EM ASIA CREDIT: China Vanke (VNKRLE, Caa2/B-/CCC+) gets rating reprieve

China Vanke (Caa2/B-/CCC+)

"*S&PGR PLACES CHINA VANKE 'B-' RTGS ON CREDITWATCH DEVELOPING"

* In summary, S&P has changed the outlook from watch negative, implying a high probability of downgrade to watch developing. Neutral for spreads.

* The change reflects the possibility that financial support will reduce liquidity risks.

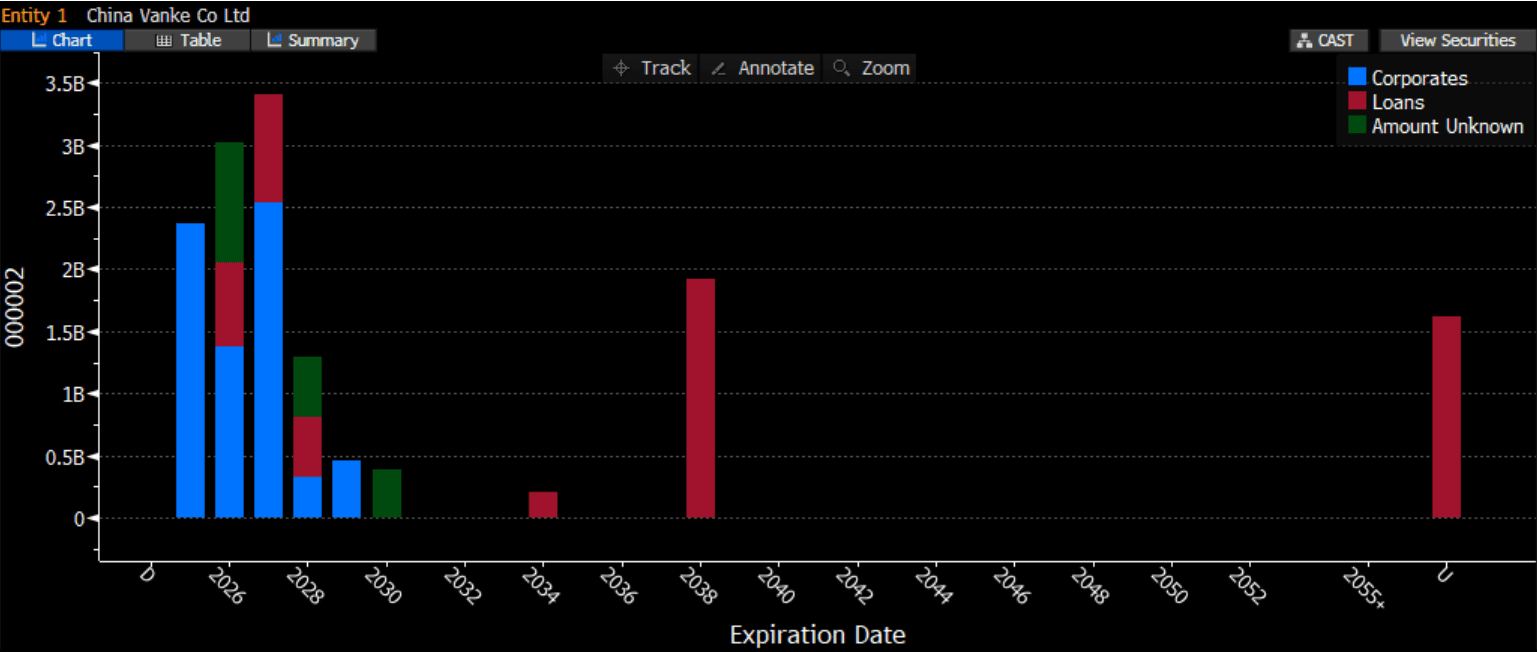

* Vanke has secured the support of its major shareholder, state backed Shenzhen Metro Group, with secured loans of RMB7bn ($970m).

* Vanke has $2.7bn equivalent due in the remainder of 2025.

