NATGAS: BP Set for Entry into Israel Offshore Gas: MEES

Mar-14 17:39

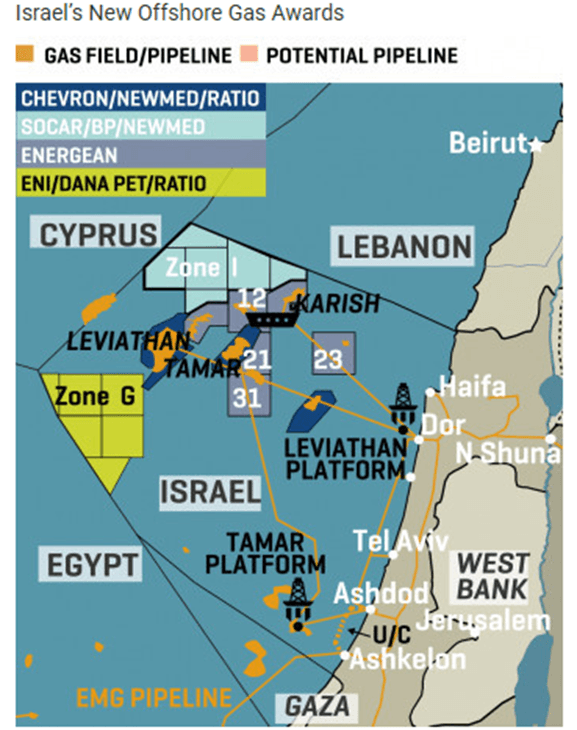

BP will make its official Israel entry this month, as Socar continues its recent expansion and industry confidence in the region rises, MEES said.

- With the conflict in Gaza and Lebanon easing, Israel is set to finalise offshore block awards officially made in Oct. 2023.

- BP is set to receive the six-block offshore Zone I alongside Socar and NewMed March 17, MEES said.

- Socar will operate with 33.34% of the Venture, with the remaining stake equally divided between BP and NewMed.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

ECB: Nagel Sees "Profound Challenges" in Using R* As Monetary Policy Guide

Feb-12 17:39

ECB's Nagel joins a set of other ECB policymakers in downplaying the importance of the neutral rate of interest, r*, for near-term monetary policy in his lecture today in London at the 'Official Monetary and Financial Institutions Forum'. Key excerpts below:

- "The idea of the natural rate serving as a guiding star for monetary policy comes with profound challenges", citing high estimation uncertainty.

- Whilst discussing a range of different "r-stars", Nagel cites the conclusion from a recent academic paper from Prof. Ricardo Reis of: "Focusing exclusively on the return on government bonds as the measure of r-star, while neglecting the return on private capital, leads to the wrong policy advice" .

- "There is no reason to act hastily in the present uncertain environment", again steering away from an accelerated cutting cycle.

- "In my opinion, proceeding in a data-driven and gradual manner has served the ECB Governing Council well [...] Using r-star alone to navigate the monetary policy universe could be like flying almost blind. But having it as one of many instruments in your cockpit is highly useful", reiterating the well-known data dependance.

FED: Powell: Don't Get Excited About January CPI, Watch PPI Thursday

Feb-12 17:35

Fed chair Powell cautions against getting "excited" about today's CPI report ahead of PPI (Thursday 0830ET), reminding us that the latter report carries potentially different implications for the Fed's preferred PCE gauge:

- "The CPI reading was above almost every forecast. But I would just offer ... two notes of caution. One is, we don't get excited about one or two good readings, and we don't get excited about one or two bad readings. The second thing, though, is we target PCE inflation because we think it's simply a better measure of inflation. And so you need to know the translation from CPI to PCE, and we get more data on that tomorrow, we'll get the Producer Price Index. So I think it's always wise, and the people who follow us closely know this, that we'll know actually what the PCE readings are, you know, late tomorrow."

US OUTLOOK/OPINION: Nomura Core PCE Tracker Rises From 0.28% to 0.35% M/M

Feb-12 17:25

- Nomura have lifted their core PCE inflation estimate to 0.351% M/M in Jan from a pre-CPI 0.28%.

- With SA revisions affecting “many subcomponents” that feed into core PCE, they see core PCE M/M inflation revised lower in Nov and Dec 2024 by 1-2bp whilst the Oct reading should be revised up 1bp.

- “Note that annual revisions to CPI data will feed into core PCE inflation in Q4 2024 and the impact of CPI annual revisions prior to Q4 2024 will not be reflected until GDP annual revisions in September 2025.”