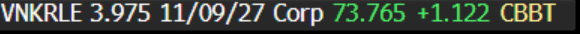

EM ASIA CREDIT: China Vanke (Caa1/B-/B-) reported to get government support.

China Vanke (Caa1/B-/B-)

"*CHINA MULLS $6.8 BILLION FUNDING PLAN TO HELP VANKE REPAY DEBT" - BBG

- If confirmed, positive for spreads.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EURGBP TECHS: Maintains A Firmer Tone

- RES 4: 0.8494 High Aug 26 ‘24

- RES 3: 0.8471 61.8% retracement of the Aug 8 - Dec 19 downleg

- RES 2: 0.8448 High Oct 31 and reversal trigger

- RES 1: 0.8424 50.0% retracement of the Aug 8 - Dec 19 downleg

- PRICE: 0.8409 @ 06:46 GMT Jan 13

- SUP 1: 0.8318/8284 50-day EMA / Low Jan 8

- SUP 2: 0.8263 Low Dec 31

- SUP 3: 0.8223 Low Dec 19

- SUP 4: 0.8203 Low Mar 7 2022 and a major support

EURGBP traded sharply higher last week and remains firm. The cross has breached resistance at the 50-day EMA, and cleared the December highs. This undermines the recent bearish theme and suggests scope for a stronger short-term recovery. Note too that 0.8376, the Nov 19 high and a key resistance, has also been cleared. Sights are on 0.8424, a Fibonacci retracement. Support at the 50-day EMA is at 0.8318.

EUROZONE ISSUANCE: EGB Supply - W/C 13 Jan (1/2): Syndication Expectations

- Austria: There is regularly a January syndication but the timing over the past few years has varied through the month. We pencil in a 14-29 January window. We expect a multi-tranche syndication (we have seen this in January in both 2022 and 2024). And we would expect one of the lines to be a new Feb-35 RAGB (there has been a new 10-year launched in January every year since 2018 with the exception of 2022). Our expectation that the Feb-35 RAGB will be launched in January has been increased due to the 10-year area being avoided for the January auction. We don’t have a strong conviction surrounding which other RAGBs are likely to be on offer in the syndication but think there is a good likelihood of the 1.85% May-49 Green RAGB that was also part of last year’s triple-tranche offering (and has only been sold via syndication or private placement since its launch). In terms of size expectation, we look for the Feb-35 tranche to be sized between E4.5-5.0bln (including E250-500mln retention) with the entire syndication to be sized between E5.75-7.0bln.

- EU: Scheduled operation, see next bullet.

- France: We think that the most likely syndication for January is a tap of the 3.00% Jun-49 Green OAT and pencil it in for this week (or possibly W/C 27 January). Last year’s launch syndication saw a size of E8.0bln but we think there is a chance of a smaller tap this year to enable more / larger auctions of other green issues to take place later this year. Other potential syndication candidates are a new 15-20-year OAT (we prefer the May-42 OAT), an earlier launch of a new 30-year OAT (we pencil this in for February) or a new OATei (potentially in the 30-year area around 2056).

- Ireland: There is one Irish syndication due in 2025 and given that there is already a May-35 IGB outstanding (that was originally issued as a 15-year bond), we see around a 50% probability that this year's new issue is not a 10-year with 15-year and 30-year both possibilities. We expect the transaction to take place this upcoming week and pencil in a E3bln size.

EUROZONE T-BILL ISSUANCE: W/C January 13, 2025

Germany, France, Spain, Belgium and Portugal are all due to sell bills this week. We expect issuance to be E17.7bln in first round operations, down from E37.9bln last week.

- This morning, Germany will sell E3bln of the new 12-month Jan 14, 2026 bubill.

- This afternoon, France will come to the market to sell up to a combined E7.9bln of 13/28/46/50-week BTFs: E3.0-3.4bln of the 13-week Apr 16, 2025 BTF, E1.6-2.0bln of the new 28-week Jul 30, 2025 BTF, E0.2-0.6bln of the 46-week Dec 3, 2025 BTF and E1.5-1.9bln of the 50-week Dec 31, 2025 BTF.

- Tomorrow morning, Spain will issue the 3-month Apr 11, 2025 letras and 9-month Oct 10, 2025 letras. The size will be announced later today.

- Also tomorrow, Belgium will look to sell E3.4-3.8bln of 4/12-month TCs: an indicative E2.0bln of the May 8, 2025 TC and E1.6bln of the new Jan 15, 2026 TC.

- Finally on Wednesday, Portugal will issue E1.0-1.25bln of the new 12-month Jan 16, 2026 BT.

For more on future auctions see the full MNI Eurozone/UK T-bill auction calendar here.