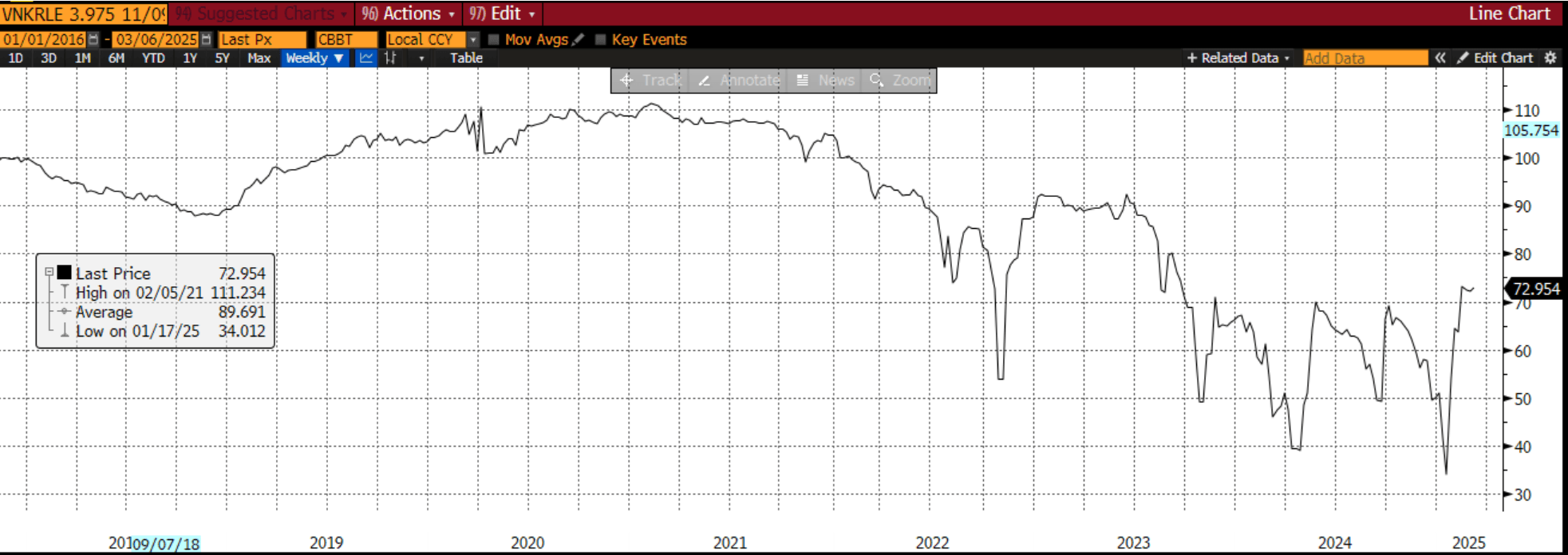

* In terms of valuations, the Vanke $ 11/27s reflect market optimism that either the main shareholder or China central government will step in and provide liquidity.

* As shown in the chart, the $ 11/27s are up 40pts from the lows, with a cash price of 73...more or less at the 15mth highs.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

AUSSIE BONDS: Holding Cheaper, Narrow Ranges On A Data Light Session

ACGBs (YM -4.0 & XM -5.5) are cheaper after dealing in relatively narrow ranges on a second-tier data day.

- Australia's household spending rose 0.4% m/m in December versus a revised +0.8% in November. Five of the nine spending categories advanced, driven by a third straight increase in discretionary goods and services.

- The ANZ-Roy Morgan Consumer Confidence index rose to 88.5 in the week of Jan. 27 to Feb. 2 from 86, marking the highest level since May 2022.

- Cash US tsys are ~1bp cheaper in today’s Asia-Pac session after yesterday’s modest sell-off following news that President Trump agreed to delay a 25% tariff on Mexico and Canada.

- Cash ACGBs are 4bps cheaper with the AU-US 10-year yield differential at -14bps.

- Swap rates are 3-4bps higher.

- The bills strip has bear-steepened with pricing -1 to -4.

- RBA-dated OIS pricing is flat to 2bps firmer across meetings today. A 25bp rate cut is more than fully priced for April (135%), with the probability of a February cut at 91% (based on an effective cash rate of 4.34%).

- The AOFM announced the issue by syndication of a new 4.25% 21 March 2036 Treasury Bond. The issue will be of a benchmark size. Initial price guidance is a spread of 2 to 5bps to XMH5. The issue is expected to be priced tomorrow.

FOREX: USD Ticks Up From Earlier Lows, China Tariff Deadline In Focus

The USD is up from earlier lows that were seen around the US/Asia Pac cross over earlier. We are around 0.20-0.40% weaker in terms of the G10 currencies versus the USD. The BBDXY index opened near 1305.3, but is now back around the 1308 level. This is still short of fresh cycle highs from Monday (just above 1325).

- In the cross asset space, US equity futures are higher, but away from best levels (Eminis last +0.30%). EU equity futures are also up, after cash losses in Monday trade. US yields are firmer, but gains are less than 1bps at this stage.

- Regional equities are higher, as relief spreads on the US tariff pause against Mexico/Canada. HK markets are up, but we still have a China tariff deadline a few hours away (midnight time in the US), which is 1pm HK time.

- USD/CNH has drifted a little higher, last near 7.3170. Earlier lows were close to 7.3000. A reminder that China markets remain closed for the LNY break, they return tomorrow.

- AUD, ZND and NOK are all off around 0.30-0.35%. AUD/USD was last 0.6205/10, while NZD/USD was back close to 0.5615. USD/JPY is higher, last in the 155.20/25 region. All these pairs remain within recent ranges.

- Earlier we had Dec household spending data for Australia, which was close to expectations, but hasn't impacted the AUD greatly.

- The data calendar is clear for the remainder of the Asia Pac session.

AUSTRALIA DATA: Household Spending Signals Rise In Q4 Consumption

Australian household spending rose 0.4% m/m to be up 4.3% y/y in December, the highest since March. November was revised up significantly to +0.8% m/m & 3.2% y/y from 0.4% & 2.4%. This is consistent with the retail sales data released yesterday showing a recovery in household spending. Consistent with this is the third straight monthly rise in discretionary spending in December.

- Total household spending volumes rose 1.4% y/y in Q4 up from 0.2% in Q3 signalling a pickup including a solid quarterly rise in the national accounts version due on March 5. Furnishings, transport, clothing and recreation saw increases in annual growth.

Australia real household consumption y/y%

Source: MNI - Market News/ABS

- Discretionary spending rose 0.6% m/m and 4.6% y/y in December, the highest in almost a year and the strongest of the main categories, after 0.9% & 2.8%. The growth was due to new vehicles, eating out, air travel & streaming services. Non-discretionary fell 0.2% m/m to be up 3.7% y/y.

- Services expenditure rose 0.3% m/m to be up 4.2% y/y down from 5.3% y/y, while goods rose 0.4% m/m to be up 4.4% y/y up from 1.5% y/y. There wasn’t payback for the discount-induced 1.2% m/m rise in goods spending in November.

- The ABS noted that “consumers have capitalised on the end-of-year sales season, driving a sustained rise in spending to finish 2024”.

- The household spending data will replace retail sales from 30 July 2025.

Australia household consumption y/y%

Source: MNI - Market News/ABS