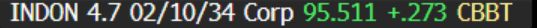

EM ASIA CREDIT: Indonesia (INDON, Baa2/BBB/BBB) Q4 GDP ahead of consensus

Indonesia (INDON, Baa2/BBB/BBB)

*INDONESIA 4Q GDP RISES 5.02% Y/Y; EST. +4.96%

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

BONDS: NZGBS: Yields Closed Higher But Slightly Outperformed $-Bloc

NZGBs closed cheaper, with the 10-year yield 4bps higher at 4.46%, the day's high. However, on a relative basis, the NZ 10-year outperformed its $-bloc counterparts, with the NZ-US and NZ-AU differentials closing 1-2bps wider.

- It was offshore factors that drove the local market, with the local calendar light again this week. Tomorrow’s release of ANZ Commodity Prices is the sole release for the week.

- On that front, cash US tsys are 1-2bps cheaper in today’s Asia-Pac session after Friday’s heavy close.

- Swap rates closed 3-7bps higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed 1-4bps firmer for meetings out to July. 52bps of easing is priced for February, with a cumulative 127bps by November 2025.

GOLD: Holding Friday Losses, But Above 20 & 50-Day EMA Support Points

Gold is a touch higher in the first part of Monday dealings, last near $2641. This follows Friday's 0.67% loss, amid a generally supported US yield backdrop and caution from Fed officials around the inflation outlook. Bullion is still up from end 2024 levels ($2624.5).

- US yields have pushed higher today (+1-2bps firmer), although hasn't weighed materially on gold at this stage.

- Spot gold is close to the 20 and 50-day EMA support zones, although the 100-day, which sits near $2600, is arguably more important. We tested sub this support zone on a number of occasions through late 2024 but each time the dip was supported.

- A fresh cycle high in the US 10yr real yield may see gold revisit these lows. On the topside, gold has found selling interest above $2700 since late November.

- Focus will rest on the FOMC minutes and US NFP print later this week.

OIL: Crude Off Intraday Highs, PMIs Released Later Today

Oil prices are off their intraday high to be down slightly during APAC trading today but are still close to the three-month high. Brent rose to $76.89/bbl but is now down 0.1% to $76.47. WTI reached $74.39/bbl before trending down to $73.90. The USD index is down 0.1% but off its intraday low.

- Some Middle Eastern pricing is signalling that demand has picked up from Asia and markets are waiting for prices from Saudi Arabia to confirm this. Crude from sanction-hit Iran and Russia has become scarcer, as sanctions target their shadow fleets.

- The market continues to expect excess supply in 2025 with demand from China likely to remain soft and non-OPEC supply forecast to rise with the risk OPEC+ decides to begin output normalisation. Morgan Stanley is projecting a surplus of around 700kbd this year. But there is a lot of uncertainty surrounding the new US administration and geopolitics.

- Later the Fed’s Cook speaks. US & European December services/composite PMIs and preliminary December German CPI data are released.