EM CEEMEA CREDIT: MNI EM Credit Market Wrap - CEEMEA (19 Mar)

Mar-19 16:19

| MNI EM Credit Market Wrap - CEEMEA (19 Mar) |

- Markets await the FED and subsequent commentary, while political risk headlines in Turkiye dominated CEEMEA. US 10Y +2bp at 4.3% and 5s/10 -1bp at 19.55. No new issues today, but we expect issuance could continue later in the week post FED.

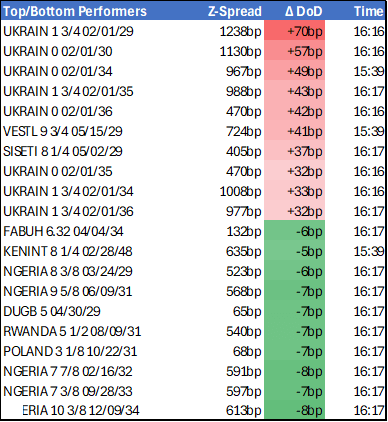

- CEEMEA sovereign spreads were dominated by political risk headlines in Turkiye with the whole curve wider. The curve moved around 20-25bps but came back ending the day to a more moderate 10-12bp wider on the day based on our screen feeds. Corporate spreads in Turkiye were impacted, notably VESTL 9.75 May29 +41bp and SISETI 8 May29 +37bp in z-spread terms. UKRAIN curve was the big mover on the day. The 10Y benchmark is closing approximately +46bp. The much anticipated phone call between President Trump and Putin didn’t lead to any immediate ceasefire. No earnings today, but ENOGLN is expected to report tomorrow with the sale of the Egyptian, Croatian and Italian portfolio key.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

OPTIONS: Larger FX Option Pipeline

Feb-17 16:15

- EUR/USD: Feb19 $1.0500(E1.6bln); Feb20 $1.0400-10(E2.7bln), $1.0430-35(E3.0bln), $1.0520-25(E1.5bln); Feb21 $1.0400(E1.5bln)

- USD/JPY: Feb19 Y155.00-20($1.7bln); Feb20 Y154.00($3.0bln)

- NZD/USD: Feb19 $0.5450(N$1.7bln)

- USD/CAD: Feb21 C$1.4500($1.2bln), C$1.4600($1.7bln)

- USD/CNY: Feb20 Cny7.2000($1.9bln), Cny7.2500($1.4bln), Cny7.3700($1.3bln)

STIR: SONIA / Euribor Z5 Spread Tightens In Tandem With The Long End

Feb-17 16:00

The SONIA / Euribor Z5 implied yield spread has tightened 2.5bps today to 186bps, mirroring moves in the long-end.

- After opening up to 5.0 ticks lower at the open, SONIA futures are now little changed on versus Friday’s settlement levels. Euribor futures are -1.0 to -3.5 ticks through the blues, with the strip steepening a little.

- ECB-dated OIS price 77bps of easing through year-end, corresponding to an implied deposit rate of 1.98%. Meanwhile, BOE-dated OIS price 57bps of easing through December, implying a Bank Rate of 3.93%.

- Earlier this morning, BOE Governor Bailey said the slightly stronger-than-expected flash Q4 GDP print does not alter the general story for the UK economy, while re-iterating the Bank’s gradual and careful approach to rate cuts.

- Tomorrow’s data calendar is headlined by the UK December/January labour market data. MNI’s full inflation/labour market preview will be released later today.

- ECB Executive Board Member Cipollone will also speak on the ECB’s balance sheet at an MNI Event at 1400GMT/1500CET (sign up here).

US-RUSSIA: Russia In Business-Like Mood Ahead Of Ukraine Talk - Kremlin Aide

Feb-17 15:33

Reuters reporting comments from Kremlin foreign policy aide Yury Ushakov stating that the Russian delegation is in a “business-like mood” ahead of preliminary Ukraine talks with the US in Saudi Arabia on Tuesday. Ushakov adds that Russian sovereign wealth fund chief Kirill Dmitriev may join the Russian delegation, "to discuss any economic questions that might arise".

- Ushakov appeared to dial down expectations of immediate deliverables from the talks, stating that tomorrow’s meeting is a bilateral discussion rather than Ukraine-focused talks as the US “has yet to appoint its chief negotiator for the Ukraine talks”

- Despite the unclear format of the talks, the Washington Post writes: “The high-level encounter, just weeks after Trump’s return to office, represents a stunning departure from America’s previous stance toward Russia,”

- US Secretary of State Marco Rubio held an “introductory” call with his counterpart, Russian Foreign Minister Sergei Lavrov, on Saturday, with Lavrov telling reporters it is time to put an end to an “abnormal period” of US-Russia relations.

- Wires noted a short time ago that French President Emmanuel Macron spoke with US President Donald Trump on the phone, ahead of a meeting between European leaders at the Elysee Palace to discuss a European response to Trump’s actions on Ukraine.