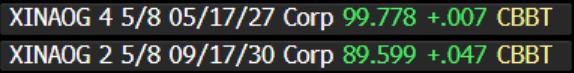

EM ASIA CREDIT: ENN Energy (XINAOG, Baa1/BBB+/BBB+) $bonds have CoC clause

Mar-19 06:00

- No update yet on ENN Energy trading halt, though the notice indicates its M&A related.

- We note that the existing $ bonds both have a put at 101 on change of control.

- A change of control includes, but is not limited to a) permitted holders having less than 20% of the total voting rights. Permitted holders are Mr. Wang Yusuo (founder) and his wife Ms. Zhao Baoju as well as their affiliates, who own c. 34% of the share capital; or b) more generally the merger, amalgamation or consolidation of the Company with another.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

CHINA: Country Wrap: Data Out Shows Bond Market’s Rapid Development.

Feb-17 06:00

- Chinese President Xi hosted Jack Ma and other leading entrepreneurs today in what is seen as a dramatic thawing of relations between the government and the tech sector. The meeting shows that following the crackdown on the sector in 2020, the relationships are now changing with the Communist Party needing to be more supportive of private sector companies to achieve their growth targets. (source: MNI- Market News).

- Over the weekend the Shanghai Security News reported on the explosion of growth of bond ETF’s in China. Analysis shows that the market now has 29 bond ETFs in existence, with the size of the funds now exceeding CNY200bn, having been only CNY100bn mid-year last year. (source: MNI- Market News).

- At a conference the Conference for Emerging Market Economies organized by the Saudi Ministry of Finance and the International Monetary Fund in Saudi Arabia over the weekend, the PBOC Governor Pan spoke to the risks for emerging markets and the policy direction for China domestically. On the domestic front, Pan indicated that more proactive fiscal policies can be expected and more accommodative monetary policy with the latter focused on boosting domestic consumption. (source: MNI- Market News).

- A poor start to the week with the Hang Seng leading markets down, by -0.50%, CSI 300 –0.08%, Shanghai -0.07% with Shenzhen the only bright spot up +0.40%.

- CNY: Yuan Reference Rate at 7.1702 Per USD; Estimate 7.2653

- Bonds: there was a pushback in the bond market today with the CGB 10YR rising +2.2bps to 1.67%.

MNI EXCLUSIVE: Capex Key To BoJ Outlook

Feb-17 05:56

Weaker capax plans within the March Tankan will risk the BOJ's smooth rate-hike path. On MNI Policy MainWire now, for more details please contact sales@marketnews.com.

BOBL TECHS: (H5) Monitoring Trendline Support

Feb-17 05:55

- RES 4: 118.310 High Dec 20

- RES 3: 118.27 61.8% retracement of the Dec 2 - Jan 14 bear leg

- RES 2: 118.100 High Jan 2

- RES 1: 117.573/980 50-day EMA / High Feb 3 / 5 and the bull trigger

- PRICE: 117.280@ 05:37 GMT Feb 17

- SUP 1: 117.190 Low Feb 12

- SUP 2: 117.016 Trendline drawn from Jan 15 low

- SUP 3: 116.550 Low Jan 24

- SUP 4: 116.280 Low Jan 14 / 15 and key support

Bobl futures remain in a short-term bull cycle and the latest pullback still appears corrective - for now. However, price has traded through support at the 20-day EMA - at 117.430. A continuation lower would expose a trendline support drawn from the Jan 15 low, at 117.016. Clearance of the trendline would strengthen a bearish threat. The bull trigger has been defined at 117.980, the Feb 3 / 5 high. A break of it resumes the recent uptrend.