OIL PRODUCTS: China’s Gasoline Demand Decline to Accelerate in 2025: OilChem

Mar-13 10:31

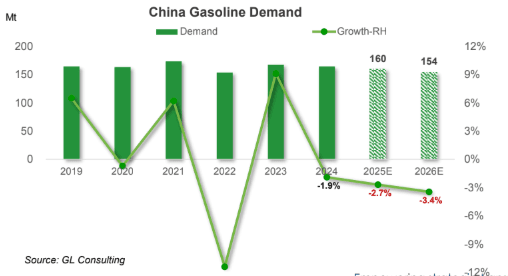

China’s gasoline demand decline is seen accelerating in 2025-2026, according to OilChem/GL Consulting due to greater EV penetration.

- This shift is expected should speed up the gasoline demand squeeze, with consumption forecasted to fall by 2.7% in 2025 and 3.4% in 2026.

- The EV penetration rate is seen rising from 8.9% of the vehicle fleet in 2024 to 13% in 2025, before hitting 17% in 2026.

- This is driven by policies such as subsidies for scrapping and relacing gasoline vehicles, fuel cost advantages of EVs over gasoline cars, and EV purchase incentives.

- New energy vehicle sales soared 85% on the year to 720k units in February, with a penetration rate of 51.5%, OilChem said.

- Key regions have introduced personal vehicle trade in programmes which are helping to drive a post-holiday market recovery.

- Viewpoints shared by GL Consulting, a think tank under Mysteel.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

FOREX: Powell in Focus, Republican Scrutiny Likely

Feb-11 10:30

- A brief phase of JPY buying has dissipated into the US open, with USD/JPY back above, and anchored to, the Y152.00 level. The general stability of the pair so far today is a decent signal that markets are well-priced for fractious trade tensions ahead, particularly as the EU outlined in detail that they'd respond in unison against the trade levies waged on steel and aluminium exported to the US.

- EUR is faring well alongside local equity markets, helping EUR/GBP progress back to 0.8350, but the consolidative move is yet to make any headway on last week's highs. This leaves EUR/AUD just above the pullback low, after the cross tested but failed break the 200-dma overnight at 1.6388. Regardless, the cross has printed six consecutive sessions of lower lows and a positive close today would be the first in seven sessions.

- Powell's appearance in front of the Senate Banking Committee later today, while bipartisan in nature, will be a focus for any Republican scrutiny on the Fed chair, with markets and lawmakers looking to gauge the Fed's potential responses to tariffs, tax actions and the impacts of immigration on US labour market gains.

- Powell's appearance is set for 1500GMT/1000ET, at which a release of text is expected. For monetary policy specifically, markets will be sensitive around wording for future rate adjustments, particularly if Powell drops a reference to "cautious" on policy ahead.

- Powell isn't the only central banker set to speak today, with BoE's Bailey, Fed's Hammack, Williams & Bowman and ECB's Schnabel all set to speak.

GILT SYNDICATION: New 10-year: 4.50% Mar-35 gilt: Final terms

Feb-11 10:27

- Size: GBP13bln (higher than the GBP8.5-10.0bln we expected)

- Orderbooks in excess of GBP140bln (inc JLM interest of GBP12bln)

- Spread set at 4.25% Jul-34 gilt + 5.5bp (guidance was + 5.5/6.0bps)

- Maturity: 7 March 2035

- ISIN: GB00BT7J0027

- Settlement: 12 February, 2025 (T+1)

- Bookrunners: Barclays, BNP Paribas, Citi (B&D/DM), Goldman Sachs International Bank, HSBC and NatWest.

- Timing: Books closed. Allocations and pricing later on today

From market source

BOE: What have we learnt from Mann today? Rounding up our thoughts

Feb-11 10:21

Rounding up some of our earlier observations:

- Ahead of today we had questioned if Mann would only be a temporary dove - and she said today that being an activist does not mean "cut, cut, cut".

- She noted that just because she voted for 50bp in February doesn't necessarily mean that she will vote for a 50bp cut in the upcoming meetings - and that it was partly a signalling device.

- Both in her speech and in the Q&A she made reference to the MaPS (BOE's survey of market participants) estimated neutral rate of 3.0-3.5% - and made no reference to the model-based estimates that were included in the MPR. We therefore think that 3.0-3.5% is likely to be more representative of Mann's own view of the neutral rate.

- Mann also reiterated that she thinks Bank Rate needs to remain restrictive - just not as restrictive as it currently is. With Bank Rate now at 4.50%, there is only 100bp before we reach the 3.50% top estimate of neutral from the MaPS. So as we noted in our BOE Review, we think that she will vote for sequential cuts at least at the next two meetings (March and May) but we aren't convinced of the magnitude of the move that she will vote for.

- She laid out a number of things she is watching to determine her future votes - and noted that risks of second-round effects cannot be ruled out, she just doesn't consider them the most likely outcome "yet". She points to distributions in the wage data (wage growth in non-consumer facing firms is target consistent), weak demand and non-linearities in the labour market, firms reducing employment due to employer NIC increases, firms having weak pricing power and soft sales volumes as reasons she isn't too concerned for now.

- So she is probably a temporary dove - although that partly depends on how quickly the wider MPC returns Bank Rate towards neutral - and partly how the incoming data come in over the next few months - particularly on the labour market and firms' pricing power.