FED: Reserves Hit 2-Year High As Treasury Cash Drains (2/2)

Mar-13 20:53

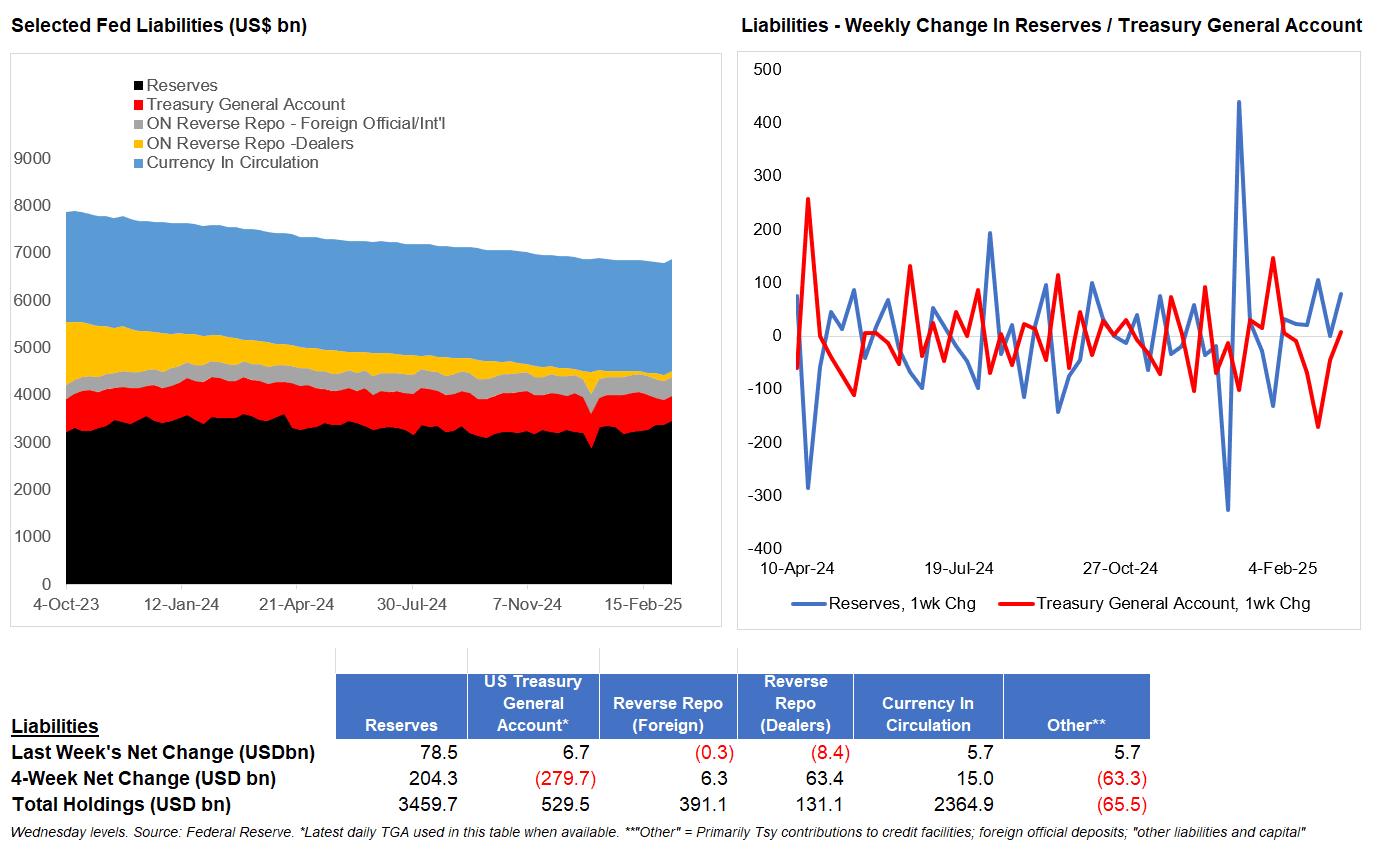

Reserve levels grew by nearly $80B in the last week, and are now up over $200B in the last month to over $3.4T.

