85/0.06%

- 1,500 SFRK5 95.68/95.75/95.81 put flys

- -6,000 SFRM5 96.31/96.50 call spds .25 over SFRM5 95.50/95.62 put spds ref 9583.5

- +10,000 0QM5 95.12/95.50 put spds 4.0 ref 96.065

- +2,500 0QU5/0QZ5 96.12/96.62/97.12 call fly strip, 16.5

- +2,500 0QM5 95.12/95.50 put spds, 4.0

FRANCE: PM Bayrou Survives Another Censure Vote As PLFSS Passage Advances

The gov't of PM Francois Bayrou has survived his third censure vote in the National Assembly in under a week. The motion came in relation to Bayrou forcing through the Social Security Financing Bill (PLFSS) without a vote in the Assembly using Art. 49.3 of the constitution. Utilising this method immediately allows the opposition to put forward a censure motion against the gov't. The failure of today's motion is not a surprise, with the centre-left Socialist Party (PS) and the far-right Rassemblement National (National Rally, RN) both declining to back the vote put forward by the far-left La France Insoumise (France Unbowed, LFI). As such the motion secured only 115 votes, well short of the 289 needed to remove the gov't.

- Following the failure of the motion, Bayrou again utilised Art 49.3, for the third section of the PLFSS relating to state expenditures. This is the fourth time the article has been utilised as part of this budget process, and will likely result in another doomed censure motion.

GILTS: Intraday Outperformance Holds Ahead Of A Busier UK Schedule On Tuesday

Gilts continue to outperform German peers, with our best guess being that the latest downbeat snippets surrounding the UK labour market (REC-KPMG Report on Jobs and comments from Bank of America) have supported UK paper today.

- Little else of note on the UK news front, with focus on the upcoming syndication of the new 4.50% Mar-35 gilt (we look for that to price tomorrow), as well as Tuesday’s scheduled comments from BoE’s Bailey & Mann.

- Our gilt week ahead publication covers the syndication and previews the comments from Mann in greater detail.

- Futures +46 at 93.66 (93.13-67 range).

- Initial support and resistance (92.50 & 94.35) remain some distance away, with the shorter-term bullish technical theme intact.

- Yields 2.5-5.0bp lower, curve bull steepens. Post-BoE lows intact.

- BoE-dated OIS now pricing ~64bp of cuts through year-end vs. ~60bp at the open.

- Low odds of a follow up cut in March still priced at this stage (~6bp), with the next cut fully discounted through May.

- We look for the next cut to come in May, although the March decision may be closer than many expect/market prices at this stage.

- SONIA futures little changed to +6.5, post-BoE highs unchallenged across the strip.