FED: Assets Little Changed In Latest Week, SOMA Holdings Steady (1/2)

Mar-13 20:44

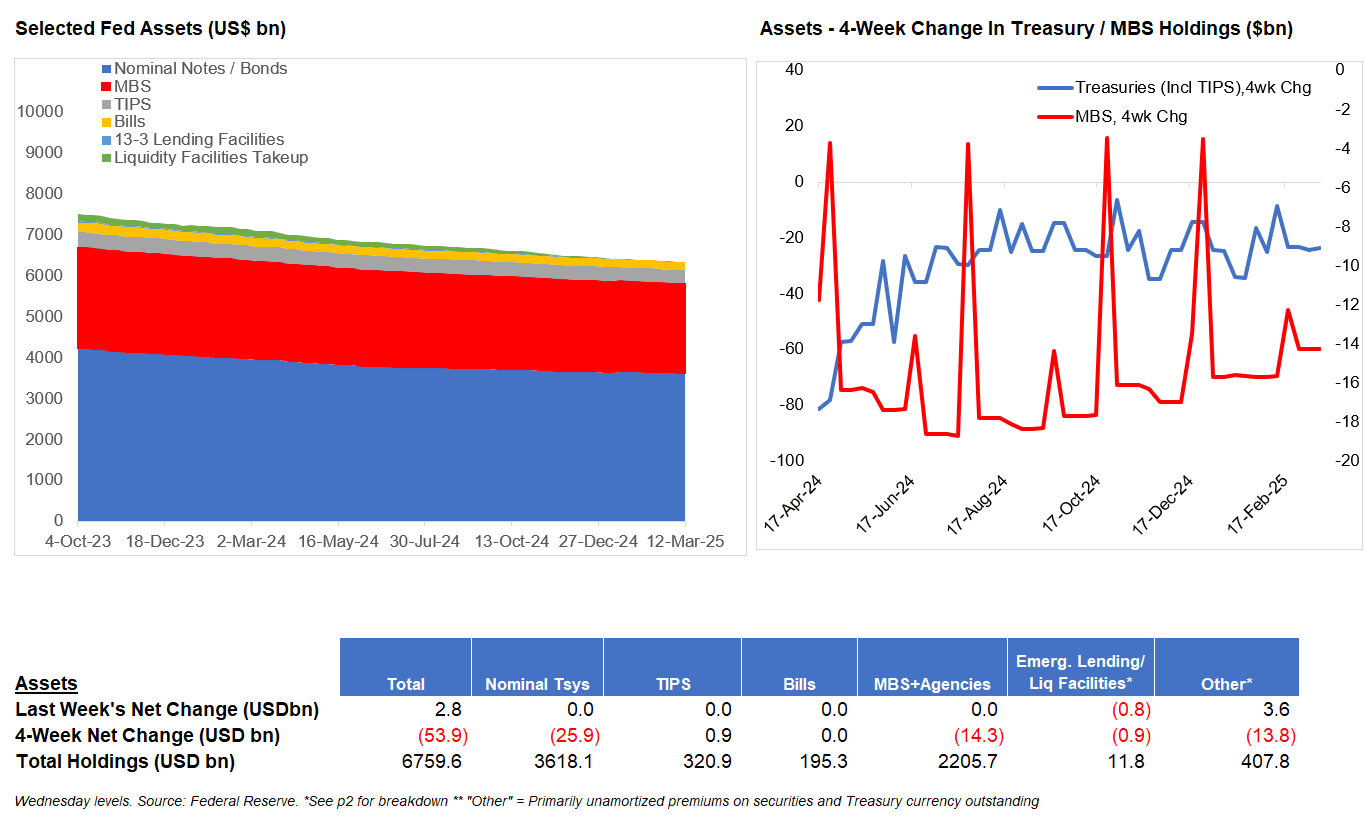

Fed assets were virtually unchanged in the most recent week (to Wednesday March 12), rising just $2.8B.