- That's come as the Treasury's cash holdings at the Fed (TGA) have fallen by nearly $300B, effectively putting reserves back into the system temporarily as the debt limit impasse continues, offset by higher reverse repo facility takeup and higher currency in circulation.

- The high level of reserves (highest on a weekly basis since April 2024) is certainly "abundant" - but they still may decide next week to pause or slow QT in order to avoid any unwelcome surprises in reserve scarcity ahead of the government's debt limit being lifted (We go through the considerations in more detail in our latest Fed Balance Sheet Tracker – link here).

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

US OUTLOOK/OPINION: JPMorgan Below Consensus For Core CPI

Feb-11 20:53

- JPMorgan see headline CPI at 0.30% M/M and core CPI at a more modest 0.23% M/M. If realized, the latter would see 3.1% Y/Y for its lowest since Apr 2021.

- “There is some risk that inflation will once again firm to start the year due to residual seasonality, but we think that many of the factors that boosted inflation readings during the first quarter of each of the past two years reflected either idiosyncratic factors or pressures that have since abated to some degree.”

- They expect core to continue to be supported by a 0.3% M/M increase across the major shelter items: OER, tenants' rents and lodging. "We continue to expect a fairly gradual — and occasionally choppy — cooling in shelter inflation based on various measures that appear to have some leading properties; our forecasts for January are marginally lower than their December readings.”

- “Another key contributor to CPI inflation dynamics since the pandemic has been the prices of new and used vehicles. However, industry data suggest that both should have been close to flat for January.”

- “We look for apparel prices to have declined for the first time in three months. A firming trend in the US dollar and the after-effects of some potential earlier front-loading around the risk for port strikes likely put downward pressure on the apparel price index, although we see a risk that tariff uncertainty could have led to front-loading in January that would put upward pressure on prices.”

US TSYS: Holding Narrow, Lower Range Ahead Key CPI Data

Feb-11 20:37

- Treasuries look to finish weaker Tuesday, see-sawing in a narrow, lower range since the open, March'25 10Y futures -8.5 at 108-30.5 vs. 108-28 low, above initial technical support at 108-20.5 (Low Feb 4).

- Curves bear steepened, bonds underperforming (2s10s +2.786 at 24.568, 5s30s +1.231 at 37.923) weakness partially tied to cross asset selling tied to record-sized 10Y Gilt syndication and orderbook.

- Many listened from the sidelines as Fed Chairman Powell repeated his January FOMC press conference at his Senate Banking Committee testimony today. Expect similar at Wednesday's testimony to the House.

- Treasury futures bounced briefly but remain weaker after $58B 3Y note auction (91282CMN8) 1.2bp stop, drawing 4.300% high yield vs. 4.312% WI.

- US$ Gapped lower/extended lows in late trade, trading desks citing a rehash of earlier headlines that Ukraine is prepared to offer territory swap with Russia - US$ recovered half the move. Earlier pressure on core fixed income and the associated higher yields on Tuesday have supported a recovery for Cross/JPY, with USDJPY briefly rising to a high of 152.60 roughly 1% off the Monday lows.

- Focus on key CPI inflation data tomorrow at 0830ET.

AUDUSD TECHS: Resistance Stays Intact For Now

Feb-11 20:30

- RES 4: 0.6429 High Dec 12

- RES 3: 0.6384 High Dec 13

- RES 2: 0.6331 High Jan 24 and a key resistance

- RES 1: 0.6302 50-day EMA

- PRICE: 0.6295 @ 16:16 GMT Feb 11

- SUP 1: 0.6171/6088 Low Feb 4 / 3

- SUP 3: 0.6045 1.500 proj of the Sep 30 - Nov 6 - 7 price swing

- SUP 3: 0.6000 Round number support

- SUP 4: 0.5931 1.764 proj of the Sep 30 - Nov 6 - 7 price swing

AUDUSD is trading closer to its recent highs. Despite the latest bounce, the trend structure is unchanged and remains bearish. The Feb 3 fresh cycle low confirmed a continuation of the downtrend and maintains the price sequence of lower lows and lower highs. A resumption of the bear leg would open 0.6045, a Fibonacci projection. Key resistance is at 0.6302, the 50-day EMA, and 0.6331, the Jan 24 high. A clear break of both levels would be bullish.