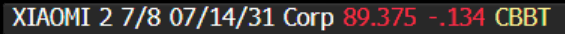

EM ASIA CREDIT: FY Results: Xiaomi (XIAOMI, Baa2/BBB-/BBB) - Beat

Mar-19 01:45

"*XIAOMI FY ADJ NET 27.23B YUAN, EST. 25.11B YUAN" - BBG

- Chinese smart phone company Xiaomi reported FY results after market close yesterday, with operating profits up 22% YoY to RMB24.5bn and ahead of consensus (RMB21.7bn). Positive for spreads.

- Xiaomi, known mostly for its smart phone products (91% of revenues), entered the automotive EV sector in 2024 with the SU7. In 2024 the company delivered 130,000 vehicles and for 2025 target 350,000 vehicles.

The auto sector is a risky, highly capital intensive business and a risk to monitor for the credit. Initial signs look positive.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

CHINA: Central Bank Governor Hints at Further Policy to Come.

Feb-17 01:44

- At a conference the Conference for Emerging Market Economies organized by the Saudi Ministry of Finance and the International Monetary Fund in Saudi Arabia over the weekend, the PBOC Governor Pan spoke to the risks for emerging markets and the policy direction for China domestically.

- On Emerging Markets, the Governor pointed out that protectionism disrupts value chains and that increasing geopolitical conflicts restrict the flow of capital, technology, and labor.

- He raised concerns as to slower global growth as a challenge for the global economy suggesting that “if protectionism escalates, rising trade fluctuations will drive up inflation expectations and undermine medium-term growth,” whilst pointing to IMF forecasts for the near term to be around some of the lowest levels for 20 years.

- A further risk he warned of was financial market instability and capital outflows as a result of uncertain monetary policies, as global financial markets re-price expectations for interest rate cuts from the Federal Reserve. Higher US interest rates and dollar traditionally pose challenges for emerging economies.

- In that context Governor Pan pointed out that whilst most countries are seeing their currency suffer at the hands of a stronger dollar, his government’s efforts to stabilize the Yuan has been supporting and maintaining a more stable economic environment.

- Governor Pan highlighted the high level of public debt (in the context of the US interest rate uncertainty) and growing investor concerns as to fiscal sustainability could lead to bond market instability.

- On the domestic front, Pan indicated that more proactive fiscal policies can be expected and more accommodative monetary policy with the latter focused on boosting domestic consumption.

- Governor Pan acknowledged that domestically there was a moderating of risks from local government debt (given the policies implemented last year) and hinted at the improving outlook for the property sector.

- Despite these comments over the weekend, China’s bond market is weaker today with the CGB10YR higher in yield in this morning’s trading.

CHINA: Central Bank Drains Liquidity via OMO.

Feb-17 01:32

- The PBOC issued CNY190.5bn of 7-day reverse repo at 1.5% during this morning’s open market operations.

- Today’ s maturities CNY229bn

- Net liquidity withdrawal CNY38.5bn.

- The PBOC maintains and controls liquidity in the interbank system via the issuance of of 7-day reverse repo.

- The CFETS Pledged Repo Deposit Institutions 7 Day Weighted Average Index declined to 1.82% from 1.94% on Friday.

- China Interbank Overnight rates were higher by 7bps at 1.85%

- China Interbank 7-day rates were higher by 9bps at 2.09%

ASIA STOCKS: Asian Equities Open Mixed, Geopolitical Tension Weigh On Market

Feb-17 01:24

Asian markets opened the week with cautious optimism on Monday, as investors weighed geopolitical tensions and upcoming central bank policy decisions. The MSCI Asia-Pacific index edged up 0.1%, while Japan's Nikkei is 0.20% lower, while the TOPIX is unchanged, South Korea's KOSPI is 0.50% higher, Taiwan's TAIEX is trading 1% higher

- Japan's GDP growth slowed sharply in 2024, rising just 0.1% for the year compared to 1.5% in 2023, However, Q4 growth accelerated to 0.7% QoQ, exceeding market expectations of 0.3%, driven by strong exports, improved auto production, and a rebound in inbound consumption.

- In Australia, ASX 200 fell 0.8%, primarily due to declines in the financial sector. Westpac shares dropped as much as 6% following a quarterly report that showed a slip in profit and margins.

- Hong Kong's market, which gained 7% last week driven by optimism in Chinese AI firms and a significant rise in Alibaba shares, is poised for a cautious start. Investors are monitoring potential developments, including a possible meeting between President Xi Jinping and e-commerce icon Jack Ma, which could further influence Chinese stocks.

- Geopolitical concerns are heightened as the U.S. and European Union engage in discussions over tariff plans and the ongoing conflict in Ukraine. U.S. President Donald Trump's proposed tariffs have prompted threats of retaliation from the EU, adding to market uncertainty.

- Commodity markets saw oil prices decline for the fourth consecutive day amid concerns over ample supply and potential impacts of tariffs on demand, this has weighed on Australia's market. Gold prices remained steady, trading near record highs as investors sought safe-haven assets amid the prevailing uncertainties

- The US market is closed later today for Presidents day.