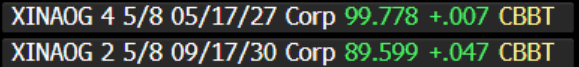

EM ASIA CREDIT: Enn Energy (XINAOG, Baa1/BBB+/BBB+) trading halt

"*ENN ENERGY HALTED PENDING HK TAKEOVER CODE ANNOUNCEMENT" - BBG

"*ENN ENERGY SAYS 4.625% GREEN NOTES, 2.625% NOTES ALSO HALTED" - BBG

Equity and credit trading has been halted due to an undisclosed material transaction.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

JGBS: Futures Cheaper After Q4 GDP Beat

In Tokyo morning trade, JGB futures are weaker, -14 compared to settlement levels, after today’s Q4 GDP data.

- Japan's preliminary Q4 GDP was above market expectations. Q3 also saw positive revisions. The q/q annualized outcome was +2.8% versus 1.1% forecast. In q/q terms, this was 0.7% (0.3% was forecast, while Q3 was revised up to 0.4% from 0.3% originally reported). In nominal terms, GDP was up 1.3%, also above the 1.2% forecast, with Q3 revised a touch higher. The GDP deflator was 2.8%y/y, in line with market forecasts.

- The detail showed positive surprises for consumption +0.1%, versus the -0.3% forecast (Q3 was a 0.7% rise) and net exports +0.7%ppts contribution to growth (+0.4ppt was forecast). Business spending rose 0.5%, which was below forecasts but still above the negative Q3 outcome.

- Domestic and private demand were still down in q/q terms after firm rises through Q2/Q3 of 2024. Both metrics are still up in y/y terms.

- Cash US tsys are closed for the Presidents Day holiday.

- Cash JGBs are slightly mixed, with benchmarks 1bp cheaper to 1bp richer. The benchmark 10-year yield is 0.5bp higher at 1.367% versus the cycle high of 1.377%.

- Swap rates are flat to 1bp higher. Swap spreads are mixed.

FOREX: Yen Outperforms Post Q4 GDP Beat, NZD Firmer

Yen is firmer, aided by the Q4 GDP beat, while AUD and NZD have ticked higher as well in early Monday dealings. The rest of the G10 aren't moving much (with SEK down modestly). The BBDXY index is little changed versus end Friday levels, last close to 1288.0.

- USD/JPY got to lows of 151.91 post the GDP print, and holds close to this level in latest dealings, up around 0.25% firmer in yen terms for the session. The Q4 GDP print continued to suggest a resilient growth backdrop, albeit with slower consumer spending. This will be a watch for the authorities, although Dec monthly data pointed to firmer real spending and wage outcomes. It should keep the BOJ on a further normalization path.

- If we can sustain a break sub 152.00, the Feb 7 low at 150.93 may come into focus.

- There is no cash US Tsy trading today, due to a US holiday. Tsy futures are softer in early dealings. The trend for US-JP yield differentials has been lower following recent US data misses.

- NZD/USD is back above 0.5730, with Friday highs near 0.5740 close by. Key levels to watch include, resistance is 0.5763 (Dec 18 highs), while 0.5790 (100-Day EMA) could become a target. Earlier data showed the services PMI rebounding back above 50.0 in Jan.

- AUD/USD is slightly trailing NZD, last near 0.6355/60. The AUD/NZD cross is back sub 1.1100. The RBA tomorrow and RBNZ on Wednesday are expected to ease.

- We have Japan data on Dec IP and the tertiary activity index later. Otherwise, the data/event risk calendar is largely empty for Asia Pac markets.

STIR: RBNZ Dated OIS Pricing Firmer Than Early Feb Levels Ahead Of RBNZ Decision

RBNZ dated OIS pricing is slightly softer across meetings today, ahead of the RBNZ Policy Decision on Wednesday.

- The RBNZ decision is widely expected to cut rates 50bp again to 3.75%. Revised staff forecasts will also be published with the decision at 1200 AEDT/1400 NZDT and Governor Orr’s press conference taking place at 1300 AEDT/1500 NZDT.

- All 22 analysts surveyed by Bloomberg are forecasting a 50bp rate cut and the RBNZ shadow board is recommending 50bp of easing.

- Notably, OIS pricing is 2–13bps firmer than pre-Q4 Labour Market data levels from February 4.

- Nevertheless, 49bps of easing is priced for Wednesday, with a cumulative 117bps by November 2025.

Figure 1: RBNZ Dated OIS Today vs. Pre-Q4 Labour Market Data (%)

Source: MNI – Market News / Bloomberg