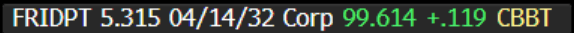

EM ASIA CREDIT: PT Freeport (FRIDPT, Baa3/NR/BBB) is approved for copper exports

Mar-07 06:00

PT Freeport Indonesia (FRIDPT, Baa3/NR/BBB)

"*INDONESIA ALLOWS FREEPORT TO EXPORT ABOUT 1M TONS CONCENTRATE" - BBG

- Last week various news sources suggested that Freeport has been given permission, by the government, to export copper concentrate. This now appears to be limited to 1 million tonnes.

- The export licence expired last year and hasn't been renewed while repairs to the Manyar smelter are ongoing. This is expected to be complete by June/July, with full ramp-up by year end.

- The company had been negotiating unsuccessfully with the government to try and extend its export licence, with copper concentrate stockpiles continuing to build up.

- The CEO previously said it had 400,000 tonnes of copper concentrate in inventory, which could rise to 1.5m during the year. In practical terms, approval to export 1m tonnes and the repair timetable, should allow the company time To manage inventory as needed.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

BUND TECHS: (H5) Bull Phase Remains In Play

Feb-05 05:50

- RES 4: 134.54 61.8% retracement of the Dec 2 - Jan 14 bear leg

- RES 3: 134.29 High Dec 20

- RES 2: 133.73 50.0% retracement of the Dec 2 - Jan 14 bear leg

- RES 1: 133.58 High Feb 3

- PRICE: 133.33 @ 05:33 GMT Feb 5

- SUP 1: 132.23 20-day EMA

- SUP 2: 131.00 Low Jan 16 / 24

- SUP 3: 131.00/130.28 Low Jan 16 / Low Jan 15 and the bear trigger

- SUP 4: 130.44 Low Jul 5 ‘24 (cont)

Bund futures traded higher Monday and the contract is holding on to the bulk of its recent gains. Price has cleared resistance at 132.22, the Jan 22 high, and is through both the 20- and 50-day EMAs. The break higher confirms a resumption of the corrective bull cycle that started Jan 14. This signals scope for an extension towards 133.73, a Fibonacci retracement point. Firm short-term support has been defined at 131.00, the Jan 16 / 24 low.

CHINA: Country Wrap: Tariff Talk in Driver Seat for Markets.

Feb-05 05:38

- China’s PMI Services for January declined to 51.0, from 52.2; likely impacted by the earlier than usual Lunar New Year Holiday. This follows Monday’s release of the China PMI Manufacturing at 50.1. The overall PMI composite saw a decline to 51.1 for January from 51.4 prior. The PMI services result was the lowest reading since September and saw the employment component decline to 48.8 to mark the lowest contribution since April. (source: MNI – Market News).

- Trump Says There’s No Rush to Talk to China’s Xi (source: BBG)

- China’s monetary easing is likely to be delayed until Trump-Xi hold talks, as trade tensions with the US are adding to the downward pressure on the yuan, according to Societe Generale SA. (source: BBG)

- In the first trading day after Lunar New Year holidays, equity markets were down for the major bourses with Shenzhen bucking the trend. The Hang Seng bore the brunt of the selling down -1.06%, CSI 300 down -0.56%, Shanghai down -0.64% whilst Shenzhen had a good day up by +0.52%.

- CNY: Yuan Reference Rate at 7.1693 Per USD; Estimate 7.2813.

- Bonds: there was surprisingly little activity in the China bond market with the CGB 10YR unchanged at 1.63% and bond future activity muted.

MNI EXCLUSIVE: BoJ Sees Little Risks Of Uncontrolled Wages

Feb-05 05:32

The BOJ sees little risk of uncontrolled wages gains. On MNI Policy MainWire now, for more details please contact sales@marketnews.com.

Related bullets

Related by topic

FRIDPT

Indonesia

EU Basic Industries

Credit Sector