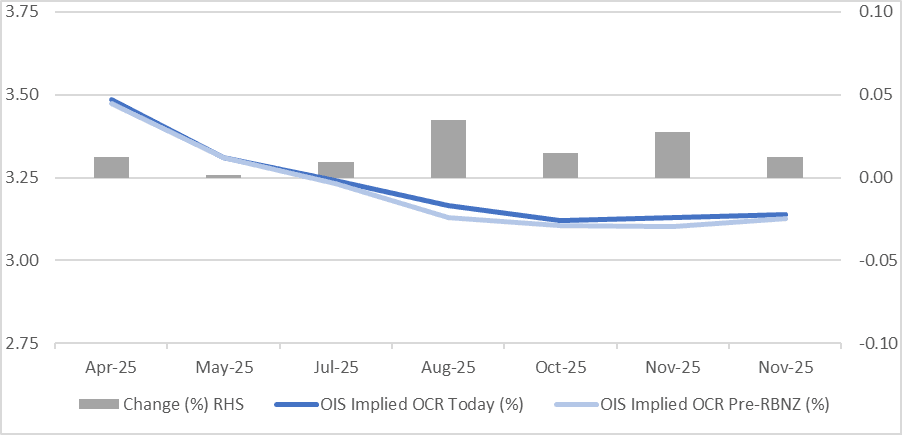

STIR: RBNZ Dated OIS Pricing Mixed Vs Pre-RBNZ Decision Levels

Feb-20 22:12

RBNZ-dated OIS pricing is slightly mixed across meetings today, holding flat to 4bps firmer than Wednesday’s pre-RBNZ policy decision levels.

- Wednesday’s widely expected 50bp rate cut to 3.75% was largely priced in, with markets having anticipated 49bps of the move.

- Currently, 27bps of easing is priced for April, with a total of 61bps expected by November 2025.

Figure 1: RBNZ Dated OIS Today vs. Pre-RBNZ (%)

Source: MNI – Market News / Bloomberg

Want to read more?

Find more articles and bullets on these widgets:

Historical bullets

GOLD: Gold Rallies as Trump’s Tariffs Unfold.

Jan-21 22:11

- Gold finished stronger today in the US trading day as the push pull of Trump’s tariff threats led to higher prices.

- Bullion opened at US2,708.21, rising throughout the trading day to $2,744.95.

- Gold typically likes either lower rates or a weaker USD and with Trump seemingly pulling back from tariffs on China for now, the USD was weaker against most Asian currencies.

- Gold also exhibits safe-haven status in times of volatility which no doubt will be in the days and weeks ahead as policies are announced.

- Trump has indicated that tariffs levelled at Mexico and Canada could come into place as early as February, and that he is considering a ‘universal tariff on all imports into the US’.

- The threat of tariffs, proposed increase in spending and trade wars sees investors having concern as to the pathway for inflation and hence interest rates.

- Whilst the geo-politics will have input into the short run impact for gold, the longer term direction for rates will be the most significant for gold.

- Some of the largest gold ETFs were up over 3% yesterday in what was one of the biggest moves year to date.

BONDS: NZGBS: Little Changed, Q4 CPI Prints Close To Expectations

Jan-21 22:05

In local morning trade, NZGBs are little changed after Q4 CPI data.

- Q4 NZ CPI was close to Bloomberg consensus expectations at 0.5% q/q and 2.2% y/y after 0.6% & 2.2% in Q3. Domestically driven non-tradeables were slightly lower than expected rising 0.7% q/q (Q3 +1.3%), while tradeables were higher at +0.3% q/q (Q3 -0.2%).

- “The largest contributor to the annual inflation rate was rent, up 4.2 per cent. Almost a fifth of the 2.2 per cent annual increase in the CPI was due to rent prices." (per Stats NZ)

- “Petrol makes up about 4 per cent of the CPI basket. Its price fall significantly contributed to the slower increase in the annual inflation rate in December 2024.”

- “If petrol was excluded, the CPI would have increased 2.7 per cent in the 12 months to December 2024.”

- Overnight, the US tsy curve bull flattened after Monday's holiday, with Trump administration policy remaining the focus after the presidential inauguration. US yields finished 1-5bps lower.

- Swap rates are little changed.

- RBNZ dated OIS pricing is 1-2bps softer across meetings after the CPI data. 45bps of easing is priced for February, with a cumulative 112bps by November 2025.

NZD: NZD/USD Holding Stead Following CPI Beat

Jan-21 22:02

- NZD/USD initially sold off during the Asia/Euro session's on Tuesday, following comments from Trump around 25% tariffs on Canada & Mexico, before a near total reversal as US yields gave back about half the sessions gains during the US session, the pair closed just 0.05% higher for the session at 0.5675.

- CPI came in in line with the prior month at 2.2%, beating estimates of 2.1% y/y. So far there has been very little reaction in FX markets with spot holding steady at 0.5676.

- The pair surged above the 20-day EMA on Tuesday, however fell short of breaking above the yearly highs of 0.5693 (Jan 7 highs), the RSI is above 50 for the first time since early October, while the MACD is printing increasing green bars, signaling potentional momentum change. Focus will now be on breaking the Jan 7 highs, with a break here opening a move to test the 50-day EMA at 0.5731, a level we have no traded above since Oct 4. Initial support is 0.5563 (Jan 17 lows).

- New Zealand Prime Minister Christopher Luxon emphasized a 2025 focus on economic growth, leveraging fiscal discipline and lower interest rates. He aims to attract global investment for infrastructure and partnerships, while Finance and Economic Growth Minister Nicola Willis plans to boost tourism and appeal to high-net-worth investors.

- The GDT auction saw whole milk powder prices rise to $3,988/ton from $3,804, with the weighted average price for all milk products at $4,146/ton. The GDT price index increased by 1.4%.

- Expiries today: 0.5475 (NZD450m). Upcoming notable strikes: 0.5675 (NZD599.1m Jan. 23), 0.5660 (NZD436.4m Jan. 23)

- There is nothing else on the local calendar this morning.