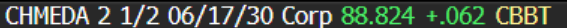

EM ASIA CREDIT: China Mengniu Dairy (CHMEDA, Baa1/BBB+/NR) S&P lowers leverage

China Mengniu Dairy (CHMEDA, Baa1/BBB+/NR)

"*S&PGRBulletin:Mengniu's EBITDA Declines Should Narrow In 2025" - BBG

- Mengniu issued a profit warning on Wednesday, but as we noted, it was largely related to a non-cash impairment.

- S&P has commented following the company announcement, more of an observation, not a rating action.

- In summary, EBITDA is going to be "slightly" better than S&Ps original projections.

- As a consequence, there leverage estimate is also better, with Net Debt to EBITDA of 1.5x - 1.6x in 2024 & 25, versus previous estimates of 1.7x - 1.8x (2023A 1.67x).

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

ASIA STOCKS: HK & China Equities Lower, Following 10% Trump Tariff Talk

Chinese & Hong Kong equities are lower today after Trump reiterated his consideration of a 10% tariff on Chinese goods, citing concerns over fentanyl shipments. While the 10% level is less aggressive than the previously threatened 60% tariffs, the remarks reignited concerns about potential trade tensions. The CSI 300 Index slipped 1%, ending a four-day rally, while the Hang Seng China Enterprises Index declined 1.55% and the HSI is 1.25% lower.

- China's luxury market sales fell by up to 20% in 2024, the steepest decline since 2011, as an economic slowdown weakened consumer confidence and spending. Watches, jewelry, and leather goods saw the sharpest declines, while even high-spending customers reduced purchases. Hainan's duty-free sales dropped 29%, with more Chinese shoppers opting for overseas purchases, particularly in Japan.

- Real estate stocks dragged the market further as Citi lowered earnings estimates and price targets for key players like China Overseas Land & Investment (-1.6%), Longfor Group (-2.6%), and Shenzhen Investment (-3.7%), citing soft market conditions and persistent sector-wide losses. Benchmark indices are also lower, with the Mainland Property Index down 1.75%, HS Property Index -1%, while the BBG China Property Developer Gauge is 2.45% lower

- The Harvest CSI 500 ETF reported a significant 4Q purchase of 1.39b shares, likely by China’s sovereign wealth fund, Central Huijin Investment. The fund now owns 44.2% of the ETF, worth an estimated 3.37bi yuan. Despite this, the ETF experienced outflows of 1.58b yuan during the quarter.

While optimism over U.S. trade policy has cooled, gradual tariff measures could ease the market's adjustment, though volatility remains high. The property sector’s challenges and a cautious outlook on stimulus add further headwinds to the Chinese market.

FOREX: USD Firmer, NZD Underperforms Post Q4 CPI

NZD/USD is the weakest performer in the G10 space, off nearly 0.45%, last near 0.5650/55. Other G10 currencies are all down against the USD, but losses aren't large at this stage. The USD BBDXY index is up a touch to be above 1303 in latest dealings, so still only modestly above recent lows.

- NZD has underperformed as the market has digested the Q4 CPI print. NZ yields are lower, while markets are close to fully priced for a 50bps cut at the Feb policy meeting. NZ-US 2yr swap spreads are lower as well, last -75bps.

- Earlier tariff threats from US President Trump (expanded to include China and the EU) is also likely an NZD headwind. AUD/USD is down modestly, last 0.6265. The AUD/NZD cross is up to 1.1080/85, but still under recent highs.

- Yen and EUR are both around 0.1% weaker versus the USD. USD/CNH is up 0.20% and holding above 7.2800 (but is sub intra-session highs from Tuesday).

- In the cross asset space, US yields have ticked up, while US equity futures are higher, led by tech, aided by earlier plans announced by President Trump and key tech executives on AI investment plans for the US. China and Hong Kong equities are weaker though.

- There is little in the way of further risk events for today's Asia Pac session.

NEW ZEALAND: Core Eases But Non-Tradeables Proving Sticky

The RBNZ’s sector factor model estimate of Q4 core inflation eased 0.2pp to 3.1% y/y, close to the top of the 1-3% target band. Q3 was revised down 0.1pp to 3.3%. Given that headline was impacted by volatile components such as air fares, the move lower in underlying inflation is good news and another 50bp rate cut in February remains the base case. But underlying non-tradeables inflation is proving sticky and will continue to be watched closely.

NZ core CPI y/y% (RBNZ sector factor model)

- Moderation in core non-tradeable inflation remains slow and it was down only 0.1pp to 4.6% y/y, the lowest since Q1 2022 but still elevated. The series average is 3.3%. Its moderation from the peak remains significantly less than the overall core, but restrictive monetary policy and weak demand should help to bring it still lower.

- Core tradeables inflation was only 0.2% y/y in Q4 after 0.4%. The headline number picked up driven by volatile second-hand car prices. The drop in the underlying measure signals that weak discretionary spending is weighing.

NZ core CPI y/y% (RBNZ sector factor model)