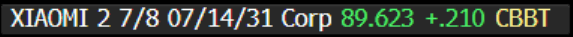

EM ASIA CREDIT: Xiaomi (XIAOMI, Baa2/BBB-/BBB) commits R&D spend to AI

Xiaomi (XIAOMI, Baa2/BBB-/BBB)

"*XIAOMI SEES 2025 R&D EXPENSES 30B YUAN" - BBG

- Xiaomi, known mostly for its smart phone products, entered the automotive EV sector in 2024 with the SU7. This is a risky, highly capital intensive, sector.

- The RMB30bn (c. $4bn) R&D investment for 2025 will support the development of the overall business, with a growing commitment to the auto sector.

- In terms of AI, around a quarter of the 2025 R&D spend will be on AI and related technologies. In all the company expects R&D to be RMB105bn over the next 5 years.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

AUSSIE BONDS: Richer After Q4 CPI Lower Than Expected

ACGBs (YM +6.0 & XM +4.5) are sharply higher after Q4 CPI data came in slightly below expectations across most metrics:

- Trimmed Mean CPI rose 0.5% q/q (vs. est. +0.6%) and 3.2% y/y (vs. est. +3.3%).

- Weighted Median CPI increased 0.5% q/q (vs. est. +0.6%) and 3.4% y/y (vs. est. +3.5%).

- Headline Consumer Prices rose 0.2% q/q (vs. est. +0.3%) and 2.4% y/y (vs. est. +2.5%).

- December's annual headline CPI matched estimates at +2.5% y/y.

- “The trimmed mean excluded price falls in both Electricity and Automotive fuel this quarter, alongside other large price rises and falls.” (ABS)

- Cash ACGBs are 4-6bps richer after the data with the AU-US 10-year yield differential at -15bps versus -10bps pre-data.

- Swap rates are 5-7bps lower, with the 3s10s curve steeper.

- The bills strip is richer, with pricing +4 to +7.

- RBA-dated OIS pricing is 3-7bps softer across meetings after the data. A 25bp rate cut is more than fully priced for April (136%), with the probability of a February cut at 89% (based on an effective cash rate of 4.34%). February was at 76% before the data.

AUSTRALIA DATA: A$ & Local Yields Softer Post Q4 CPI Miss

The A$ is weaker in the aftermath of the Q4 CPI print. We are back around 0.6225/30, off close to 0.40%. Jan 21 lows at 0.6209 will be in focus on a further pull back. In the bond futures space, ym +7 xm +5, slightly off best levels. OIS is 3 to 7bps softer across RBA meeting dates.

- Q4 CPI was weaker than forecast across both headline and trimmed mean. More details to follow.

AUSTRALIA DATA: Underlying CPI Inflation Moderates Slightly More Than Expected

Q4 trimmed mean CPI rose 0.5% q/q and 3.2% y/y, while headline was +0.2% q/q & 2.4% - both moderated more than expected. The December measures posted increases of 2.7% y/y and 2.5% respectively. More details to follow. See ABS press release here.