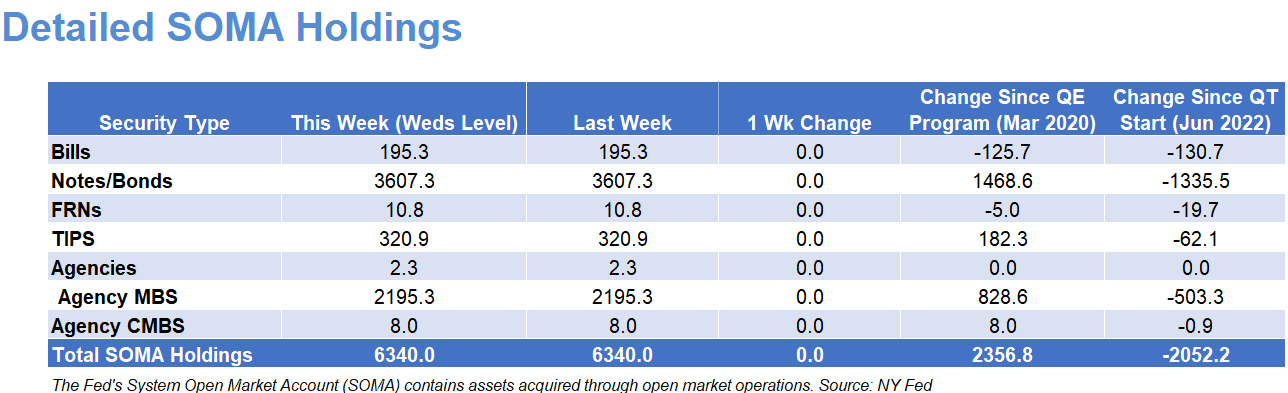

- There was only a marginal rise ($0.6B) in the size of SOMA holdings on the week, but they are down by around $40B in the last 4 weeks (around $26B in Tsys, $14B in MBS/Agencies), matching the medium-term monthly runoff average under the Fed's QT program.

- Discount window takeup fell $0.7B to $2.4B.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US TSYS: Holding Narrow, Lower Range Ahead Key CPI Data

Feb-11 20:37

- Treasuries look to finish weaker Tuesday, see-sawing in a narrow, lower range since the open, March'25 10Y futures -8.5 at 108-30.5 vs. 108-28 low, above initial technical support at 108-20.5 (Low Feb 4).

- Curves bear steepened, bonds underperforming (2s10s +2.786 at 24.568, 5s30s +1.231 at 37.923) weakness partially tied to cross asset selling tied to record-sized 10Y Gilt syndication and orderbook.

- Many listened from the sidelines as Fed Chairman Powell repeated his January FOMC press conference at his Senate Banking Committee testimony today. Expect similar at Wednesday's testimony to the House.

- Treasury futures bounced briefly but remain weaker after $58B 3Y note auction (91282CMN8) 1.2bp stop, drawing 4.300% high yield vs. 4.312% WI.

- US$ Gapped lower/extended lows in late trade, trading desks citing a rehash of earlier headlines that Ukraine is prepared to offer territory swap with Russia - US$ recovered half the move. Earlier pressure on core fixed income and the associated higher yields on Tuesday have supported a recovery for Cross/JPY, with USDJPY briefly rising to a high of 152.60 roughly 1% off the Monday lows.

- Focus on key CPI inflation data tomorrow at 0830ET.

AUDUSD TECHS: Resistance Stays Intact For Now

Feb-11 20:30

- RES 4: 0.6429 High Dec 12

- RES 3: 0.6384 High Dec 13

- RES 2: 0.6331 High Jan 24 and a key resistance

- RES 1: 0.6302 50-day EMA

- PRICE: 0.6295 @ 16:16 GMT Feb 11

- SUP 1: 0.6171/6088 Low Feb 4 / 3

- SUP 3: 0.6045 1.500 proj of the Sep 30 - Nov 6 - 7 price swing

- SUP 3: 0.6000 Round number support

- SUP 4: 0.5931 1.764 proj of the Sep 30 - Nov 6 - 7 price swing

AUDUSD is trading closer to its recent highs. Despite the latest bounce, the trend structure is unchanged and remains bearish. The Feb 3 fresh cycle low confirmed a continuation of the downtrend and maintains the price sequence of lower lows and lower highs. A resumption of the bear leg would open 0.6045, a Fibonacci projection. Key resistance is at 0.6302, the 50-day EMA, and 0.6331, the Jan 24 high. A clear break of both levels would be bullish.

US OUTLOOK/OPINION: MS Above Consensus For Core CPI Inflation

Feb-11 20:23

- Morgan Stanley see core CPI at a seasonally adjusted 0.37% M/M in January (cons 0.3), with wildfires and residual seasonality behind the temporary acceleration.

- “The concept of residual seasonality refers to the fact that seasonally-adjusted series still show some seasonal pattern within a given year. In other words, seasonal factors fail to clean seasonal shifts from the inflation series.” They have found an overall upward bias of 5bp for January core CPI and include it in their forecast.

- “January is particularly hard to forecast because of potential residual seasonality that often pushes m/m prints. Adding more noise, CPI seasonal factors will be revised historically for the years 2019-2024 and new factors will be released for 2025 at the individual component level. As a result, error bands around our forecasts are wider than usual, and a print rounding to 0.3% is still possible. Slightly milder seasonality will easily yield core CPI m/m rates below the 0.35% mark.”

- “We think core goods prices increased 0.37%, with still strong used and new car inflation due to the effect of wildfires. We also see acceleration in "other core goods", especially in recreation goods, drugs, motor vehicle parts.”

- Elsewhere in the details, they expect car insurance inflation to “continue to suggest gradual deceleration ahead, but at a slower pace than the one implied by the last three prints. We forecast payback in January, but the overall disinflation trend continues in 2025.”