EM ASIA CREDIT: PT Freeport Indonesia (FRIDPT, Baa3/NR/BBB) full capacity by Dec

Feb-19 06:51

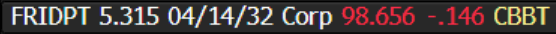

PT Freeport Indonesia (FRIDPT, Baa3/NR/BBB)

"Freeport Indonesia’s New Smelter to Run At 100% Capacity By Dec." - BBG

- The Grasberg copper mine, located in Indonesia, was reported yesterday to be running at 40% capacity according to the company.

- Repairs to the Manyar smelter are expected to be complete by July, with full ramp-up by year end.

- The company continues to negotiate with the government to extend concentrate export licences, allowing international shipments. For now copper concentrate is building up.

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

EUROZONE ISSUANCE: EGB Supply - W/C 20 Jan: Syndication Expectations (2/2)

Jan-20 06:51

- Spain (10-year): We look for the first 10-year Obli syndication to take place this week (the first full auction-free week of 2025). This would be a slightly later launch than the past few years. We pencil in a transaction size of E10-15bln.

- EFSF: On Wednesday 15 January, the EFSF sent an RFP with regards to an upcoming syndicated transaction, subject to market conditions.

- We had written in our Issuance Deep Dive that we expected a dual-tranche EFSF syndication in January. There has been a dual-tranche transaction in early January each year since 2021 with the transactions gradually growing in size (E5.0bln in 2021, E5.5bln in 2022, E6.0bln in 2023 and E7.0bln in 2024). We see E6.0bln as the minimum transaction size with a larger transaction very possible.

- We don't have a strong view regarding the bonds on offer, but we expect the transaction to take place either today or tomorrow.

EUROZONE ISSUANCE: EGB Supply - W/C 20 Jan: Syndication Expectations (1/2)

Jan-20 06:48

- Austria: There is regularly a January syndication but the timing over the past few years has varied through the month. We pencil in a 21-29 January window.

- We expect a multi-tranche syndication (we have seen this in January in both 2022 and 2024). And we would expect one of the lines to be a new Feb-35 RAGB (there has been a new 10-year launched in January every year since 2018 with the exception of 2022).

- Our expectation that the Feb-35 RAGB will be launched in January has been increased due to the 10-year area being avoided for the January auction.

- We don’t have a strong conviction surrounding which other RAGBs are likely to be on offer in the syndication but think there is a good likelihood of the 1.85% May-49 Green RAGB that was also part of last year’s triple-tranche offering (and has only been sold via syndication or private placement since its launch).

- In terms of size expectation, we look for the Feb-35 tranche to be sized between E4.5-5.0bln (including E250-500mln retention) with the entire syndication to be sized between E5.75-7.0bln.

- Finland (20-year): We expect a syndication to launch a new Apr-45 RFGB. There is an outside chance of an Apr-46 maturity (the 20-year launched in 2022 had an Apr-43 maturity) but an Apr-45 maturity would sit in the middle of the gap between the 0.50% Apr-43 and 1.375% Apr-47 RFGBs, plugging the biggest gap in the Finnish curve). We pencil in this week for the transaction with a chance that it comes a week later. We look for a E3bln transaction size.

EURGBP TECHS: Trend Needle Points North

Jan-20 06:45

- RES 4: 0.8530 76.4% retracement of the Aug 8 - Dec 19 downleg

- RES 3: 0.8494 High Aug 26 ‘24

- RES 2: 0.8471 61.8% retracement of the Aug 8 - Dec 19 downleg

- RES 1: 0.8463 High Jan 15

- PRICE: 0.8441 @ 06:45 GMT Jan 18

- SUP 1: 0.8385 Low Jan 14

- SUP 2: 0.8336/8284 50-day EMA / Low Jan 8

- SUP 3: 0.8263 Low Dec 31

- SUP 4: 0.8223 Low Dec 19

EURGBP maintains a firmer tone and the cross continues to trade closer to its recent highs. The latest recovery undermines the recent bearish theme and suggests scope for stronger short-term gains. 0.8376, the Nov 19 high and a key resistance, has been cleared. Note too that 0.8448, the Oct 31 high, has been pierced, a clear break of this hurdle would strengthen the bullish theme. Support at the 50-day EMA is at 0.8336.

Related bullets

Related by topic

FRIDPT

Indonesia

EU Basic Industries

Credit Sector